It looks as if European and US equity markets are finally getting off the fence, states Ian Murphy of MurphyTrading.com.

The reimposition of lockdowns in China, confirmation of an ECB rate hike in July, and stubbornly high oil prices were too much to bear for bulls yesterday.

Click images to enlarge

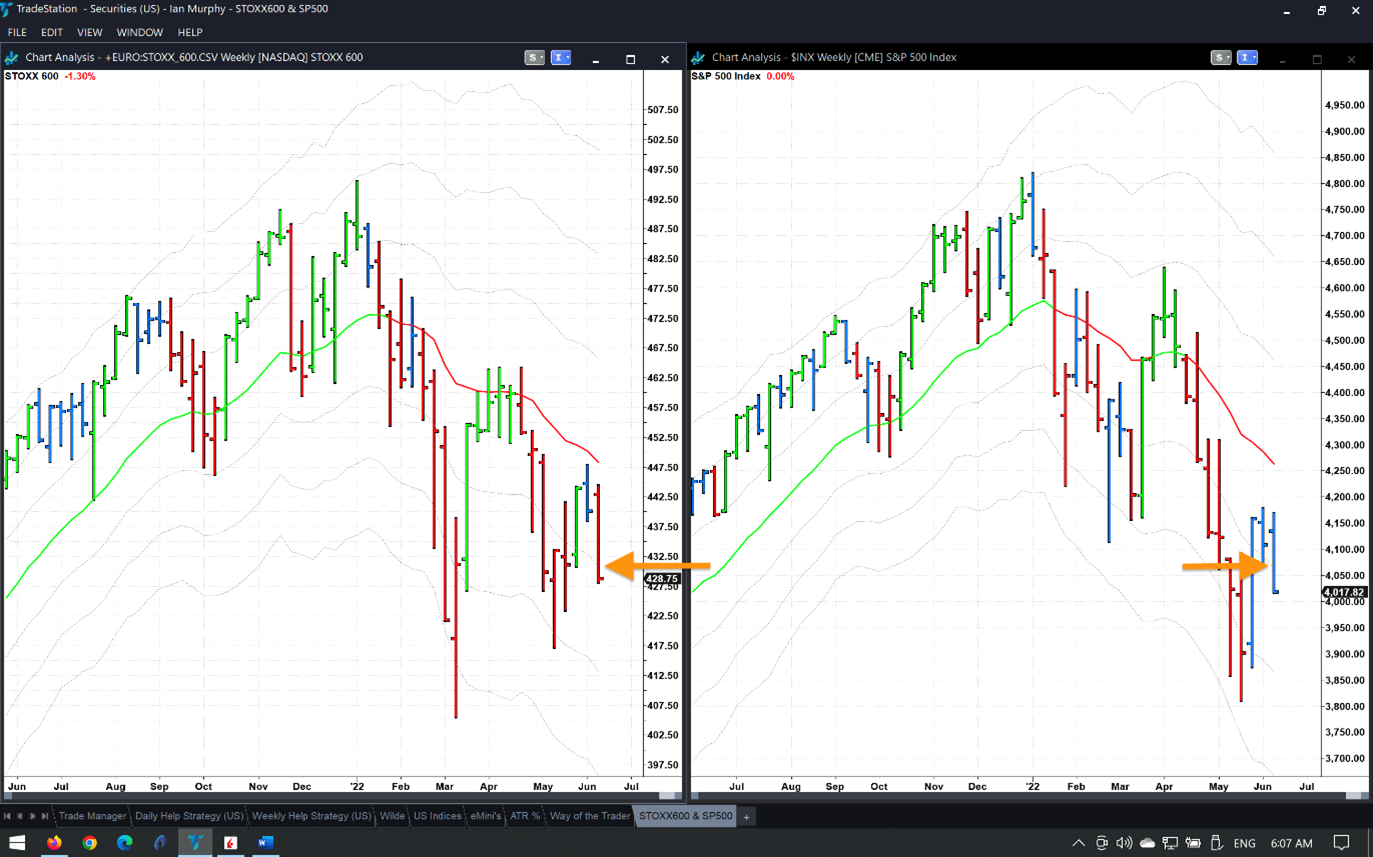

In early morning trade, the STOXX 600 of leading Western European shares is off 1.5% (left above), placing the index back below its -1ATR line on a weekly chart (arrow). That puts the index back in a bear market from a technical perspective. The S&P 500 (SPX) also went bearish in yesterday’s brutal selloff.

