When you sift through thousands of ETFs each day, you’re bound to spot a trend, states Lucas Downey of Mapsignals.com.

This year is no exception, with global equity ETFs attracting massive inflows. Today I’ll break down the top four European ETFs in 2023. I love trawling through data, especially when it comes to supply and demand. No other market force moves stocks more. I saw it with my own eyes years ago on Wall Street when I was an ETF trader.

When massive pension funds and RIAs (Registered Investment Advisors) want to own a sector or group of stocks, they can buy for days and weeks at a time, often pushing prices higher along the way. Their buying can cause demand to spike and volumes to explode. It was an unforgettable experience watching money being put to work.

Fast forward years later, I’m not sitting on an institutional trading desk. I’m poring through MAPsignals software searching for those unusual footprints. Our software signals when shares trade in an unusual way. Recently there’s been a flurry of buy activity in global ETFs. Let’s dive in!

Top Four European ETFs in 2023

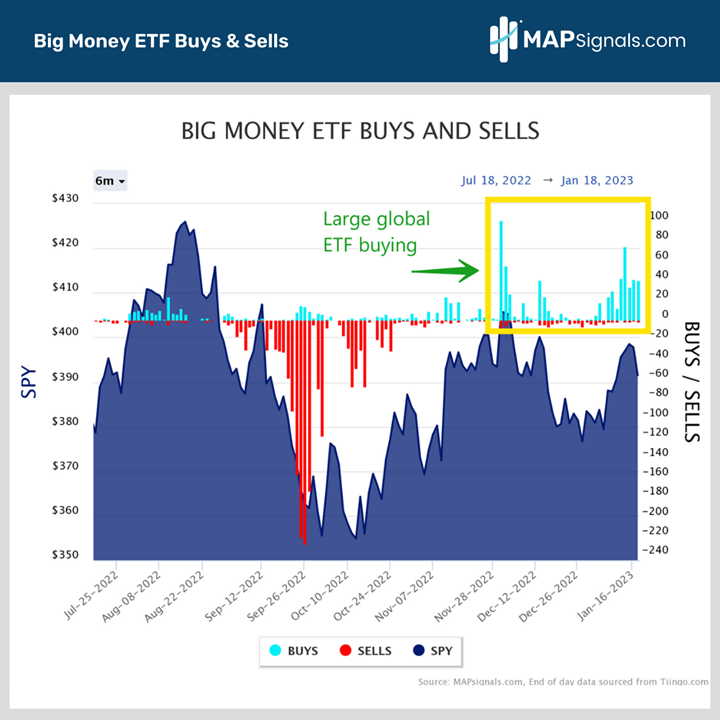

I spotted the surge in ETF activity with our Big Money ETF Buys and Sells chart. It details the daily count of funds rising and falling on elevated volumes. Beginning in 2023, ETF buying has surged to levels we haven’t seen in many months. You can see what I mean below. There’ve been multiple days in January where dozens of ETFs were surging:

Anytime there’s large ETF buying, I take notice. Looking deeper under the surface there’s a major equity theme underway: Global ETFs are under accumulation, specifically across the pond in Europe. Let’s now go through the top four tickers seeing repeat buy signals.

