The recent rally in US equities reminds me of a guy up the street who nobody likes, but when he suddenly strikes it rich, everyone reluctantly pretends to like him, writes Ian Murphy of MurphyTrading.com.

The bounce in stocks is being grudgingly accepted but market participants are hesitant. Who knows how long it will last, so our focus should be on getting stops on open long positions to break even as soon as possible.

The opportunity may come this week as earnings season picks up steam with Microsoft and Tesla expected to draw extra attention on foot of recently announced layoffs and discounts. A few other blue chips will also report before the flood begins in earnest next week.

In addition, board members of the Fed will commence a media blackout today ahead of their FOMC meeting and rate announcement on February first. So, these two drivers (earnings and rates) will dictate whether this rally has a future or not.

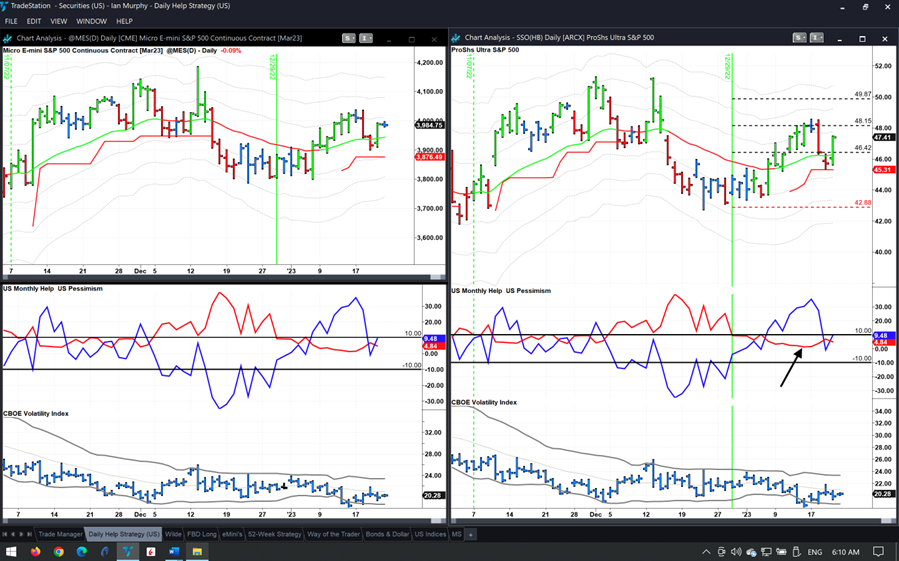

Last week started off poorly for equities, but as time progressed the mood changed and the S&P500 rallied strongly on Friday. The weekly bar didn’t close positive on the 52-Week Strategy trigger, but it finished above the 21EMAC while Elder Impulse remained green and the NHNL indicator was above zero (circles), so the trade is still open and doing nothing wrong.

The open Help Strategy trade pulled back sharply on ProShares Ultra S&P500 2x Shares (SSO) on Wednesday (right chart) and came within 7c of being stopped out before recovering again on Friday. Futures had more room to breathe (top left) and that stop has flatlined. In the week ahead, keep an eye on the Pessimism indicator (arrow), which will start rising if the rally is over.

Learn more about Ian Murphy at MurphyTrading.com.