Last July, I wrote about inflation and one of its main drivers, commodity prices. I made the case then that although the Fed was aggressively moving to limit inflation through higher rates, commodity prices had been decreasing sharply since mid-June and were not supporting higher prices, states Brett Friedman of Winhall Risk Analytics.

This was particularly true in energy, specifically crude oil and gasoline. In short, the Fed could not point to commodity prices as a reason to raise rates. Is this still true? Is the Fed’s latest tightening merited by commodity prices?

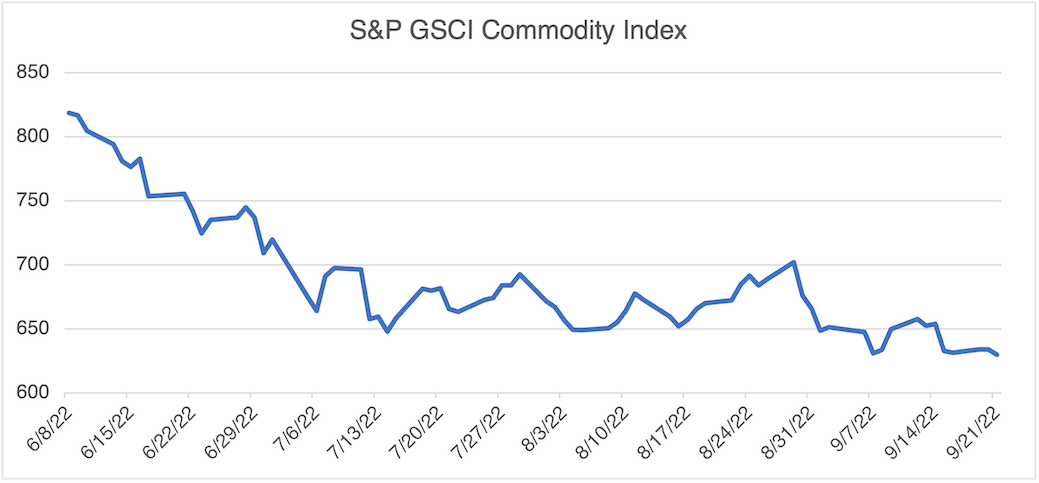

Short answer: no, or at least to the extent that commodity prices influence inflation. The latest price action of the commodities displayed below since June eighth, roughly their YTD peak, leads to this conclusion. Consider the broadest indicator, the Goldman Sachs Commodity Index, below, as well as the accompanying table:

Source: S & P

Interestingly, the implied volatility (30-day) of the commodities displayed above has remained relatively stable, on balance, since June eighth. However, since these commodities continue to be affected by the war in Ukraine, the latest escalation in the war has led to some short-term increases, mostly in natural gas and agriculture.

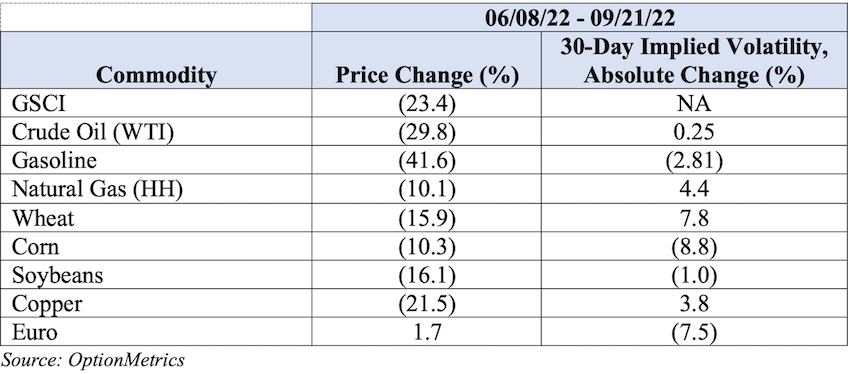

Taking energy first, the commodity class that gets the most attention, crude oil and gasoline prices have continued to move lower since mid-June. For crude, implied volatility is usually inversely proportional to price and tends to confirm the move. That is the case here, as continued Covid lockdowns in China lead to demand destruction and an easing of the supply situation.

