The first half of 2022 is pretty much in the books, the bear market has sent stocks tumbling, says Lucas Downey of Mapsignals.com.

That doesn’t mean it’s time to give up. Nope, it’s time to be proactive, by searching the landscape. While nearly all groups were sold hard this year, two sectors are primed for upside.

It’s no secret that the theme of this year has been volatility. Stocks twisted and turned, with plenty of capitulation-style pullbacks. It’s been a difficult period indeed, but that just points to the potential upside once the macro landscape improves.

Today we’ll review how sectors performed YTD and also recap that action through the Big Money lens. From a data standpoint, two groups jump out as extremely oversold.

And as I’ll show you, these two areas are poised for higher prices given Wall Street targets.

Alright, let’s jump in.

First Half Sector Dive

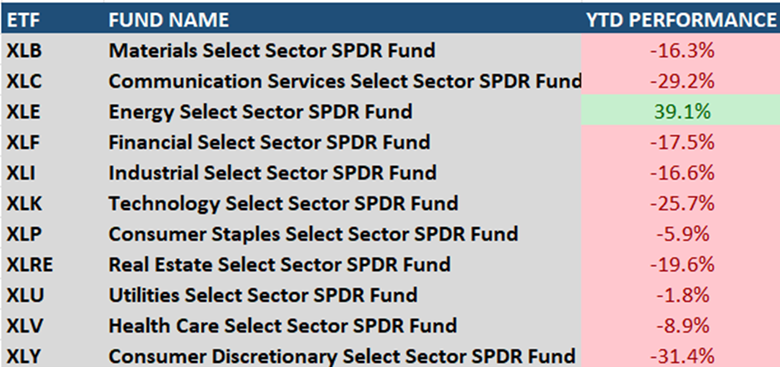

If your stocks are down, you’re not alone. Just about all major sectors are in the red in 2022. Below I’ve listed 11 sector ETFs with their YTD performance. Energy is the only bright spot, while Technology (XLK), Communications (XLC), and Discretionary (XLY) stocks are down over 25%:

Source: FactSet

When prices fall across the board, you can bet that sellers have been abundant. Inflation fears, rising interest rates, war, recession, and more have been major headwinds for risk assets. Buyers were no match for the non-stop sell wave.

Looking at the Big Money data also paints a similar picture. Selling has been the name of the game.

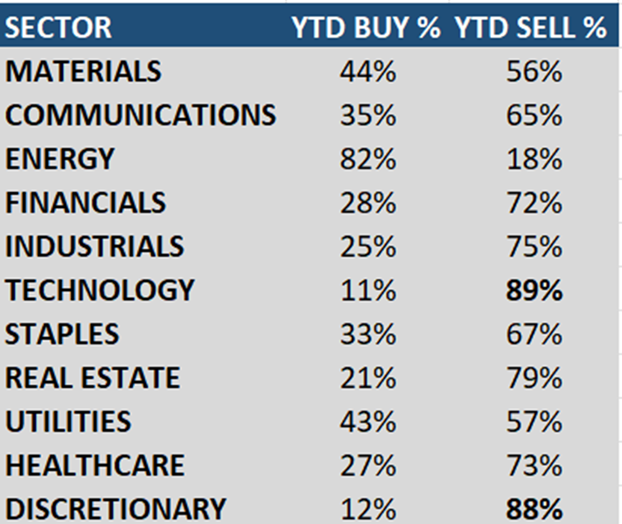

Below are details of the buys and sells by sector in 2022. As you’d imagine, many of the weakest performing sectors saw the largest percentage of sell signals.

Below is a first-half recap. The middle column lists the percentage of our signals that were buys while the right column lists the sells—all in relation to their sector:

Source: FactSet

You’ll notice every group saw more sells than buys this year except Energy (XLE). That lines up with the sector performance YTD to a tee. But notice two areas in bold: Discretionary and Technology stocks saw nearly nine sells for every one buy signal this year.

Fears over the strength of the consumer, rising inflation, and recession have dragged on these consumer-driven areas. These groups alone have been some of the most oversold areas in our data.

An easy way to see that is by looking at our sector buys and sells charts.

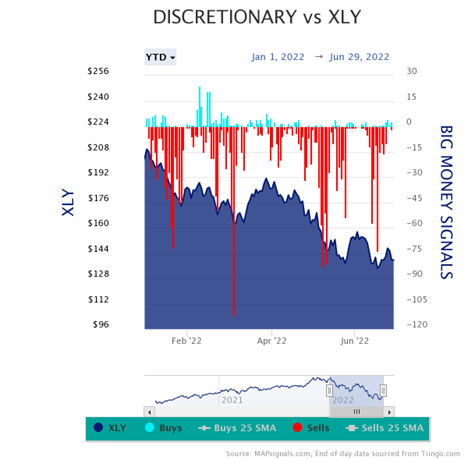

We’ll start with Discretionary stocks, the worst-performing sector YTD, with XLY down 31.4%. It saw 88% of all signals on the sell-side. That’s extreme one-way action. Below you’ll notice how scarce buys have been (blue bars), while selling (red bars) has been relentless:

When nearly nine out of ten signals are sells, prices have nowhere to go but lower.

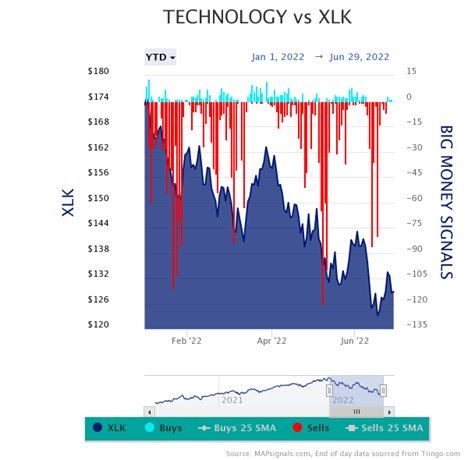

Now, let’s look at Technology. The XLK ETF is down 25.7% in 2022. From a Big Money trading standpoint, 89% of all signals were red:

Many of these companies thrived in prior years as growth was in favor. But investor worries around slowing growth have dragged heavily on the group.

