I’ll admit, last week I expected a rosier near-term picture for markets, says Lucas Downey of Mapsignals.com.

The data pointed to de-risking grinding to a halt. Since then, major selling fired up again. Macro headwinds continue to accelerate volatility: namely, rising inflation and higher interest rates. It’s ugly. But it’s not all despair.

Today we’ll look at the recent Big Money selling and briefly discuss the challenging inflation issues. Then I’ll point to one silver lining in today’s environment. Let’s go.

Signs of Capitulation are Here

Last week I noted how massive selling slowed, buoying stocks higher. Normally that’s a near-term bullish sign, but not this time. I was wrong. Mr. Market had other ideas. The major missing piece in our data was buyers. Go figure.

Once Friday’s red-hot May CPI reading of 8.6% hit, traders rushed for the exits in a big way. That bled into Monday’s 3.8% pullback in the S&P 500 ETF (SPY), which had signs of capitulation…i.e. everything got sold. Basically, there was zero leadership as investors threw in the towel.

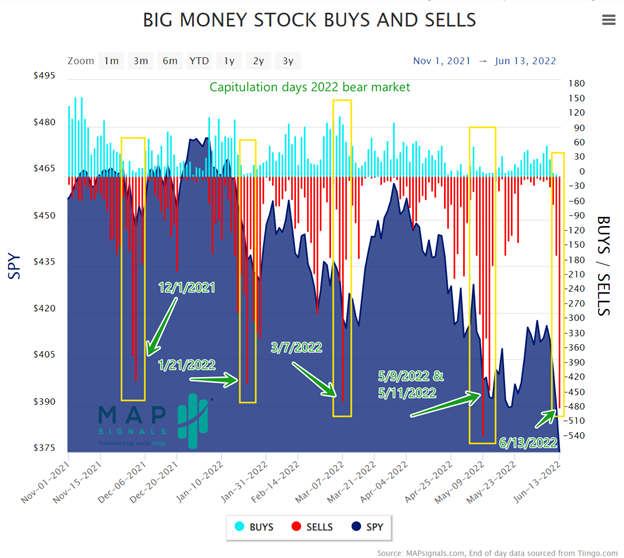

According to our data, Monday had 473 stocks register sell signals. With a universe of ~1500 institutionally tradable stocks, anytime 30%+ get sold, that’s mega-size. Monday marked the second largest sell day over the past year. We’ve only seen a larger daily count back in May. Below, I’ve outlined Monday’s plunge and other recent capitulation days:

Visually, you’ll notice that stocks tend to stage a relief rally shortly after such washouts. Capitulation days tend to ricochet stocks higher. So that’s a positive at least!

In fact, back in March, I created a table of all prior capitulation days going back 20 years. You can check out the study in further detail. But here’s a quick synopsis: "After these washout days, the returns for markets are very bullish one to 12 months later, on average."

Here’s a snapshot:

Incredibly, a year after days like Monday, the markets are generally +20.1% higher.

But we all know that 20 years of data doesn’t incorporate periods like now with out-of-control inflation and soaring interest rates. These are shifts we haven’t had to deal with in this cycle.

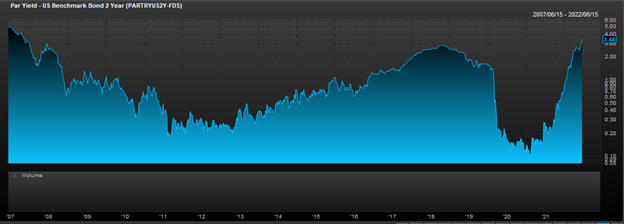

The two-year Treasury yield jumped to 3.48% earlier this week—a level not seen since 2007:

Source FactSet

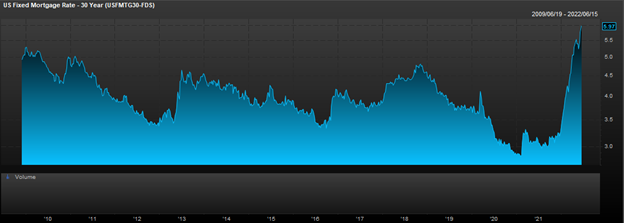

Now, look at the mortgage market. The 30-year mortgage rate in the US surged to nearly 6%. We haven’t seen levels like this in well over a decade:

Source FactSet

These are just some of the new realities investors have had to swallow in the last few months. As Alec Young noted: "The two-year Treasury yield is a great real-time market proxy for where the Fed funds rate is heading."

The Fed hiked its benchmark rate 75bps on Wednesday, the largest increase since 1994.

Listening to the meeting, Powell used language like “flexible” in their approach and “data-dependent.” His message was one of hope and eventual prosperity, where inflation ultimately shows signs of flattening. I’m in the hopeful camp!

Now for the positive message. I’m bringing up the macro for a reason. Until inflation is under control, markets will likely experience volatility. News headlines are prone to dictate sentiment and price action over the near term.

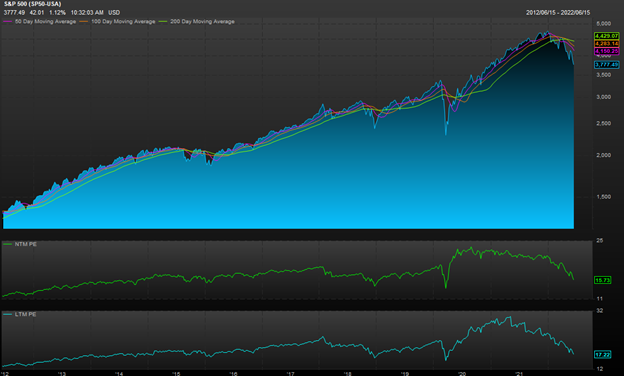

And while that’s unsettling, don’t let it be lost that company valuations are quite attractive. Yesterday I pulled up the Price to Earnings Ratio (P/E) for the S&P 500. The current reading has fallen to 17.22 while the forward sits at 15.73. These are levels not seen since early April 2020:

Source: FactSet

Valuations like these rarely come along. Many stocks are down massively in the last six months. If you’re an investor with many years ahead of you—be happy and proactive. Take your time and nibble at healthy companies with wide moats.

Chances are, years from now, you’ll be glad you did.

Let’s wrap up, here's the bottom line:

The first signs of capitulation are here. De-risking picked up again as inflation and interest rates surged. Based on the last 20 years, stocks tend to stage a relief rally soon after. But we must acknowledge the ever-growing challenges on the macro front. There’s a lot of wood to chop regarding inflation. Until it peaks, expect further volatility.

But on the flip side, there’s no arguing that valuations are reaching bargain levels. Proactive investors should take their time, slowly adding to healthy businesses with rich cash flows. My bet is once the tide turns on the macro front, these are going to be the leaders. Look, there’s been a lack of buyers in our data for weeks. That’ll change someday. My message to you is don’t give up.

Years from now we’ll all look back at the bear market of 2022. Hopefully, a few of you grab a few great stocks along the way. That’ll be a great story to tell.

To learn more about Lucas Downey, visit Mapsignals.com.