Observing the current narrative in the financial media, some are saying with confidence the selloff in stocks is over, others say more pain is coming, writes Ian Murphy of MurphyTrading.com.

Interestingly, most money managers believe stocks will end the year higher than they opened, but this might have more to do with keeping clients in equity portfolios than objective analysis. As you know, my preferred trading style is Trend Following, and since last summer I have not opened new trend following trades but have been daily swing trading and grabbing a few bucks when the opportunity arises.

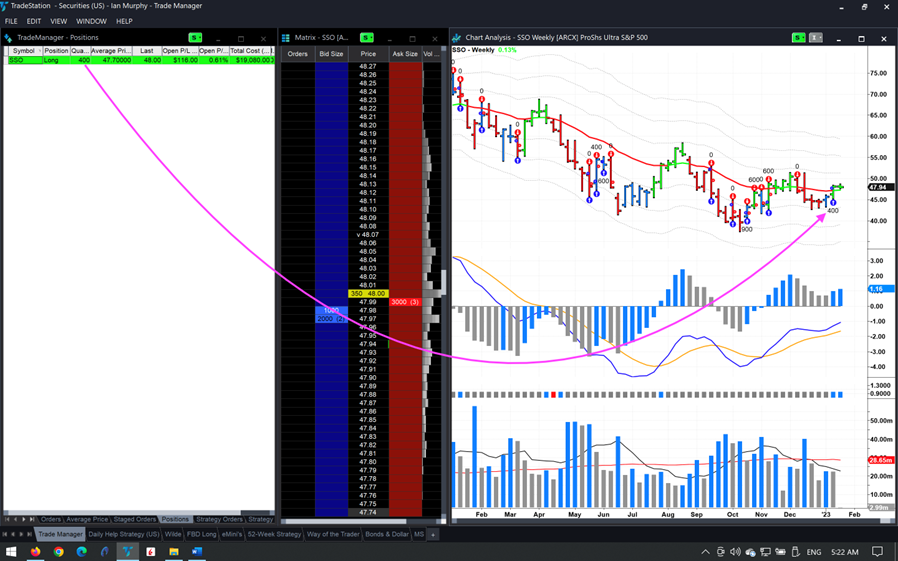

I don’t know if we are seeing the bottom in stocks, but last week’s pattern on the S&P 500 (SPX) on a weekly chart is exactly what a bottoming pattern looks like, so I have taken a moderate position of 400 shares in ProShares Ultra S&P500 2x Shares (SSO) using the 52-Week Strategy just in case this is a bottom - or the bottom!

The soft trailing stop on a closing basis is currently at $43.12, so this position will be reviewed on Friday coming into the close. As traders we are in the probability game, not the prediction game, and I don’t know if this is the bottom, but I like the probability of the current setup.

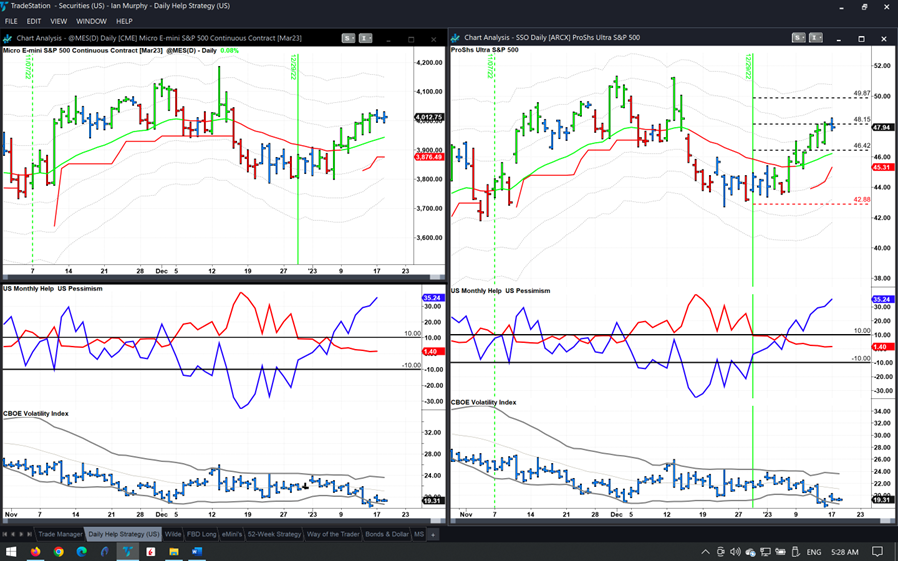

Meanwhile, in short-term trades, the Help Strategy hit T2 on SSO on Friday and the trailing stop has moved above the point of entry (right chart).

Learn more about Ian Murphy at MurphyTrading.com.