When you rely on data, opportunities arise…often when you least expect it, states Lucas Downey of Mapsignals.com.

If our data could speak, it’d scream, materials stocks are set to rally hard. Let’s be honest, the stock market is full of noise. The list of investor fears is endless: debt ceilings, rising interest rates, slowing earnings, etc. The wheel of worry is constantly spinning. As I’ve learned over the years, following headlines rarely offers value. Arming yourself with cold hard data is much more powerful. It’s emotionless. Currently, tons of trader attention is aimed at popular AI and technology stocks. Many believe that’s the only area ripe for opportunity. Not so fast!

What happened recently in the materials sector points to a big upside ahead. You wouldn’t know that by following the news. You’d only know it by following big institutional footprints. Let’s first take a peek at the overall market landscape. Then we’ll zero in on why I’m very bullish on the Materials group.

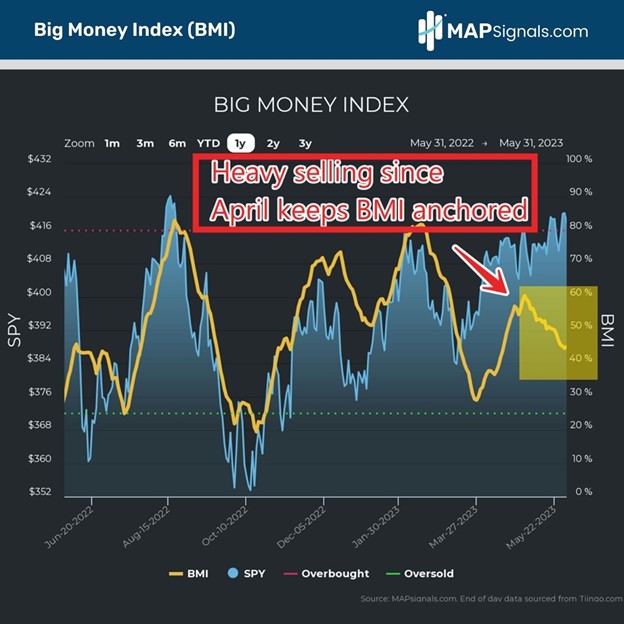

Big Money Index Remains Under Pressure

If you want a true picture of the health of the market, follow the money. Currently, it’s been in a downtrend for months. When the yellow line is falling, more stocks are being sold than bought. Notice how it’s currently at levels not seen since March:

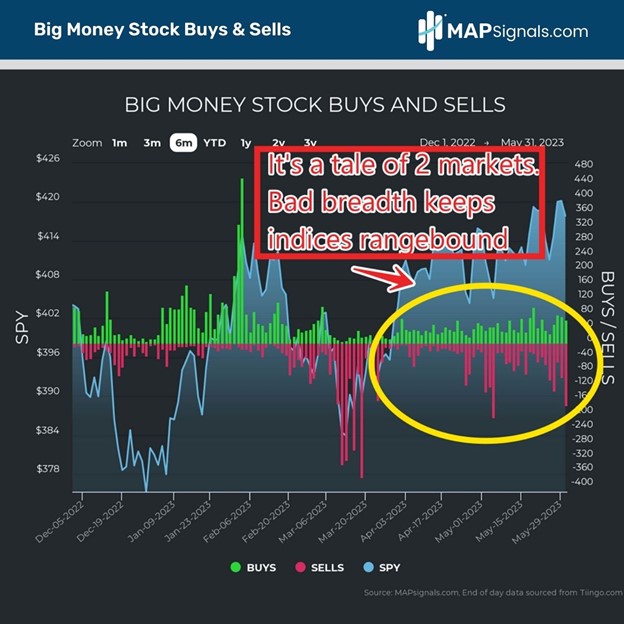

As indices bob and weave, under the surface reveals why we’re experiencing rangebound action. Weak breadth suggests the overall narrative is risk-off for most stocks. I’ve circled the past few months of data, highlighting choppiness:

Given the lack of direction in the market, you may be inclined to take a nap on the market. But I wouldn’t do that—you’ll miss the move. Now it’s time to let data do its magic.

