When future generations write the financial history of 2022, this week will be remembered for profound reactions to press conferences, writes Ian Murphy of MurphyTrading.com.

Putin’s speech to his fellow citizens on Tuesday caused a stampede for the exits in Russia, Jerome Powell’s comments on Wednesday sent US equity indices south for the winter, and the new UK chancellor’s economic plan has just triggered a major selloff in the pound.

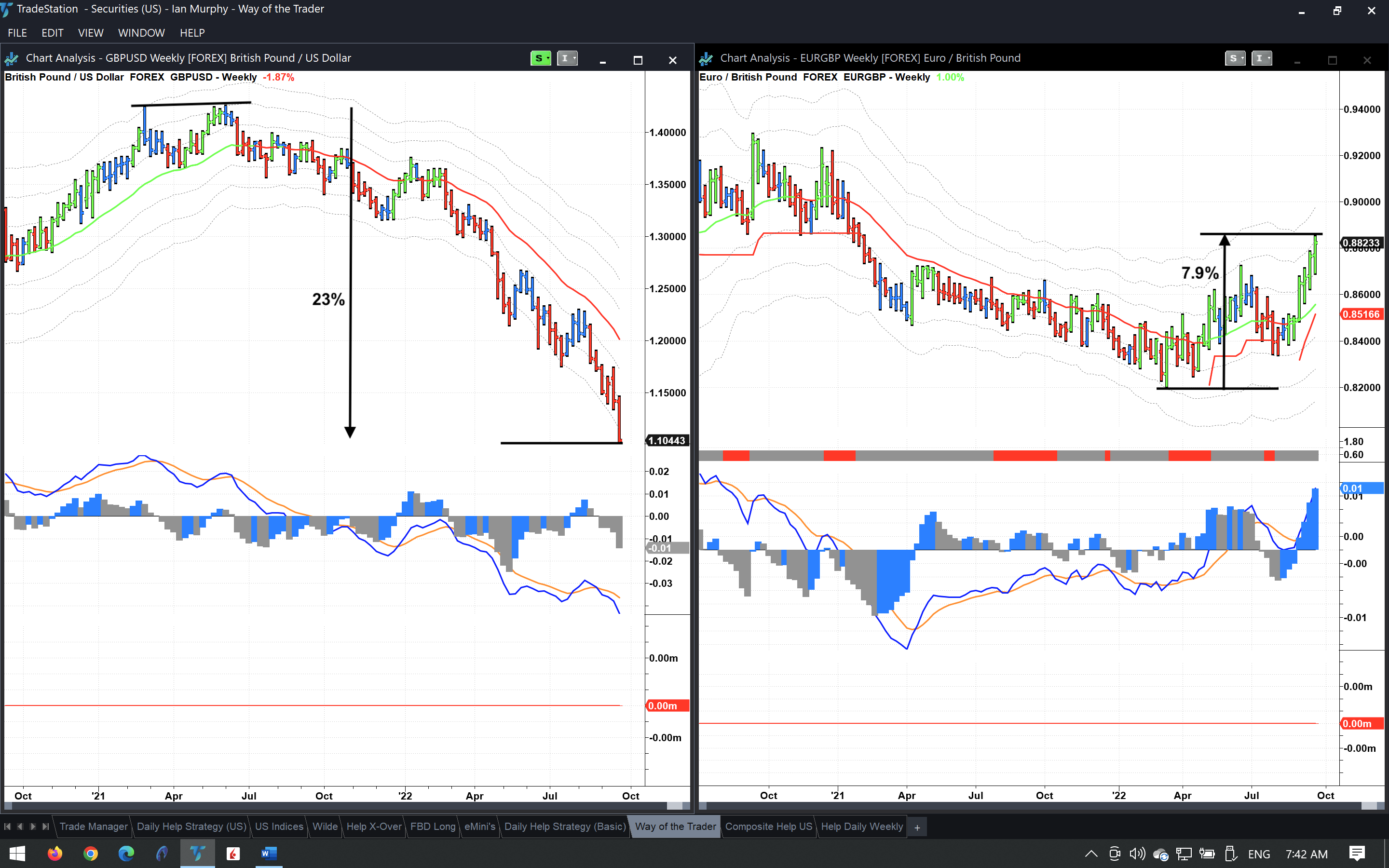

Sterling has lost 23% against the US dollar in the past year, and traders have parity with the dollar in sight (left chart). Surprisingly (and confusingly) the Euro has gained 7.9% against the pound (right chart) since March while also falling against the dollar. Meanwhile, Japan announced yesterday it had intervened in forex markets to stem the fall in the yen.

Throughout the week, long-side traders have been mostly sitting in cash, but the few who reversed positions on the last Help Strategy exit are up 11% on the SSO ETF based on yesterday’s close. At 08:00 ET, futures of the S&P 500 (SPX) were down 1.3% (insert chart), so it’s time to start thinking about closing the position when the -3ATR channel is hit.

Learn more about Ian Murphy at MurphyTrading.com.