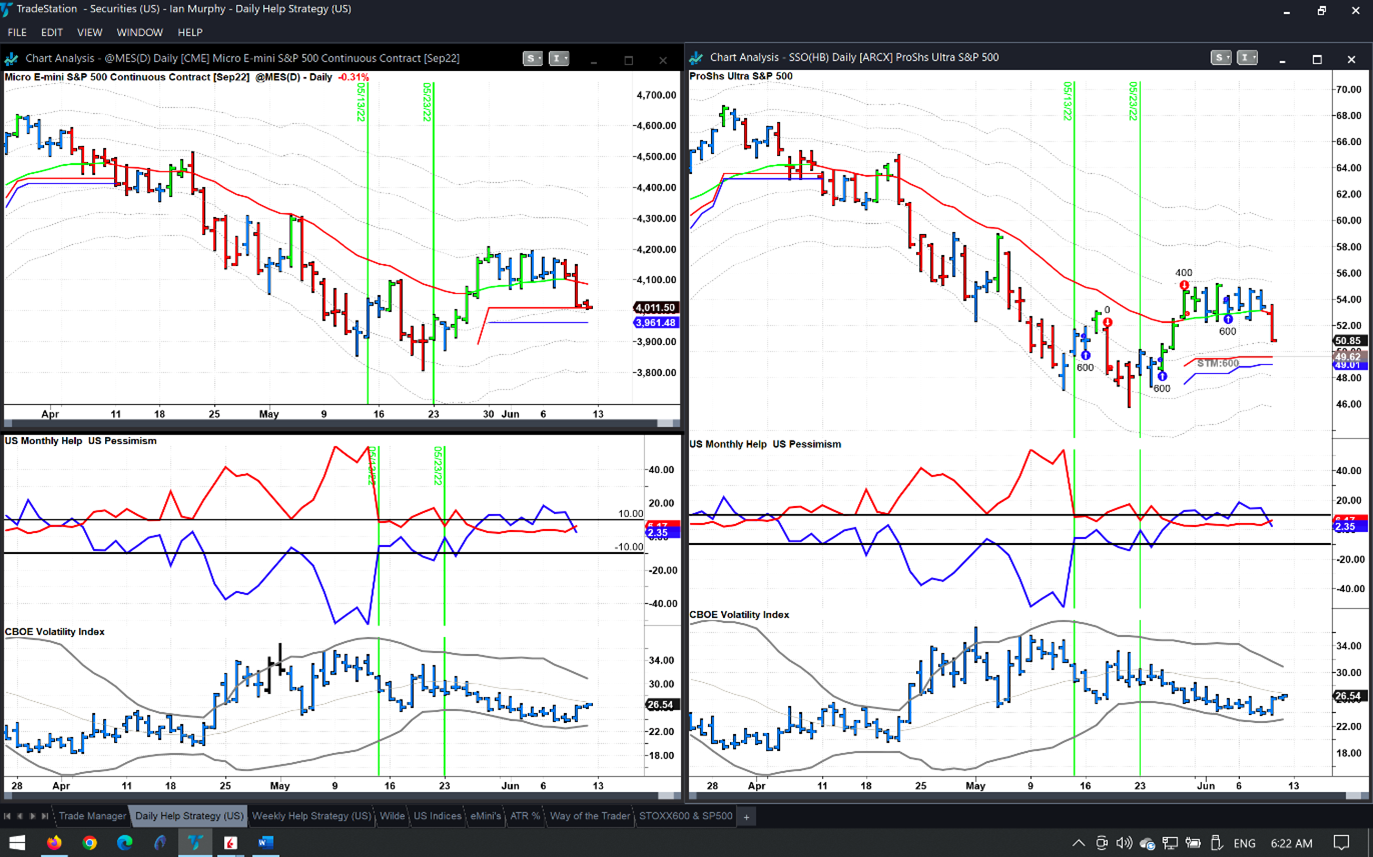

The Daily Help Strategy was stopped out overnight on Micro E-mini futures (left above) for 0.92% profit on the trade. Not exactly spectacular after 14 sessions in the position, but T1 offered increased profit for those who scaled out. T2 was a bridge too far on this occasion.

On SSO (right), the stop is at $49.62 which will represent a loss of 0.52% if hit in today’s session. T1 offered a scale-out and some profit on the trade.

Finally, if we see follow through on yesterday’s global selloff today, it’s likely the WTF portfolio will lose two stocks. The new position in ASML Holdings (ASML) is trading below its -1ATR line and American Water Works (AWK) is within $1 of it. Pfizer (PFE) and Vestas Wind Systems (VWSB) are holding up well so far.

Learn more about Ian Murphy at MurphyTrading.com.