The bears are out in full force, says Lucas Downey of Mapsignals.com.

And I don’t blame them—there’s a lot to be worried about on the economic front. But there’s also reason to be hopeful and bullish. Markets are officially oversold, and valuations are becoming attractive.

It’s hard to find reasons to buy stocks right now. Inflation is raging at 40-year highs, interest rates are on the upswing, and the S&P 500 (SPX) briefly entered a bear market last week. These are just a few of a never-ending onslaught of negative headlines.

Add to the list of ugly, new homes sales plunged 16.6% in April. Ugh.

There’s no denying the murky outlook for stocks. But on the flip side, when all hope is lost, an opportunity emerges. Today I’ll make the case why we could be looking at higher stock prices in the months ahead. Let’s now turn to data.

Big Money Index is Oversold

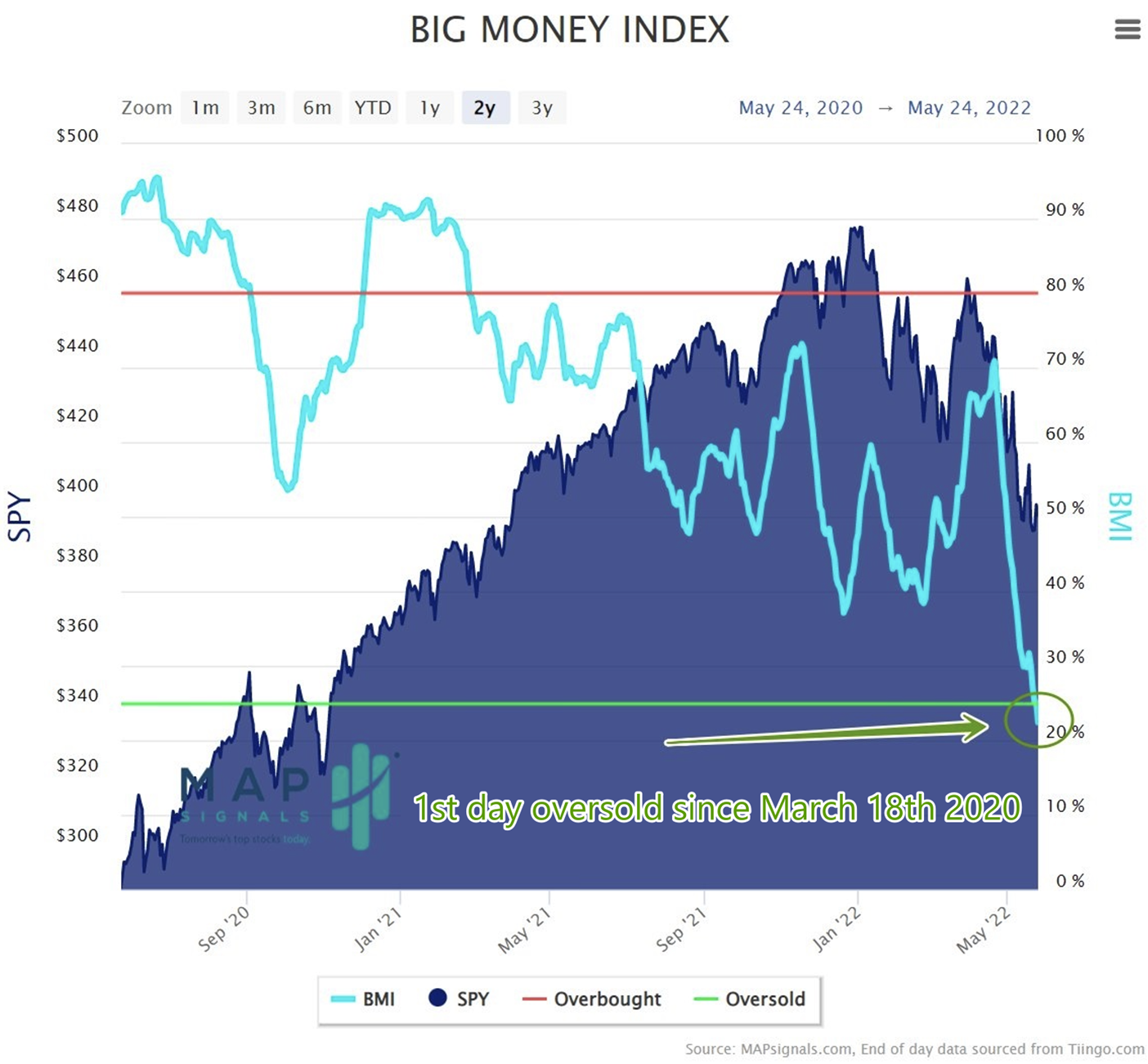

To start off, we’ll check in on the big event: The Big Money Index has finally hit oversold levels.

Last week the memo went out. I suggested how the Big Money Index should hit oversold within days. We pierced through the rare green line Wednesday morning. The BMI sits at over a two year low of 22%:

We are in rare times folks. It’s not often that I get to opine on moments like now. Only when the market reaches a tipping point does this signal flash. You can bet when the BMI is oversold, most investors have given up. But you shouldn’t.

It’s usually when there’s zero reason to own stocks that the biggest bargains appear. That’s why when headlines are a never-ending death spiral, I turn to data. I search for opportunities.

If the BMI could speak it’d probably say, “Expect better days ahead. Selling like this rarely lasts.”