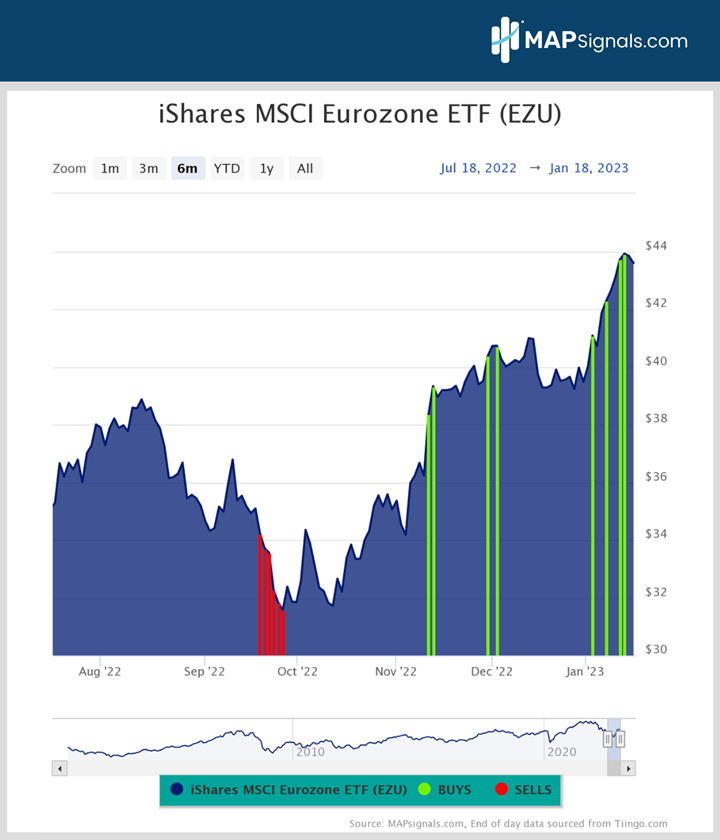

Up first is the iShares MSCI Eurozone ETF (EZU). It’s a cap-weighted index of large- and mid-cap companies that use the euro. Now you may be wondering why investors would be attracted to European equities—one reason is valuation. As of December, the basket of stocks sported a P/E of nearly 13, much cheaper than US stocks (S&P 500 SPY ETF) priced with an 18.71 PE. MTD (Month to Date) the fund has gained 10.42%. Since November there’ve been eight accumulation signals—that’s a trend!

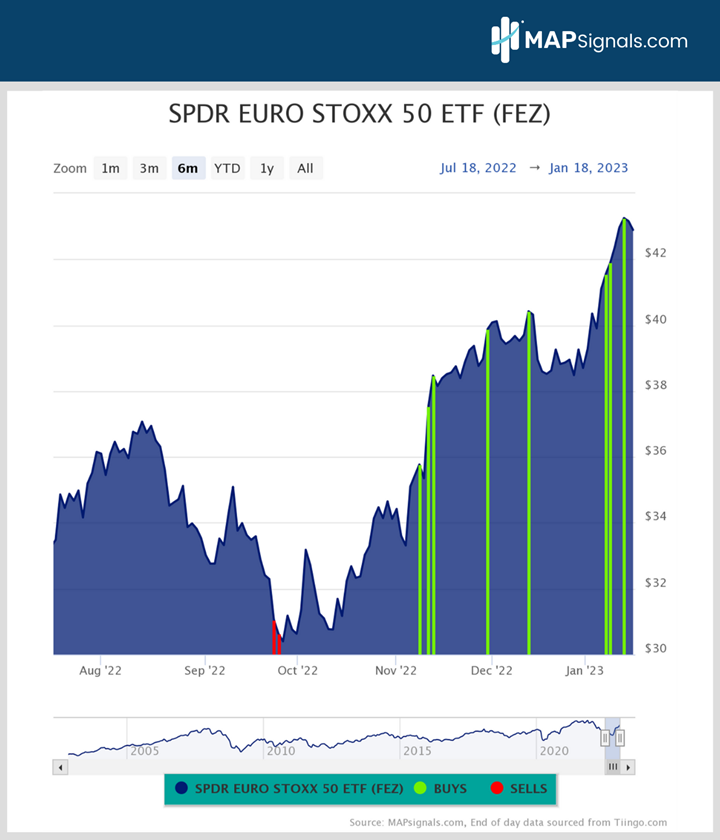

Next, there’s the EURO STOXX 50 ETF (FEZ). It’s a basket of 50 of the largest eurozone companies. Again, valuation matters. The fund’s December P/E sits at 13.63. Month-to-date the ETF has ramped up 10.83%. Like EZU, it’s full of green shoots with eight accumulation signals since November:

