What we do here is analyze the most popular stocks during the week and find opportunities to either join in and ride these momentum names higher or fade the crowd and bet against them, states Steve Strazza of AllStarCharts.com.

We use a variety of sources to generate the list of most popular names. Whether we’re measuring increasing interest based on large institutional purchases, unusual options activity, or simply our proprietary lists of trending tickers, there’s a lot of overlap. Relying on our entire arsenal of data makes us confident that we’re producing the best list each week and gives us more optionality in terms of finding the most favorable trade setups.

Here’s our latest list of hot stocks:

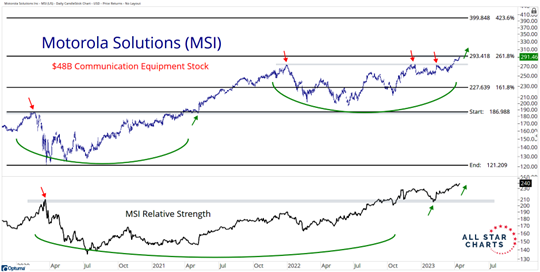

Our first setup today is the $48B company that provides communications and enterprise security solutions in the United States. Here’s Motorola Solutions (MSI):

Motorola Solutions is trading at new all-time highs as buyers appear to have absorbed all the overhead supply at the former all-time highs. Bulls need to see some upside follow-through this week to confirm a valid resolution from this base-on-base pattern. On a relative basis, MSI has also resolved higher from a three-year basing formation. These new all-time highs on relative terms support a breakout on absolute terms. If we’re above 293, we want to own MSI with a target of 400 over the coming three-six months.

To learn more about Steve Strazza, please visit AllStarCharts.com.