With US equity markets closed for Martin Luther King, Jr. Day, let’s catch up on European stocks, writes Ian Murphy of MurphyTrading.com.

The ‘STOXX50’ is an index provided by a subsidiary of Deutsche Börse in Germany and it tracks 50 blue chip firms from countries where the euro currency is used. The ‘STOXX600’ has a broader base and covers the largest 600 firms in Western Europe regardless of their currency. This means it includes non-EU countries such as the UK and Switzerland, so it offers a deeper perspective on business activity and market sentiment.

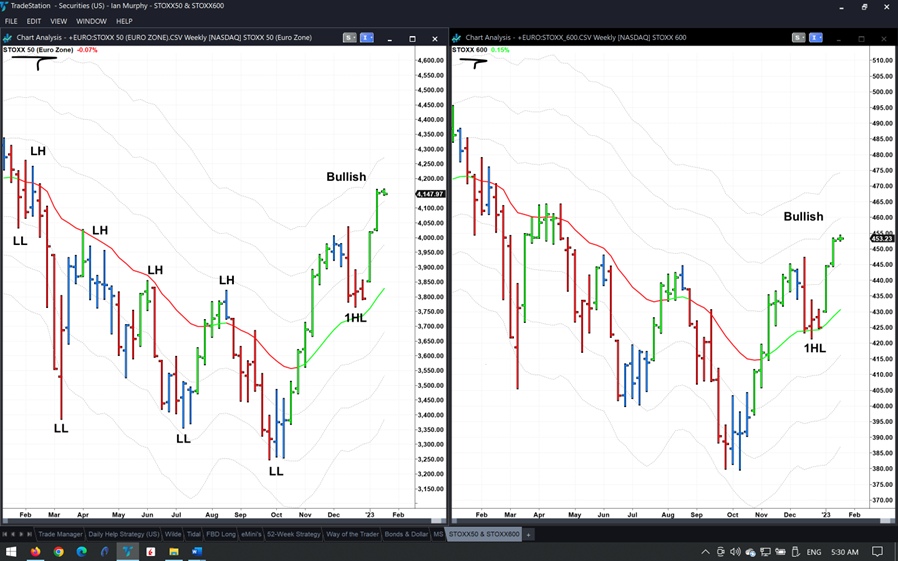

Source: Yahoo Finance

On the left of the weekly charts above, a classic bearish trend structure of lower highs and lower lows mirrors what we saw in the US equity market last year. However, Europe appears ahead of the States on this occasion because a first higher low pattern crystallized in December and a new bullish trend may be in play—the pattern is still unfolding on the S&P 500 (SPX).

It’s a positive start to 2023 but there is one caveat for bulls and a potential fly in the ointment for stocks—earnings season! We have already seen numbers from banks for Q4-2022 but other sectors will start reporting en masse from the following Monday onwards. Please keep this in mind when opening new positions as a surprise on the earnings front can violently move a stock’s price.

Learn more about Ian Murphy at MurphyTrading.com.