Stocks stopped going down a long time ago, states JC Parets of AllStarCharts.com.

In bear markets, stocks go down in price. In bear markets, you get more and more stocks making new lows. In bear markets, the indexes don't keep putting up major gains quarter after quarter. And so, what's been happening in the current market environment? Most stocks stopped making new lows last June.

Since then, almost no stock in the market is still making new lows. When the S&P 500 (SPX) hit new lows last October, there were barely any stocks left still going down. We know. We have the data. Everyone does. It's free. It's just that most people see what they want to see.

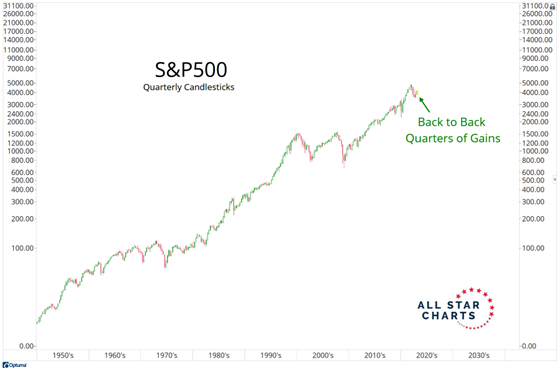

Here at All Star Charts, we pride ourselves on living in reality. We don't care about narratives because we're adults who don't need bedtime stories to sleep at night. Yesterday morning we talked about how the S&P 500 is finishing up another very strong quarter.

Here's what this looks like. Notice how in bear markets you never see back-to-back quarters of impressive gains:

Look for yourself. I'm not making it up. It's just math. The S&P 500 rallying 6% this quarter, after putting up a 7% print last quarter, is perfectly normal market behavior in bull markets. If this was a bear market, it would be the first time in history that stocks keep going up during a bear market. By definition, they do not.

It's funny to think that there are people out there who believe that stocks go up regularly in bear markets. These same people must think that in bear markets the majority of stocks don't go down in price. Is it bad math? Or is it a psychological thing? I don't know. But I like it. The angrier they are. The more scared they get. The more fuel there is to continue to drive stocks higher. It's a market of stocks. Don't forget that.

And that's the point. "JC who cares whether this is a bull market or a bear market". The reason we care is to help answer the question of whether we want to be spending more time looking for stocks to buy, or should we be spending more time looking for stocks to sell. That's why it's important.

First, we want to identify the market environment, and then choose which tools are strategies are best for that market. Multiple timeframe analysis helps tremendously with that. So when you zoom in to the S&P 500 shorter term, we're still in this range stuck below overhead supply. But as more and more stocks break out, and fewer and fewer stocks break down, in which direction is this consolidation likely to resolve?

I think higher. It's a weight-of-the-evidence thing. Europe is showing the US which direction stocks are heading (Euro STOXX 50 is up 16% this quarter & up 25% last quarter). The US is just a laggard in this bull market. And there's nothing wrong with that. The US doesn't always have to be the leader. In fact, go back in history. There were a ton of bull markets throughout history where the US was the laggard.

It's ok. It's perfectly normal. Some people can't adapt. Don't be one of those people.

To learn more about JC Parets, please visit AllStarCharts.com.