The week began with the possibility of an entry trigger on the 52-Week Strategy, writes Ian Murphy of MurphyTrading.com.

The indicator closed above zero last week so another positive reading today would be a valid trigger, and a decision to enter or not will need to be made this afternoon about 20 mins before the close.

As things stand, the indicator closed at -177 yesterday (circle) and it will take a lot of buying to drive the S&P 500 (SPX) back above 4000. But who knows? It might happen today—stay tuned!

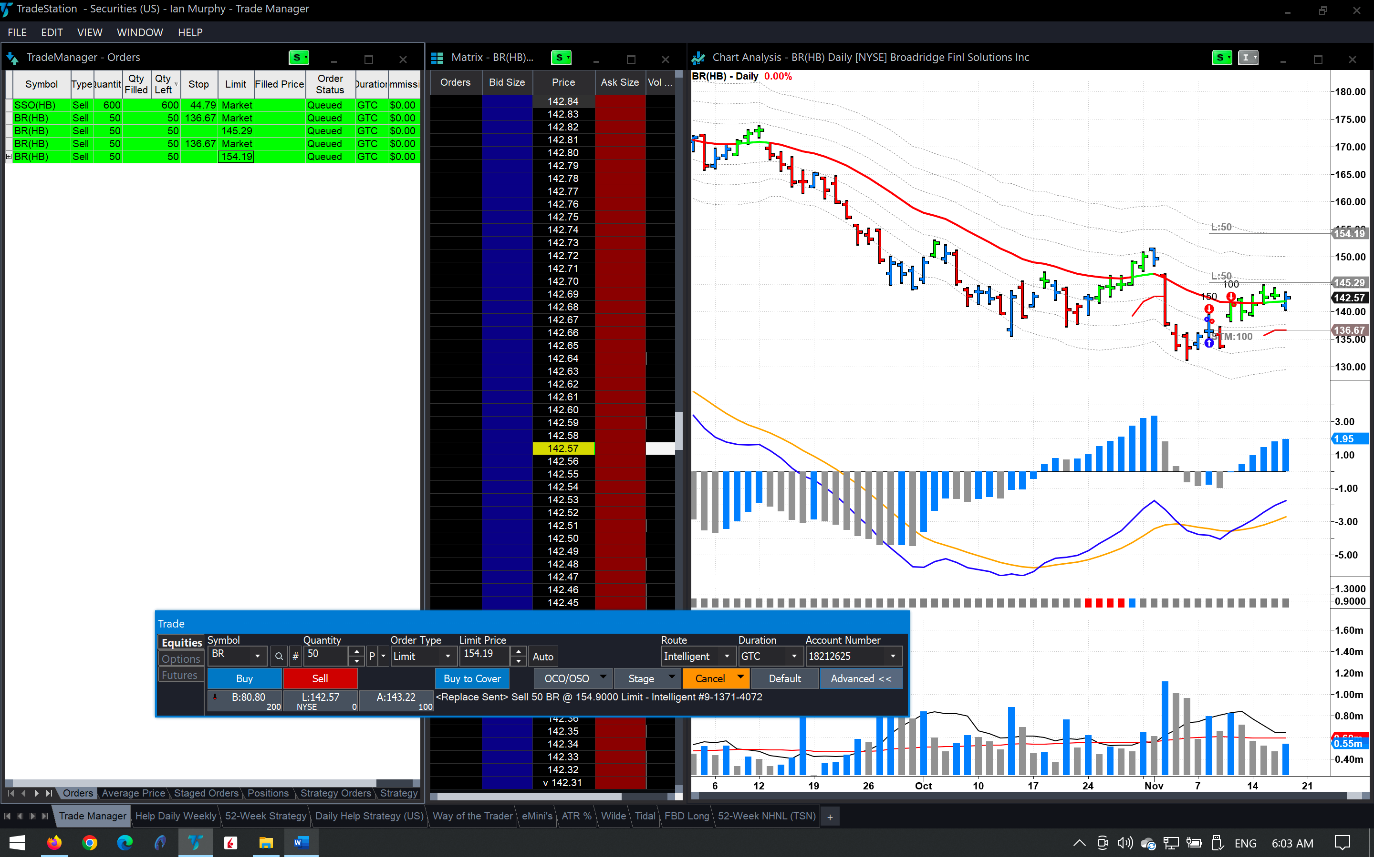

Over on the False Breakout Divergence (FBD) Strategy, only one stock caught my eye recently, namely Broadridge Financial Solutions (BR). It triggered on Tuesday of last week and the first target has been hit, but not before a close shave with the initial protective stop. The remaining targets and trailing stops are shown above.

Learn more about Ian Murphy at MurphyTrading.com.