The core Consumer Price Index (CPI) data in the US showed prices (excluding food and energy) increased 6.6% from a year earlier, writes Ian Murphy of MurphyTrading.com.

With that level of inflation, and record numbers of people in employment, another interest rate increase of at least 0.75% can be expected next month. It would also be reasonable to expect US stocks to tank on the news. Instead, they whipsawed and started to surge!

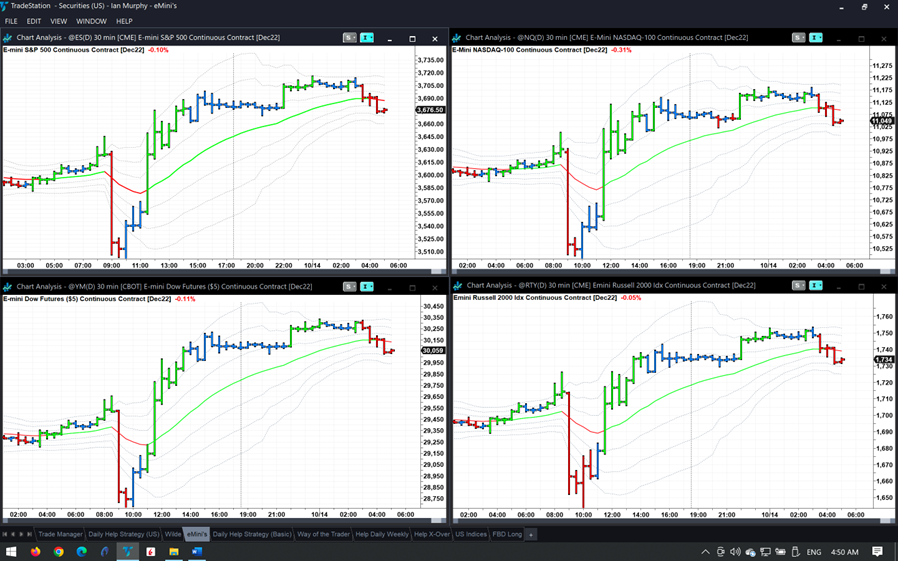

The markets have never been a bastion of reasonable and rational behavior, and price action in futures as shown above was a reminder of that. No doubt explanations for the move will emerge but these washout reversals are a gift to technical analysts because they offer support levels to watch.

The two black dashed lines above are a 50% retrace of the weekly and daily bars on the S&P 500 (SPX) and these will need to stand firm if the market is going to rally from here. There is also a possible bullish divergence forming on Composite Help because the number of new monthly lows (1705) was significantly less than the number at the first low (3686).

One thing which stood out for me in the surprise rally was the CBOE SPX Volatility Index (VIX) (circles). This index measures implied volatility and is calculated from the price of 30-day options on the S&P 500. It did not fall by a corresponding amount as the S&P 500 rose and has continued rising in overnight trading ahead of the open of the regular session.

Don’t forget bank earnings are due today—buckle up and watch those protective stops.

Learn more about Ian Murphy at MurphyTrading.com.