My wife and I met on a cruise, so it seemed only appropriate to celebrate our tenth anniversary on the Freedom of the Seas last week, states Mike Larson, editor of Safe Money Report.

We were fortunate to get back before some bad weather from Tropical Storm Alex moved through, and had a great, relaxing time.

But thank goodness we didn’t have to fill that sucker up! Holy cow. Can you imagine how much it must cost to fuel a diesel-powered ship now? One that weighs 156,271 gross tonnes, sports 19 decks, and can carry up to 5,900 passengers and crew?

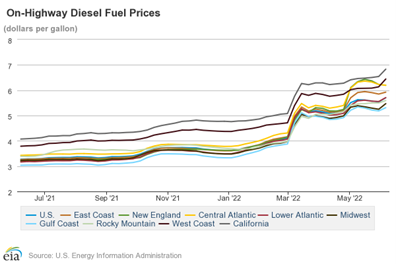

After all, diesel prices have been exploding along with most other fuels. The retail price of a gallon of diesel hit $5.70 per gallon this week, according to the Energy Information Administration. That’s a whopping 74% rise year-over-year!

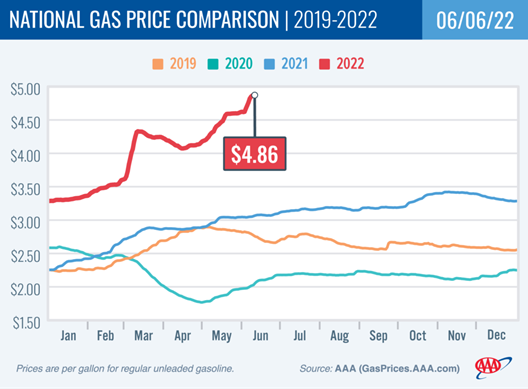

But it’s not just diesel. The national average cost of a gallon of gasoline just rose to $4.86, according to AAA. That’s up 59% from a year ago, as you can see in this chart.

Natural gas? No relief there, either. Gas futures have roughly tripled in the last year and were recently trading around $9.45 per million British thermal units. That puts them at a 14-year high.

In short, there’s no place to turn if you’re an energy consumer. But if you’re an energy investor, it’s a profit bonanza.

The Energy Select Sector SPDR Fund (XLE) is probably the most popular sector ETF that tracks oil and gas stocks. It’s up a hefty 68% year-to-date...a stunning 81 percentage points better than the money-losing SPDR S&P 500 ETF (SPY).

But we have leveraged riskier ETFs and ETNs in our Weiss Ratings database that have gone absolutely bonkers. I’m talking about things like the ProShares Ultra Bloomberg Natural Gas (BOIL). It’s up 412% in 2022 alone!

I’m not saying you need to run out and buy BOIL. When you add leverage to the mix, your risk of loss goes up notably.

But there’s no reason to sit out the rally in energy entirely. That certainly isn’t what I’m doing in my Safe Money Report, and I’m pleased to report my subscribers are benefitting from this rally.

Now, it’s time to start noodling about the next cruise (and hope diesel doesn’t get to $10 before then!)