Jerome Powell’s hawkish remarks on interest rates before a senate banking committee spooked the market yesterday, states Ian Murphy of MurphyTrading.com.

He believes rates will ultimately go higher than the market has priced in, and the hikes will happen faster than expected. The S&P 500 (SPX) closed down 1.5% on the news.

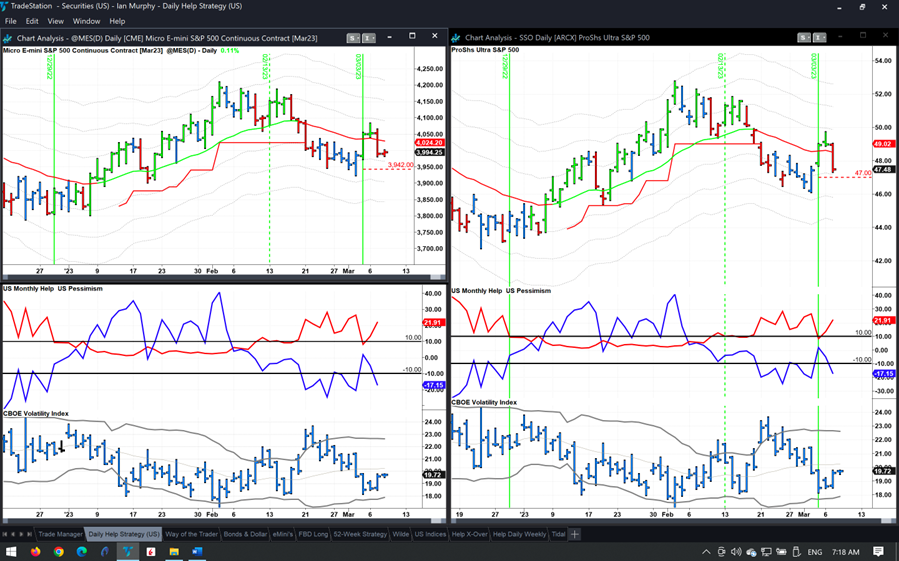

The still-fresh Help Strategy trigger remains open and if we get a recovery during the week, it will be a classic whipsaw pattern. As I wrote in Way of the Trader, “A whipsaw is never a one-off event. It keeps happening because these reversal points are the market sending out feelers, looking to see if the next step will be up or down. When a trader understands whipsaws in this context, he realizes good trade ideas can still be stopped out.”

And that’s exactly what’s happening, the market is trying to gauge where to go from here and the initial protective stop just below the -1ATR (red dashed line) is located perfectly to get us out if the selloff deepens, and keep us in if we get a whipsaw.

Learn more about Ian Murphy at MurphyTrading.com.