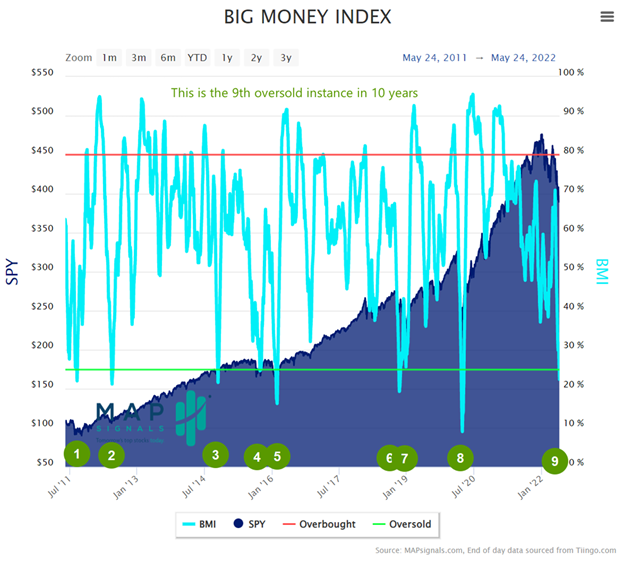

I’d agree. Below are all oversold instances for the last ten years. Notice how when the electric blue line dips below the horizontal green line, markets are often near lows:

Each of those green bubbles represents depressed periods for stocks, very similar to today. Included are the pandemic lows of March 2020. Prior to that was October-December 2018. Those were dire times indeed. But as it relates to stocks, they were massive buy opportunities.

Get this: since 2011, the eight oversold triggers prefaced the S&P 500 gaining an average of 22.8% a year later. Two years later saw stocks rally 39.2%!

So, while today’s environment is facing headwinds, the fact remains that selling of this magnitude rarely lasts. To prove that point, notice in the chart above how the BMI has tended to reach overbought soon after falling into the green zone. That’s right, often, once massive de-risking stops, buyers swoop in…fast.

That’s why I’m focused on the small window of opportunity right now rather than fear.

You should be too.

And finally, when stocks are pushed lower month-after-month, week-after-week, and day-after-day—it means valuations are becoming attractive.

Check it out.

Valuations are Becoming Attractive

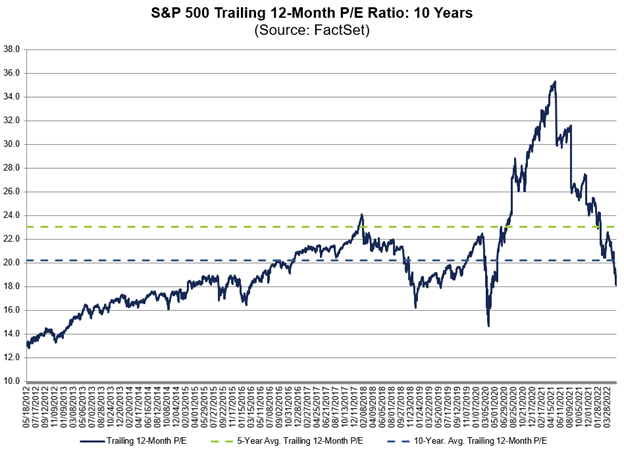

There are plenty of valuation metrics out there. But one of the most widely followed is the price to earnings ratio (P/E). To calculate it, simply take a stock’s price and divide it by its earnings. This simple ratio tells us what investors are willing to pay for an asset based on what it earns.

You can plot the P/E of the market as well. Just divide the index price by its earnings.

Below is a chart of the trailing 12-month P/E ratio of the S&P 500 from FactSet. Notice how the ratio has collapsed:

Currently, the P/E sits at 18.1 which is below the five-year average of 23.1 and ten-year average of 20.2. Value hunters should be getting giddy right about now. Keep in mind that this ratio is looking backward at the prior year of earnings.

Now let’s look forward.

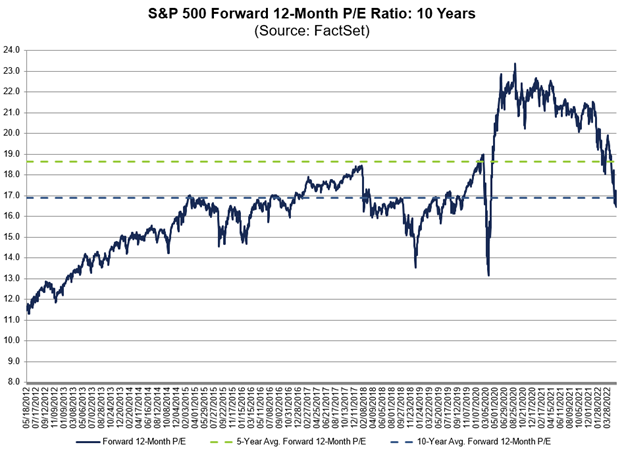

Below plots the 12-month forward P/E ratio for the market. This takes the price of the S&P 500 index and divides it by the expected earnings next year:

Currently, the forward P/E sits at 16.4, which is below the five-year average of 18.6 and the ten-year average of 16.9. Keep in mind that forward earnings are an estimate which can change. But there’s no denying that as assets fall in dramatic fashion, valuations are becoming attractive. Marrying an oversold BMI and valuation contraction could set us up for a big relief rally soon. It wouldn’t surprise me one bit. Let’s wrap up.

Here’s the bottom line: Ladies and gentlemen, the Big Money Index is oversold. It’s our rarest buy signal. History shows that moments like now are often when investors can win big. Add to it the falling P/E ratio of the market, and you’ve got an attractive picture being painted for stocks. Look, I don’t have a crystal ball. I’ve just sat through plenty of pullbacks to know that relentless selling in stocks is a chance to pick up great stocks at bargain prices.

I’m not buying into the fear.

I’m buying into great businesses.

The BMI has steered me right many times in the past. I’m willing to bet on it again. What about you?

To learn more about Lucas Downey, visit Mapsignals.com.