iShares US Healthcare ETF (IYH) tracks a market-cap-weighted index of pharmaceutical, biotechnology, health care services, and equipment companies in the United States, explains Jim Woods, editor of Bullseye Stock Trader.

IYH represents the health care segment by holding an assortment of the largest pharma, health care, and biotech companies in the United States. The fund tracks an index of large- and mid-cap companies in the healthcare sector, which consists of pharmaceuticals, biotechnology, healthcare services, and equipment companies.

Stocks within IYH are selected and weighted by float-adjusted market cap.

The index caps individual securities at 22.5% and also caps all issuers individually exceeding 4.5% to a maximum of 45% of the fund. Index rebalancing is done on a quarterly basis. Prior to September 20, 2021, the fund tracked the Dow Jones US Health Care Index.

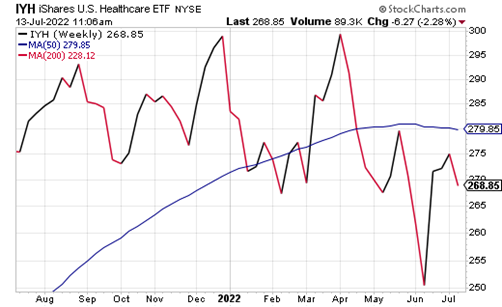

Source: StockCharts.com

The fund generally will invest at least 80% of its assets in the component securities of its underlying index and in investments that have economic characteristics that are substantially identical to the component securities of its underlying index.

The underlying index measures the performance of the healthcare sector of the US equity market. The fund is non-diversified.

IYH has $2.89 billion in assets under management and a 0.05% average spread. Its expense ratio is 0.41%, meaning it is relatively inexpensive to hold in relation to other exchange-traded funds. It has 115 holdings and pays a 1.07% dividend, which is always a plus.

While IYH provides investors with great exposure to the health care sector, this kind of ETF may not be appropriate for all portfolios. Interested investors always should conduct their own due diligence in deciding whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.