The best way to demonstrate a strategy is to trade it in a real account with real money states Ian Murphy of MurphyTrading.com.

While back-tested results are essential to assess the viability of a trading strategy, when it comes to a live market, things can unfold a little differently. March offered an example of the difficulties.

The position in the 52-Week Strategy as discussed in last month’s newsletter has been open for 11 weeks but has gone almost nowhere in terms of profit. To add to the challenge, the price bar appeared to be closing right on the -1ATR line on Friday, March tenth, so I closed my trade on this one (magnified below). As it happens, ProShares Ultra S&P500 2x Shares (SSO) closed just above the -1ATR line so the trade should have remained open, but a decision needed to be made coming into the close and I am a conservative trader by nature.

I originally bought 400 shares in SSO @ $47.70 ($19,080) and sold @ $44.23 ($17,692) giving a loss of $1,388 which was 1.15% on this $120k account. A loss profile of 2% was calculated when opening the trade but this was reduced because the soft stop inched up while the trade was open. Among the clients, I’ve spoken to who took the trigger, about 60% closed out (as I did) while the remainder hung in.

The setup is still valid, so I re-entered yesterday on this week’s bar. Even though I bought back in at a higher price ($48.70), because the soft stop on the -1ATR is at $44.12, the position size is now larger because the distance in dollars from entry to exit is smaller. I was allowed to buy 525 shares without exceeding 2% risk, but I like to round down to the nearest 100 shares whenever possible to get a quicker fill on a stop loss order when the time comes.

Bear in mind, this is a weekly trend-following approach and a pure play on the US stock market, so it’s not unusual to have to take one or two bites at the beginning of a trend change (if this is one) to get an entry before the initial powerful move to the upside begins (if it does). It also means you can still enter today on this week’s price bar (if it closes positive) and the soft trailing stop is currently at $44.12.

Help Strategy Update

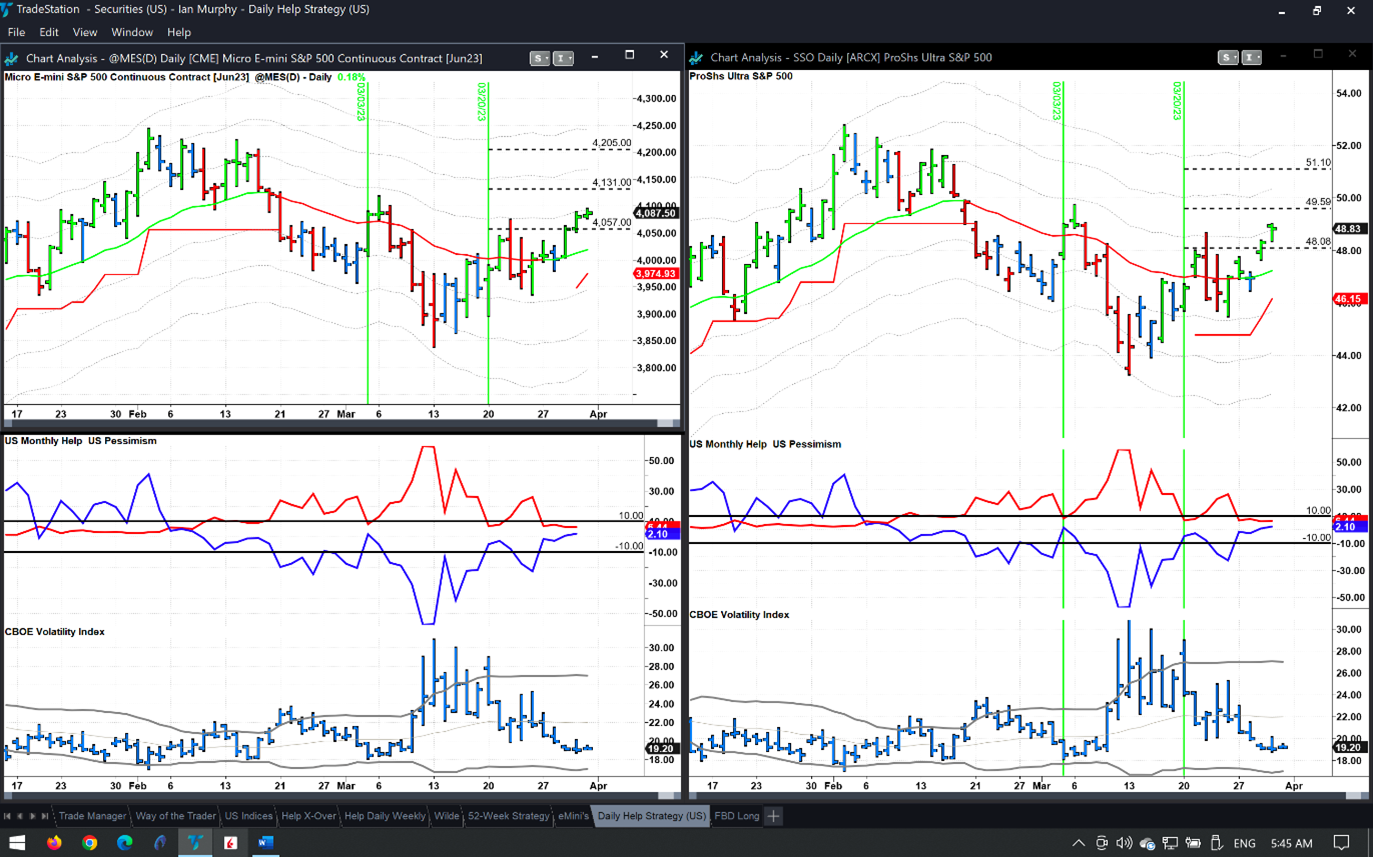

The same ETF is also in play for a shorter daily swing trade. SSO is shown below on the right with the initial entry highlighted with the vertical green line.

Three targets are in black dashed lines and the trailing stop moved up to $46.15 after yesterday’s close. The entry on this was at $46.57, so it’s comfortably in profit by now. E-mini futures are on the left and their trailing stop has moved up to spitting distance of the entry price. Before the opening of the regular session, futures are up so we may get a positive close today.

Investors and traders can easily find opportunities in the stock market, but we struggle when it comes to managing our positions and knowing when it's time to get out, or when to hang in for the long haul.

On Thursday, April 13, 2023, at 10:00 EDT, I will deliver a free intensive presentation on ‘How to Cut Losses and Let Our Winners Run.’ With the aid of real-life examples, we will see how to identify when we have overstayed our welcome in stock and it's time to exit. I will also reveal how to tell if we have a keeper on our hands and if we should commit to a long-term relationship.

Learn more about Ian Murphy at MurphyTrading.com.