The underperformance out of US Large-cap Growth indexes continues, states JC Parets of AllStarCharts.com.

It's not the stock market's fault that the S&P 500 (SPX) has way too much exposure to large-cap growth. And when we talk about "the stock market," there are countries outside of the United States that continue to shine.

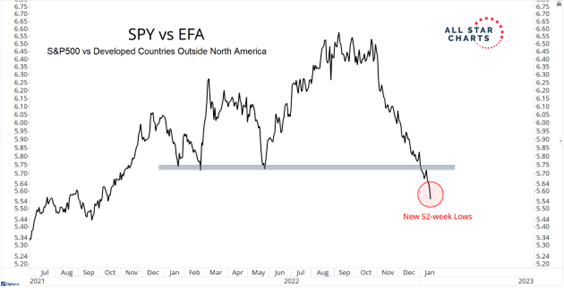

Today's Chart of the Day shows the S&P 500 hitting new 52-week lows relative to Developed Countries outside of North America:

EFA is one of the most important indexes to track for equities. This index is loaded up with European and Japanese stocks and serves as a great gauge for equities in developed countries outside North America.

The S&P 500 has been held back from huge gains that we've seen elsewhere, in part because of its egregious exposure to Growth stocks. But both the S&P 500 and Dow Jones Industrial Average remains below overhead supply. That still hasn't changed.

Last year we saw International Stocks outperform the US for the first time in a while. US investors, particularly those that got high on their growth stocks for so many years, are not used to this sort of thing. So, remember, the US underperformance is not just a 2023 thing. This started last year.

To learn more about JC Parets, please visit AllStarCharts.com.