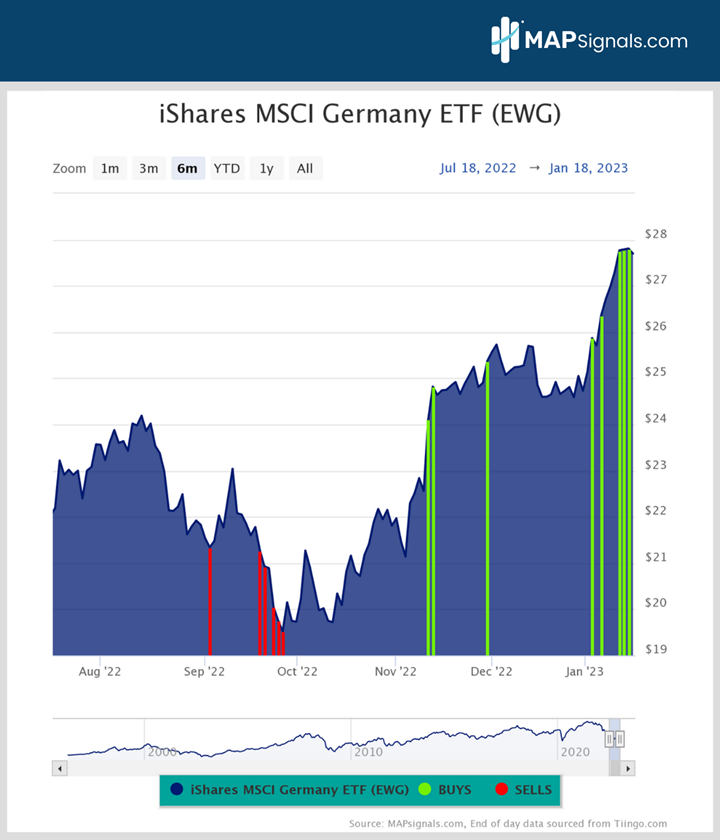

Now, let’s shift our focus to Germany. The iShares MSCI Germany ETF (EWG) has been heavily in demand with eight buy signals since November. With a “cheap” 11.6 P/E as of December, value hunters spot the opportunity. This fund was an under-performer in 2022, falling 23%. In January, the fund is up double digits at +10%:

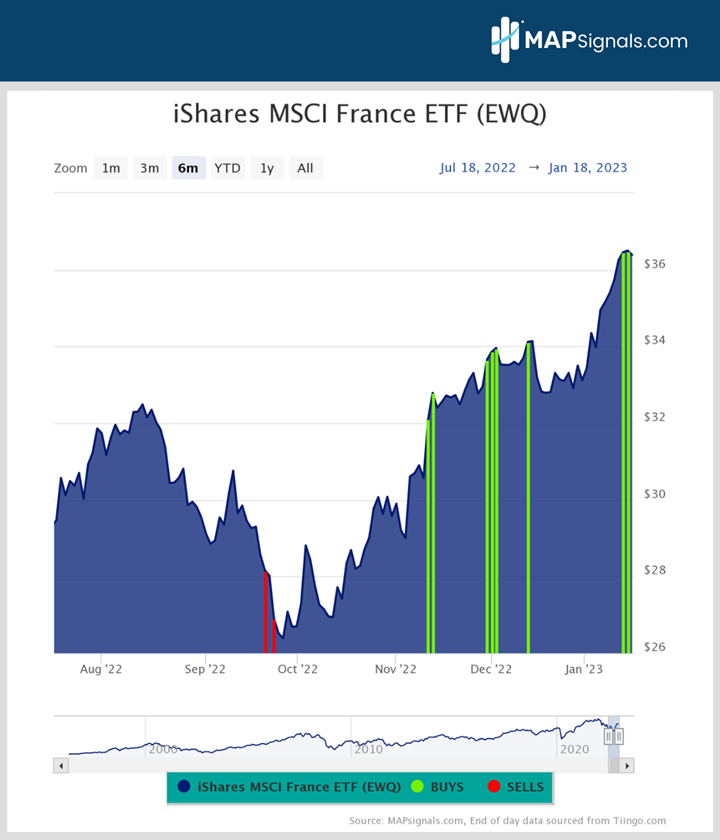

Finally, let’s hop over to France. The iShares MSCI France ETF (EWQ) is also part of the European bullish theme. Inflows have been one-way the past two months: UP. The shares have gained nearly 10% this year alongside strong inflows:

In 2023, there’s been a flood of money chasing European ETFs. If you’re only focused on the US, you can miss major themes. That’s why we say to follow the Big Money! It alerts you to the opportunity. Let’s wrap up.

Here’s the bottom line: Global stocks are off to a great start in January. One of the most powerful themes in the market is the bid for international companies. Based on data, the top four European ETFs in 2023 are EZU, FEZ, EWG, and EWQ. Each of these funds sports cheaper valuations than the US market and is under heavy accumulation. Consider them on any meaningful pullback if you’re looking to add European exposure.

To learn more about Lucas Downey, visit Mapsignals.com.