To be clear, there’s no indication that buyers are stepping into these areas. So, until the data changes, shares will remain heavy. But that’s where being opportunistic can pay off over the long run.

Two Sectors Are Primed for Upside

When stocks go on sale, valuations start to reach compelling levels. When they reach oversold levels, they can be primed for upside.

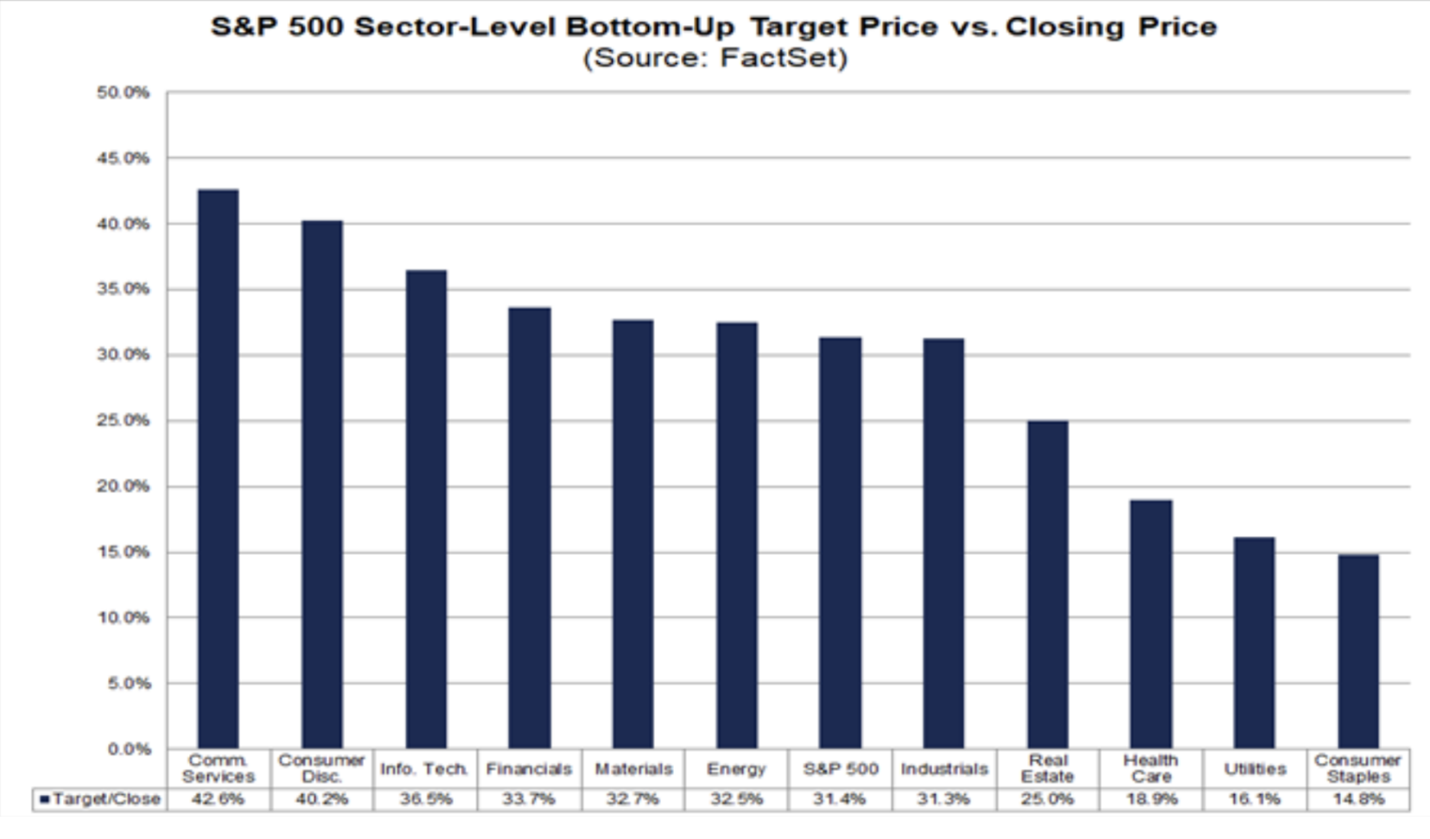

Yesterday, when I was culling all the sector data, I came across a great chart from FactSet detailing each S&P 500 sector ranked by bottom-up price targets.

According to FactSet, Discretionary and Technology stocks are two areas expected to see some of the largest upside price increases:

Source: FactSet

Based on estimates, Discretionary and Technology stocks are expected to see price increases of 40.2% and 36.5% respectively. Keep in mind that these are only estimates which can change.

But, at a minimum, the forward picture appears brighter than today’s environment. Couple that with extremely oversold action, and my bet is these groups will thrive again once selling slows.

Let’s wrap up.

Here’s the bottom line: Sellers took control in the first half of 2022. Discretionary and Technology stocks saw incredible action with nearly nine sells for every one buy. That’s oversold action.

Add in that price targets for the two sectors indicate a big upside, opportunity could come sooner than many expect.

From my standpoint, focus on best-of-breed stocks inside these groups. Take your time and nibble as prices meet your levels. Once the tide turns, these stocks can rerate a lot higher.

To learn more about Lucas Downey, visit Mapsignals.com.