Materials Stocks Are Set to Rally Hard

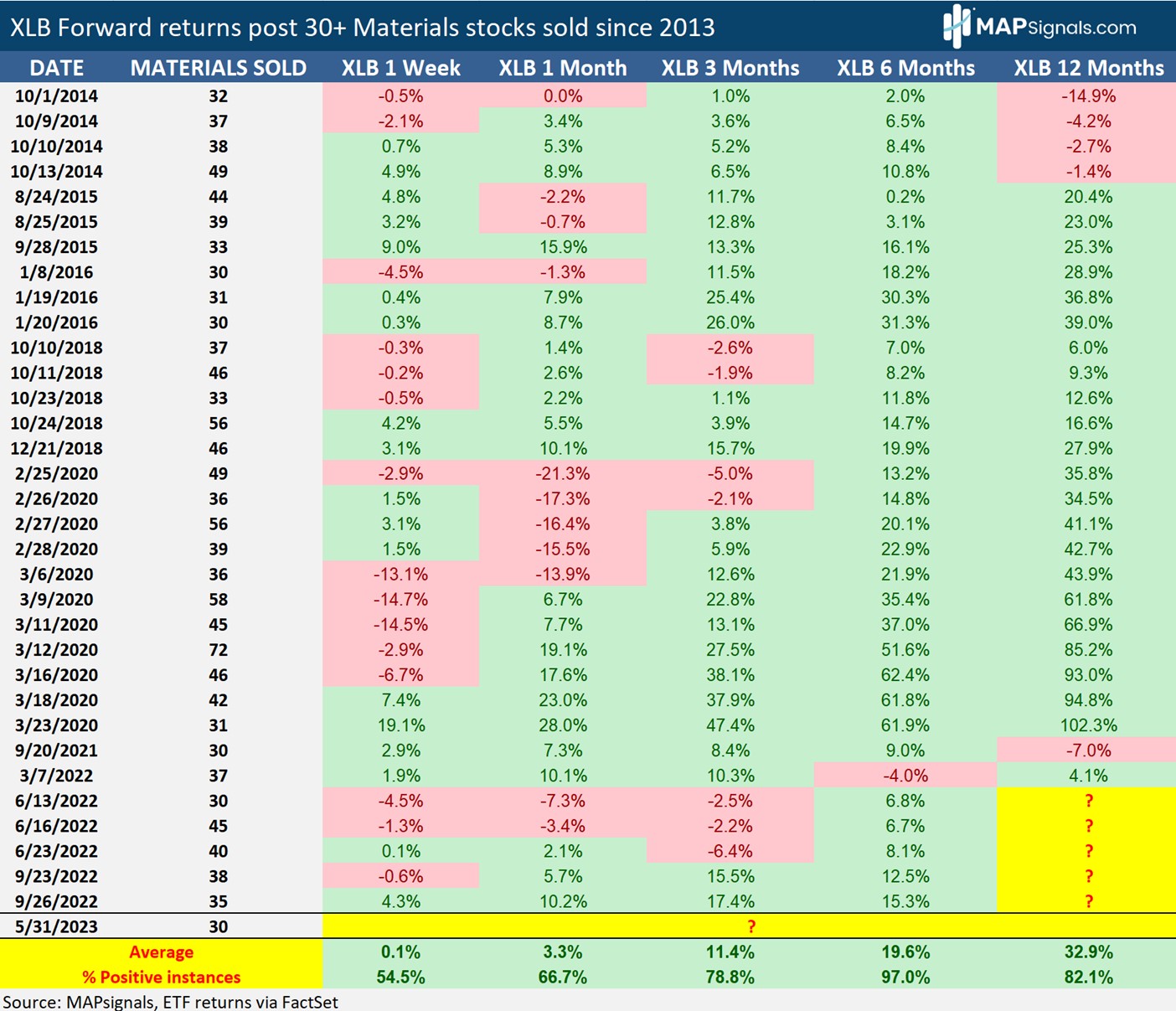

Stocks go up and they go down. Everyone knows that. But, sometimes selling reaches extreme levels, offering a ricochet effect. Said simply, too much selling often signals a very bullish setup. This morning revealed heavy sell signals in materials stocks. In fact, this is the most red we’ve seen in the group since September. Thirty discrete stocks were dumped. The one-year chart of our materials universe below shows how rare this action is. I’ve highlighted prior similar instances:

If your eyes spot an opportunity, congrats! Major selloffs are ripe for blastoff once the swelling dissipates. Consider the following historical study. Going back to 2013, there’ve been 33 instances where 30 Materials stocks or more were sold in a day. This showcases how rare yesterday’s action was. Below plots the forward returns of the Materials Select Sector SPDR ETF (XLB) post these selloffs. As you can see, the fund gains 3.3% a month later. Six months later the group is up a massive 19.6%. A year later these stocks are up 32.9%!

Ladies and gentlemen, this is what opportunity looks like. Based on history, Materials stocks are set to rally hard. If you recall, we did a similar style study on utilities a few months back…it was a beauty! Let’s wrap up.

Here’s the Bottom Line: Headlines rarely offer value to investors. Cold hard data reveals the true opportunity hidden in plain sight. Extreme selling has hit materials stocks. History says this is a great opportunity to go shopping for beaten-up equities.

To learn more about Lucas Downey, visit Mapsignals.com.