Abrupt moves in Japanese bonds overnight were taken as a sign the Bank of Japan may be starting to normalize monetary policy, states Ian Murphy of MurphyTrading.com.

In response, US treasuries fell (Japanese investors are the largest overseas holders) and stocks followed suit.

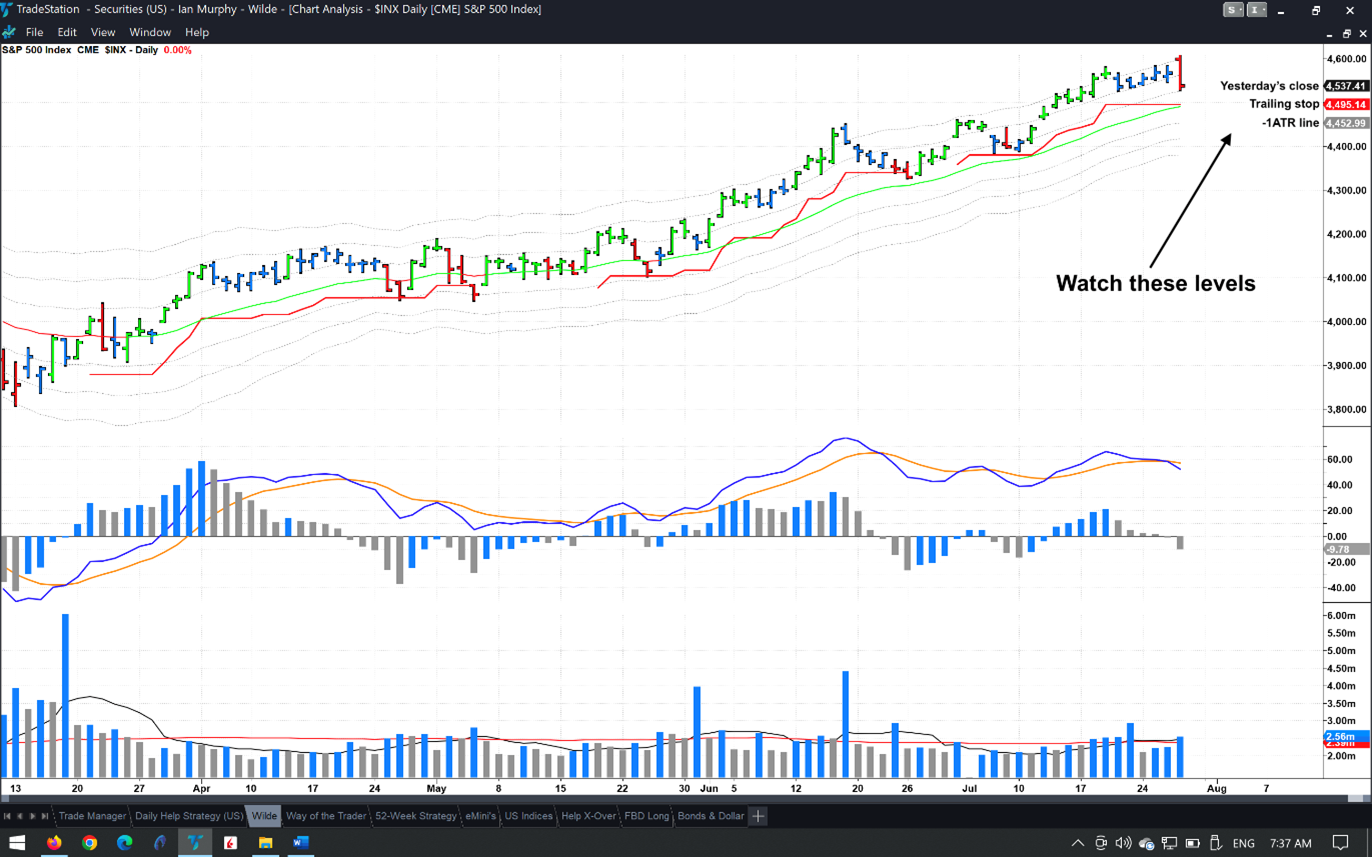

It’s too early to say if this will be a normal pullback to value in an ongoing bullish trend or if it will be something deeper, time will tell. In order of importance, the support levels to watch on a daily chart of the S&P 500 (SPX) are (1) a trailing stop, (2) the -1ATR line on an intra-day basis (3) the -1ATR line on close.

