Yesterday we talked about how early the Phlx Gold & Silver Index was in this cycle, states JC Parets of AllStarCharts.com.

This index of 30 precious metal mining companies was the first of the Gold related stock indexes to break out. This was about a month after Gold Futures confirmed a buy signal for us in early October. But of the "stock" related indexes, we look to the Phlx Gold & Silver Index (XAU) as a leader. It certainly acts like one. And do you know how I know it's not a downtrend?

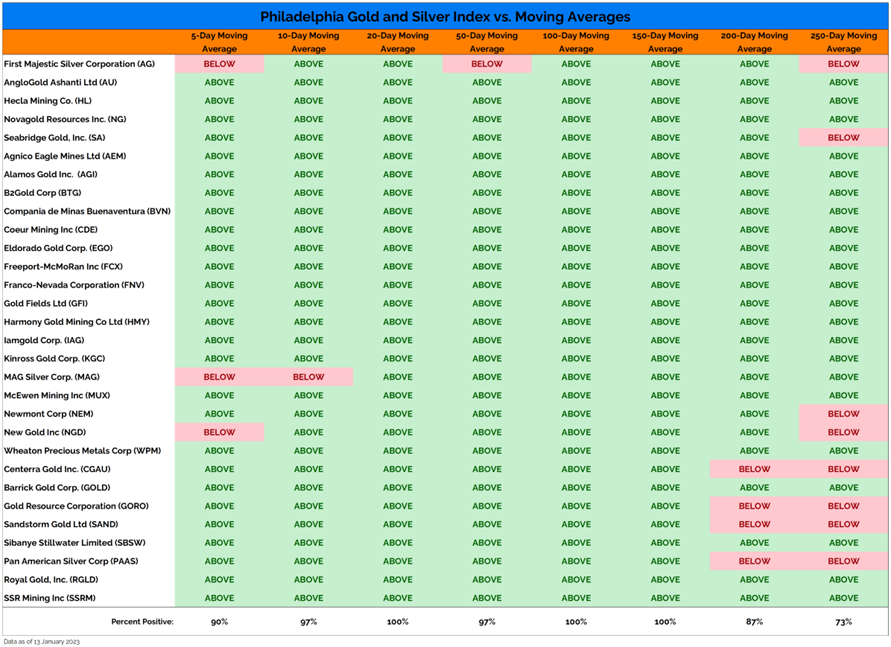

Look at its components. Each column represents a different moving average ranging from the five-day all the way to the 250-day. The further to the right the column sits, the longer the smoothing mechanism we used. Green cells represent when the price of the stocks is above that particular moving average, and each of the 30 stocks is listed on the left side of the table:

I see a lot of green. How about you? We know prices are not in downtrends when prices are above their moving averages. They may not be uptrends, but they're certainly not trending lower.

The further to the right on the table you go, the longer the smoothing mechanism and the stronger the trend. If you're shorting stocks in uptrends, you better have a good reason. And you better have rigorous risk management procedures.

I do it sometimes, whenever the data is overwhelming, like in Bitcoin and micro strategy recently. But by our work, when it comes to Gold and Mining stocks, this is not one of those situations. Quite the opposite actually.

The weight of the evidence suggests we’re in the early stages of a major Gold Rush. This is serious. The time is now.

To learn more about JC Parets, please visit AllStarCharts.com.