The utilization of uranium is a key component of nuclear energy, as the nuclear industry is propelled by the mining, refinement, and delivery of uranium, states Jim Woods of The Deep Woods.

The Global X Uranium ETF (URA) offers investors exposure to a wide array of companies involved in both global uranium mining and its production. The exchange-traded fund (ETF) chooses companies that are purely involved in these pursuits or derive a large portion of their revenue from the uranium industry.

The companies that have revenues in the uranium industry are involved in uranium processes that include extraction, refinement, exploration, and sometimes even manufacturing of the equipment for the uranium and nuclear industries. Created in 2010, URA provides exposure to nearly 50 global companies involved in the uranium industry.

URA has amassed $1.76 billion in net assets and $1.77 billion in assets under management. The ETF is highly traded, with an average volume of more than two million shares per day. Moreover, URA provides a high yield of 6.02% and has an expense ratio of 0.69%.

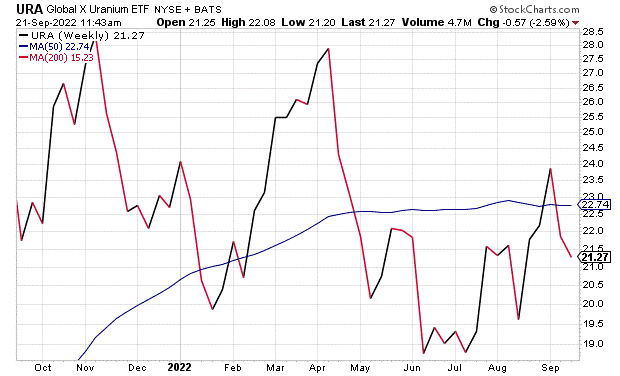

As evidenced in the chart below, URA has seen its share of ups and downs year to date, which is not unusual given the market uncertainty over the same time frame. However, while many stocks and sectors continue to falter, given the current inflation-rate debate, URA is rebounding.

In November 2021 and April of this year, the ETF saw remarkable spikes. Nearly 72% of URA’s holdings are in the energy sector, and its top ten holdings make up 70.45% of its total assets.

Chart Courtesy of Stockcharts.com.

Exclusive Drilling for a "Clean Power" ETF

Ultimately, the Global X Uranium ETF is a nuclear energy play as it offers investors access to companies worldwide that participate in uranium processes including extraction, refinement, exploration, and/or manufacturing of the equipment for the uranium and nuclear industries.

So, while URA is a gateway to uranium and nuclear energy, this kind of ETF may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether a given fund is suitable for their investing goals.

Learn more about Jim Woods here.