Stock markets will remain on edge today as traders react to the slightest indication the FOMC might waiver from the well-flagged (and highly anticipated) 0.5% rate increase next Wednesday, writes Ian Murphy of MurphyTrading.com.

In other markets, the mood music has changed significantly as traders come to terms with increased rates and slowing growth.

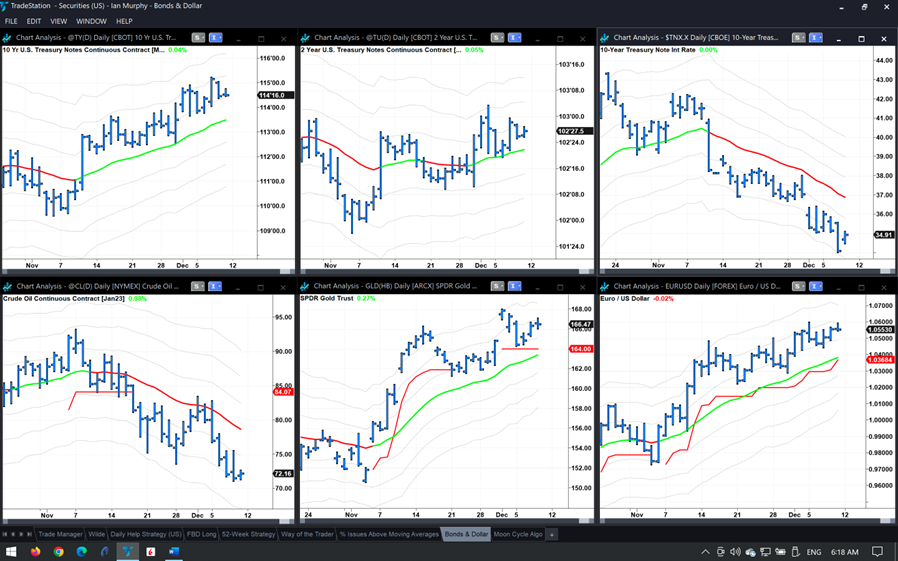

Looking at the daily charts of bonds, commodities, and currencies above, ten-year treasuries have been rising steadily for a month (top left) while their yield is heading back to 3.4% having fallen from 4.3% (top right). Oil has $70 in its sights (bottom left) while gold is feeling the love again (bottom middle).

In currencies, the Euro has reversed off parity with the US dollar as markets expect the Fed to ease off on rate hikes before the ECB does. Throughout the year I held 75% of my trading equity in USD—which has now been rebalanced to 50/50, Euro, and USD.

Learn more about Ian Murphy at MurphyTrading.com.