The Chart of the Day belongs to the multi-line retailer Winmark (WINA), states Jim Van Meerten of BarChart.com.

I found the stock by using Barchart's powerful screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum, and a Trend Seeker buy signal then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 1/10 the stock gained 15.49%.

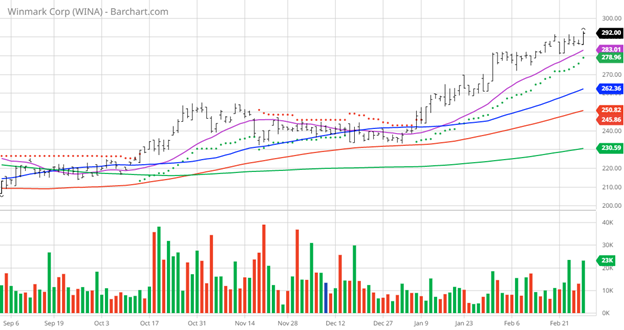

WiINA Price vs Daily Moving Averages

Winmark Corporation, together with its subsidiaries, operates as a franchisor of retail store concepts that buy, sell, trade, and consign used merchandise primarily in the United States and Canada. The company operates through two segments, Franchising and Leasing. Its franchises retail stores operate under Plato's Closet, Once Upon A Child, Play It Again Sports, Style Encore, and Music Go Round brand names. The company's Plato's Closet brand stores buys and sells used clothing and accessories for the teenage and young adult market; and Once Upon A Child brand stores buy and sell used and new children's clothing, toys, furniture, equipment, and accessories primarily to parents of children ages infant to 12 years.

Its Play It Again Sports brand stores buys, sells, trades in, and used and new sporting goods, equipment, and accessories for various athletic activities, such as team sports, fitness, ski/snowboarding, golf, and others; Style Encore brand stores buys and sells used women's apparel, shoes, and accessories; and Music Go Round brand stores buys, sells, trades in, and used and new musical instruments, speakers, amplifiers, music-related electronics, and related accessories. In addition, the company is also involved in the middle-market equipment leasing business focusing on technology and business-essential equipment. Winmark Corporation was incorporated in 1988 and is headquartered in Minneapolis, Minnesota.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals

- 40.81+Weighted Alpha

- 29.08% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50, and 100-day moving averages

- 12 new highs and up 11.84% in the last month

- Relative Strength Index 65.80%

- Recently traded at $292.00 with a 50-day moving average of $262.86.

- Market Cap $985 million

- P/E 25.65

- Dividend yield .98%

- Analysts have not made Revenue and Earning projections

Analysts and Investor Sentiment

I don't buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- The individual investors following the stock on Motley Fool voted 82 to 12 for the stock to beat the market with the more experienced investors voting 18 to two for the same result

- Value Line gives the stock an above-average two rating and gives it an 85 percentile rating on Price Growth Persistence

- CFRAs MarketScope recommends a Hold

- 1,630 investors monitor the stock on Seeking Alpha

Disclosure: I/we have no stock, option, or similar derivative position in any of the companies mentioned but may initiate a beneficial long position through a purchase of the stock, or the purchase of call options or similar derivatives in the next 72 hours.

Additional Disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least on a weekly basis.

Learn more about Jim Van Meerten at BarChart.com.