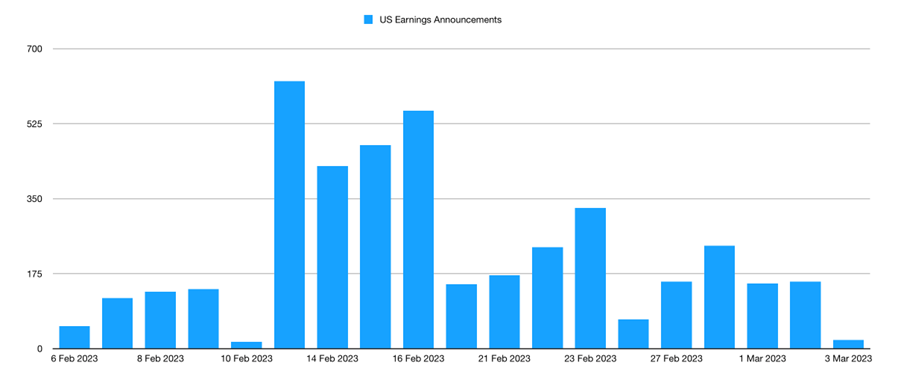

With the latest round of interest rate hikes out of the way, attention this week will return to the market's love affair with earnings which will reach a peak around Valentine’s Day, writes Ian Murphy of MurphyTrading.com.

As of Friday, 50% of S&P 500 (SPX) firms had reported with 70% coming in above expectations according to Refinitiv.

The energy and industrial sectors were strong, consumer discretionary, materials and commercial services—not so much.

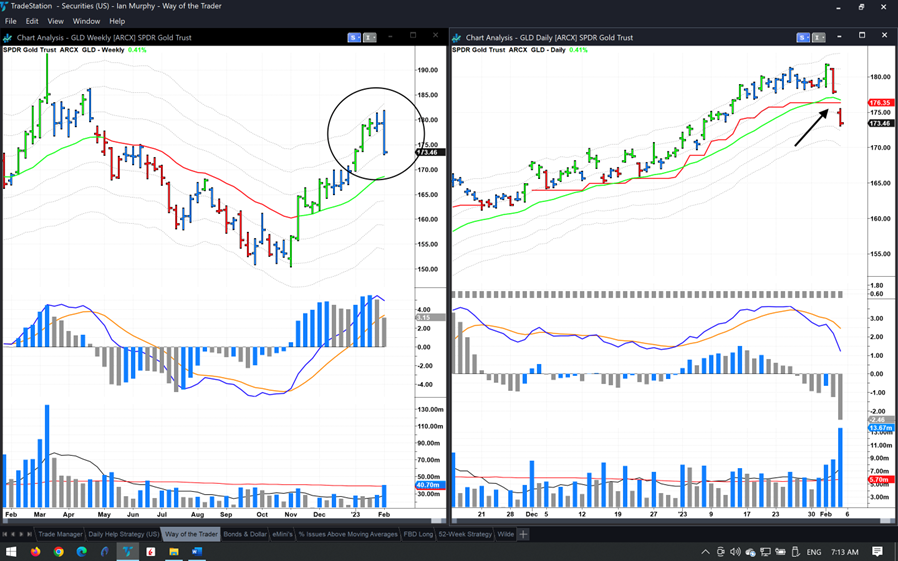

Away from stocks, Gold (GLD) sold off strongly on Friday (circle) and was down 4.7% for the week. The elevated price trading at the 3ATR channel on a weekly chart was noted in Thursday’s webinar. The price gapped over a trailing stop on the daily chart (arrow), and as it’s trading below the 1ATR line it’s now technically bearish on this daily timeframe.

It’s too early to read much into this fall in gold—it could be a shift out of a safe haven into stocks, or it might be plain old profit-taking at the top of the price channel. Let’s wait and see.

Learn more about Ian Murphy at MurphyTrading.com.