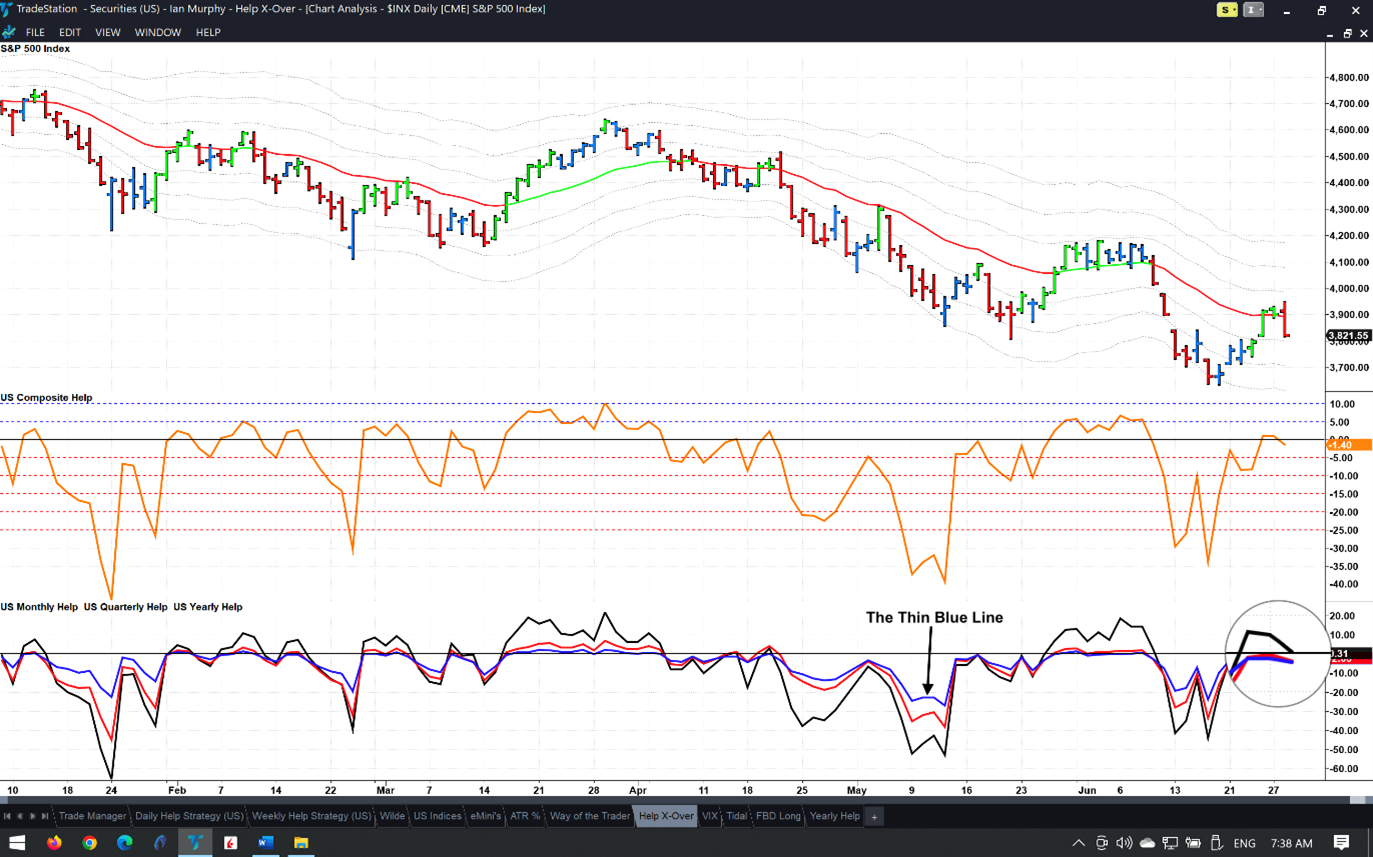

The Yearly Help Indicator (highlighted with the black arrow below) is one of the most important leading stock market indicators I know of, states Ian Murphy of MurphyTrading.com.

Unless this guy steps over the threshold, any party the bulls hold is sure to be a flop.

Click charts to enlarge

We will discuss this indicator in more detail in the monthly newsletter, but for now we can see it failed to break above zero in last week’s rally (magnified) and reversed course as the S&P500 sold off yesterday.

Calculated from stocks trading at 52-week highs and lows, the indicator has failed to hold above zero for any significant period since the year began. We will not return to a bull market until this thin blue line breaks above zero and stays there.

Click charts to enlarge

Trigger #140 on the Daily Help Strategy failed to reach T2 on ProShares Ultra S&P500 (SSO) and Micro E-minis (MES=F), and the trailing stops have flatlined.

I wouldn’t give up on this one just yet as the Pessimism indicator is still inside the channel and VIX is calm for the moment. Ahead of the open, futures are flat to slightly positive so we might get another attempt at T2 in today’s session.

Learn more about Ian Murphy at MurphyTrading.com.