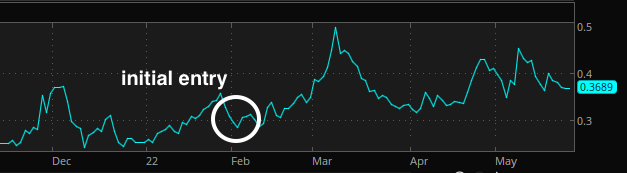

Back on February second, we initiated a long-term bullish bet in Chevron (CVX) January 2024 150-strike calls, states Sean McLaughlin of AllStarCharts.com.

You can read all about our thinking at the time here. In short, we believed that a big breakout in the energy sector was appearing likely.

As you can see from this updated chart, our bet proved to be prescient. We’ve already taken back our original risk capital in this trade when we sold half of our position on March second at double what we originally paid. That has given us the superpower to continue holding the remaining half position until now, achieving more gains.

While we continue to our remaining January 2024 calls, the chart action suggests to us that another leg higher in $CVX may be imminent. And with the big round number price level—$200—dangling above, we think there’s an opportunity to make an additional tactical bet to augment our current gains in this position.

The ASC team was chatting this morning about the continued resistance in the energy, oil, and exploration sectors and we couldn’t help but be enticed by what appears to be a tightening coil in a lot of these names, including $CVX. These setups feel incredibly bullish to us.

Meanwhile, implied volatility in these $CVX options has risen significantly since we initiated our entry back in February:

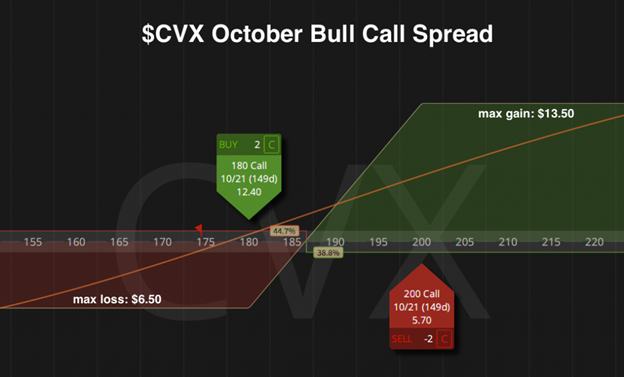

As such, we’ll employ a spread position to participate in a potential 200-dollar-roll to help minimize the impact of the high volatility pricing on our position.

Here’s the Play:

I like buying a $CVX October 180/200 Bull Call Spread for approximately $6.50 here. This means we’ll be long the 180 calls and short an equal amount of the 200 calls for a net debit, which represents the most we can lose in this trade.

While our risk is defined, our upside is also capped by the short 200-strike calls. The most this spread can be worth is $20.00.

We’ll leave a resting order to close this spread for a profit at $13.25. This would mean we’ve earned more than a doubling of our invested capital, and we’ve captured 50% of the maximum possible gain in this spread without having to hold the position all the way into October expiration. Stick and move!

If $CVX threatens to make a run to and through $200 per share, we should have no trouble hitting our profit objective.

On the downside, if the move we’re looking for fails to materialize and instead $CVX reverses course and breaks below $155 per share, I’ll look to exit the position to eliminate the risk of any further losses in the value of this spread. Any $CVX closing price below 155 is my signal to exit the trade.

Learn more about Sean at AllStarCharts.com.