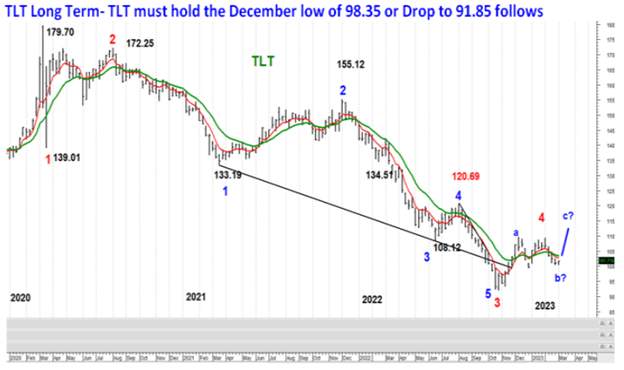

As I discussed weeks ago, the rally since bond prices reached a bottom in October is likely Wave Four (red) from the high in March 2020, states Jim Welsh of MacroTides.com.

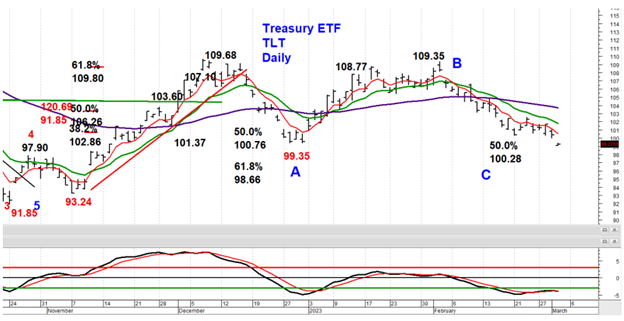

The crossroad for iShares 20+ Year Treasury Bond ETF (TLT) is whether Wave Four is complete, or whether the recent high is Wave a (blue) of Wave Four. My bias has been that the rally was Wave a, and the current pullback is Wave b (blue).

If correct, Wave c (blue) of Wave Four would take TLT up above $109.68, and Treasury bond yields below the lows on February second. (3.334% - ten-year-, 3.4987% 30- year) If TLT undercuts the December 28 low of 99.35, it will need to quickly reverse higher to reaffirm that Wave b is ending.

The 30-year yield may briefly spike above 3.99% but would need to drop back below 3.99% quickly. If not, Treasury yields will head up to the October highs (Wave 5). (10-year 4.333% and 30-year 4.425%) I think it’s worth buying TLT below $99.35 or as close to $99.35 as possible and using a stop of $97.80. TLT is currently trading at $99.33.

Learn more about Jim Welsh at MacroTides.com.