Dave C. has asked how I estimated we would break even on a Help Strategy trade as he is recording a small loss, states Ian Murphy of MurphyTrading.com.

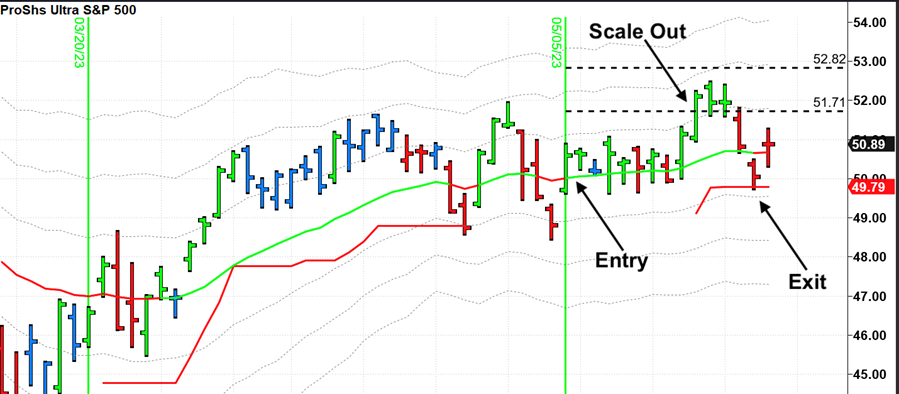

For example, risking 2% on a $20k account ($400) with an entry on ProShares Ultra S&P500 2x Shares (SSO) at the closing price on May 5th ($50.60) and an initial protective stop at $49.10, we could buy 266 shares ($400/$1.50).

Scaling out ⅓ (88 shares) at the first target ($51.71) and getting stopped out on May 10th at $49.79 would have produced the following:

266 x $50.60 = $13,459.60

88 x $51.71 = $4,550.48

178 x $49.79 = $8,846.60

Loss $46.50 (0.35%)

A $46.50 loss is significantly less than the initial $400 risked (admittedly not breakeven), but these calculations are based on the assumption we entered at the close, a better entry might have produced a small profit.

Learn more about Ian Murphy at MurphyTrading.com.