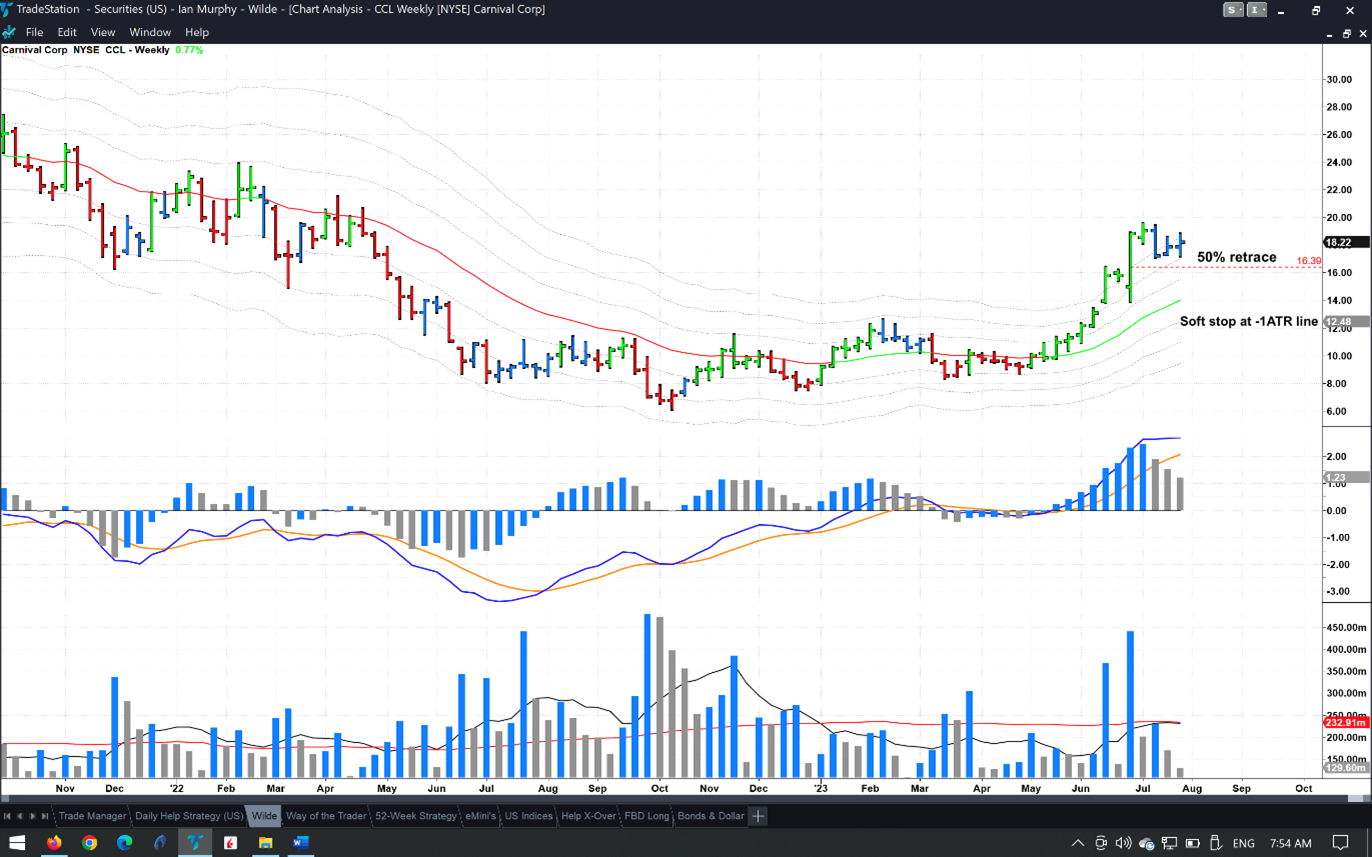

On the Weekly Trend Following Strategy, Carnival Corp. (CCL) appears to have found support at a 50% retrace of the tall price bar which was printed in the last week of June. The trailing stop at $12.48 is almost $6 from the current price so there is plenty of room for this to pull back for breath without flashing an exit signal.

Learn more about Ian Murphy at MurphyTrading.com.