Source: OptionMetrics

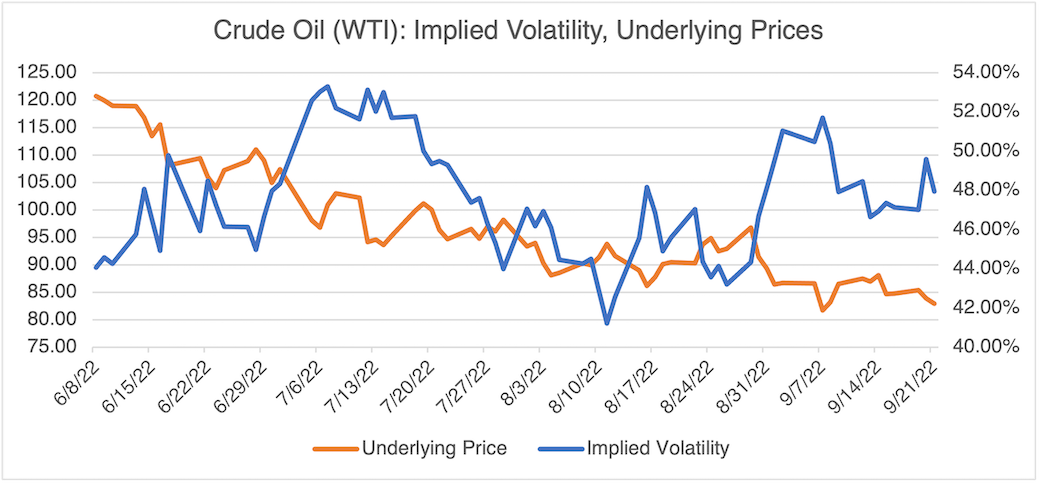

Source: OptionMetrics

Gasoline continues to show the largest price decline of the commodities sampled above. Curiously, and unlike crude oil, its implied volatility has been declining somewhat as the underlying price decline continues.

