As it happens, we did have a Help Strategy trigger yesterday following a gap up in the S&P 500 (SPX), writes Ian Murphy of MurphyTrading.com.

The price remained stable throughout the session while the number of stocks making new lows on all three timeframes dropped significantly.

Considering North Korea, the US, and Japan are lobbing missiles into the pacific while Ukrainian forces are pushing Putin closer to going nuclear, a reluctance to take yesterday’s trade is understandable, but let’s remember the data on which these triggers are based comes from an analysis of all US stocks, and yesterday people were buying across the board.

Click charts to enlarge

The initial protective stops and targets on ProShares Ultra S&P500 2x Shares (SSO) and Micro E-minis are shown above. Ahead of the open futures are down slightly and Cboe SPX Volatility Index (VIX) up a little, but no major cause for concern just yet.

A question came in yesterday about where to place these targets and stops if you enter early in the session and the levels have moved at the session’s end. A great question that I will answer in tomorrow’s webinar.

Click charts to enlarge

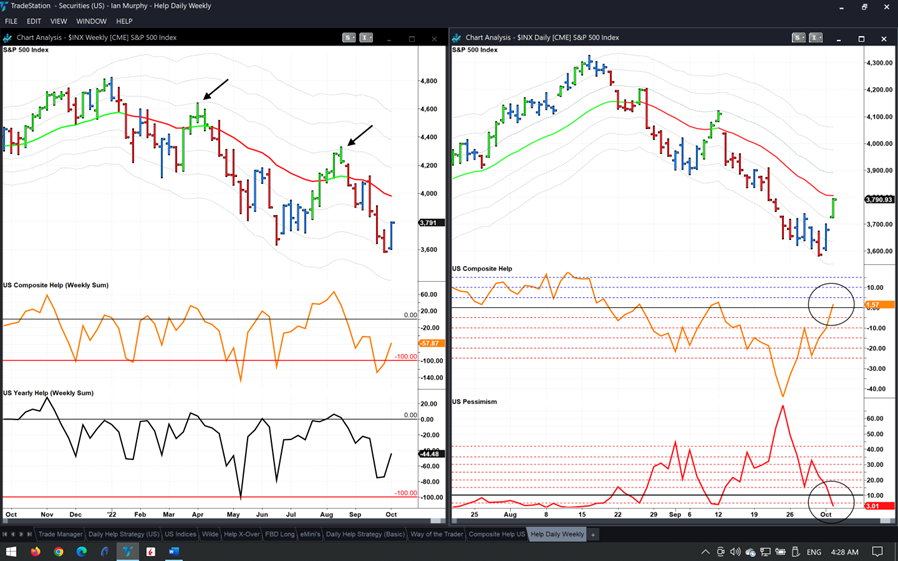

The underlying strength of this bounce can be seen on the right above where the Composite Help and Pessimism indicators have crossed their zero and -10% lines respectively (circles).

If I was forced to offer a target level for this bounce, the 1ATR line on a weekly chart at 4200 (left above) would be reasonable as this is where the previous rallies ran out of steam.

Learn more about Ian Murphy at MurphyTrading.com.