The chart of the day belongs to the technology company Squarespace (SQSP), states Jim Van Meerten of BarChart.com.

I found the stock by using Barchart's powerful screening functions to find stocks with the highest technical buy signals, highest Weighted Alpha, superior current momentum, and a Trend Seeker buy signal. I then used the Flipchart feature to review the charts for consistent price appreciation. Since the Trend Seeker signaled a buy on 12/22 the stock gained 38.33%.

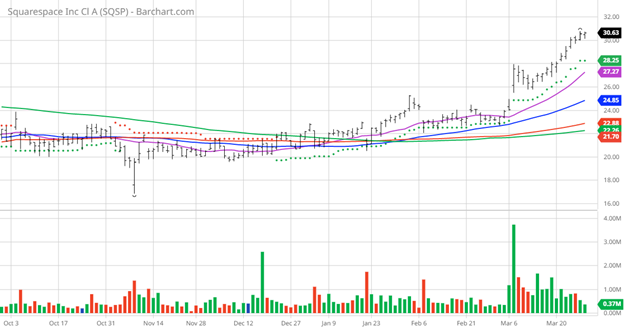

SQSP Price vs Daily Moving Averages

Squarespace, Inc. operates a platform for businesses and independent creators to build an online presence, grow their brands, and manage their businesses across the internet. Its suite of integrated products enables users to manage their projects and businesses through websites, domains, e-commerce, marketing tools, scheduling, and hospitality services, as well as tools for managing a social media presence. It serves a range of industries and sizes from sole proprietors to enterprises. Squarespace, Inc. was founded in 2003 and is headquartered in New York, New York.

Barchart's Opinion Trading systems are listed below. Please note that the Barchart Opinion indicators are updated live during the session every 20 minutes and can therefore change during the day as the market fluctuates. The indicator numbers shown below therefore may not match what you see live on the Barchart.com website when you read this report.

Barchart Technical Indicators:

- 100% technical buy signals

- 36.78+Weighted Alpha

- 18.14% gain in the last year

- Trend Seeker buy signal

- Above its 20, 50, and 100-day moving averages

- 12 new highs and up 30.46% in the last month

- Relative Strength Index 80.96%

- Recently traded at $30.65 with a 50-day moving average of $24.84

Fundamental Factors:

- Market Cap $4.13 billion

- Revenue is expected to grow 11.30% this year and another 11.50% next year

- Earnings are estimated to increase 119.40% this year and an additional 40.00% next year and continue to compound at an annual rate of 11.20% for the next five years

Analysts and Investor Sentiment: I don't buy stocks because everyone else is buying but I do realize that if major firms and investors are dumping a stock it's hard to make money swimming against the tide:

- Wall Street analysts issued four strong buys, one buy, and nine hold opinions on the stock

- Their price targets are $19.60 to $36.00—a very wide range

- The individual investors following the stock on Motley Fool

- Comments by Zacks: The stock has steadily outperformed the market this year, rising nearly 24% year-to-date. Notice how SQSP has been steadily making a series of higher highs while trading above upward-sloping 50 (blue) and 200-day (red) moving averages. Shares continue to hover near a 52-week high—a sign of strength

- 2,490 investors monitor the stock on Seeking Alpha

Disclosure: I/we have no stock, option, or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in the next 72 hours.

Additional disclosure: The Barchart Chart of the Day highlights stocks that are experiencing exceptional current price appreciation. They are not intended to buy recommendations as these stocks are extremely volatile and speculative. Should you decide to add one of these stocks to your investment portfolio it is highly suggested you follow a predetermined diversification and moving stop loss discipline that is consistent with your personal investment risk tolerance and reevaluate your stop losses at least weekly.

Learn more about Jim Van Meerten at BarChart.com.