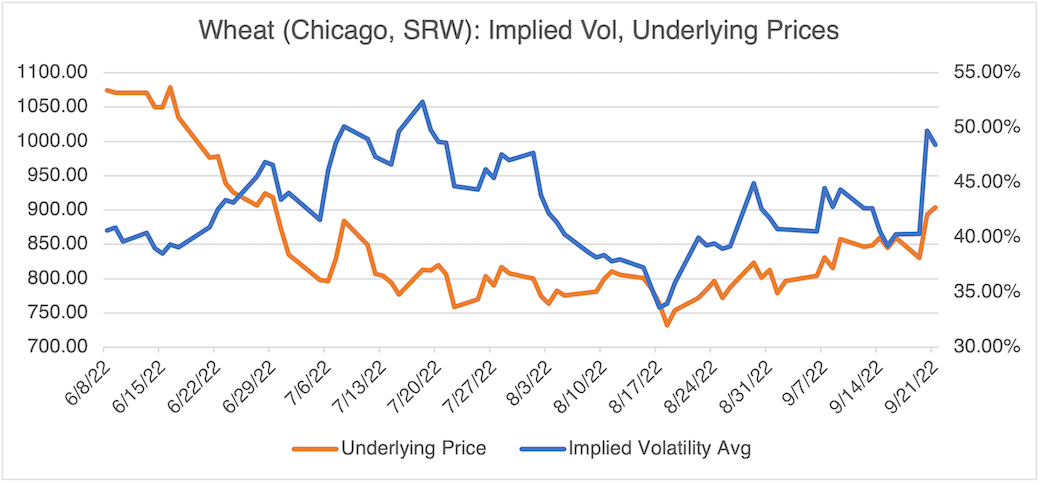

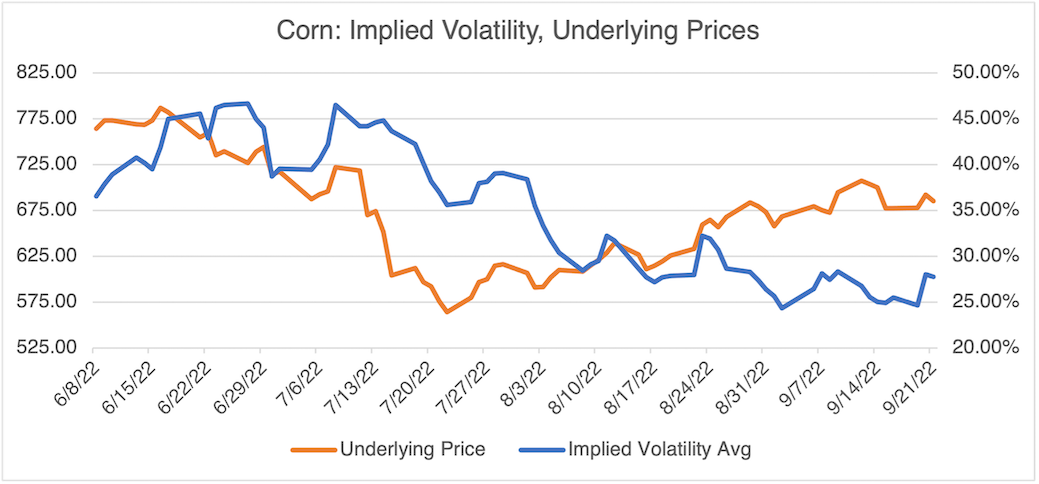

Agriculturals have remained largely lackluster to marginally higher for the last month or so. As is the case with the energies, they are being affected by the war in Ukraine and will tend to drift sideways in the absence of new developments.

Source: OptionMetrics

Source: OptionMetrics

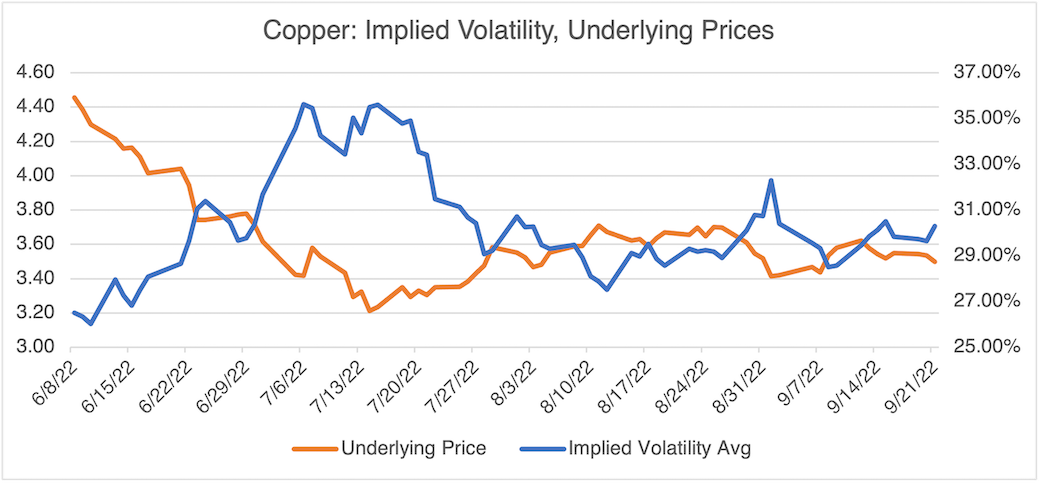

Copper, an indicator of industrial demand, continues to be under pressure due to the specter of an upcoming recession:

Source: OptionMetrics

Although commodity prices do not seem to be supporting inflation, that does not necessarily mean that the Fed will back off from its aggressive stance. Other inflationary inputs are also considered. But, there is also a subtle, behavioral reason for the Fed’s continued efforts to address inflation. Most of the Fed governors began their careers during the 70s, the last time that inflation was raging in the US. Experience tells them that once inflationary expectations become psychologically ingrained, they are extremely difficult to get rid of. Paul Volcker, the chairman of the Fed at the time, clamped down hard, sending mortgage rates to almost 17% in 1981. It is safe to assume that the governors do not want to relive that experience. Therefore, their natural inclination will be to maintain an aggressive stance, despite what commodity prices are doing.

Brett Friedman is a managing partner at Winhall Risk Analytics and a contributor at OptionMetrics. He has managed risk for over 30 years and has broad experience working with financial institutions in risk management and operations. Mr. Friedman has built and managed three risk management organizations, two trading startups, and has transacted on numerous exchanges and OTC markets; and draws on first-hand management, operations, and valuation experience.