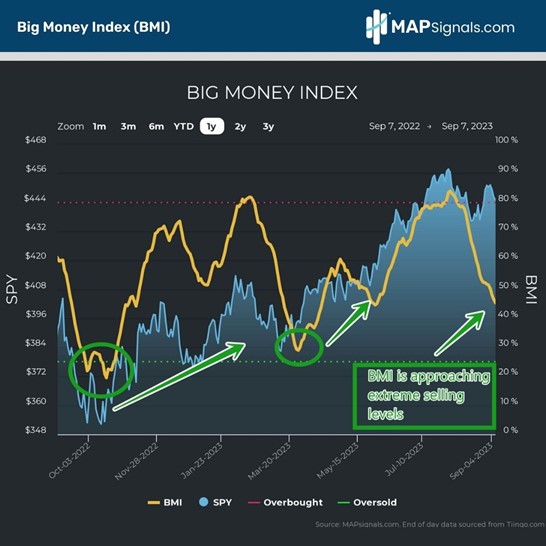

After a great run, stocks are finally seeing healthy profit-taking. Last month, we enforced our pullback narrative after the BMI hit a scorching 83.9 on August first, states Alec Young of MAPSignals.

Stocks never do well in the short term when the BMI gets that hot. Today, we’ll show you why rising interest rates won’t kill stocks. We’ll cover what’s driving this sell-off and…why it’s a buyable dip. Then we’ll use the Big Money Index (BMI) to signal when to buy stocks and which sectors to lean into.

What’s Driving the Selloff in Equities

Several macro headwinds have combined to shake investors’ confidence. The consensus soft landing view helped lift the S&P 500 to its recent high of 4607 on July 27. But that narrative has begun to shift.

Here’s a run-down of the latest bear-du-jour worry list:

- Inflation Jitters: Mixed inflation readings alongside oil’s 23% rally to $87 since mid-July have sparked renewed fears that cooling inflation is over. Some see inflation’s rapid decline to 3.2% from its 9.1% peak will either slow down or reverse course.

- Rising rates: The ten-year Treasury yield recently hit 4.36%, a 16-year high, amid solid economic data. A flood of looming Treasury and corporate bond issuance doesn’t help matters.

- Fed Tightening: Two-year Treasury yields are back above 5%, as the odds of a November Fed rate hike are up to 60%.

- Strong Dollar: Rising rates are boosting the dollar. The Dollar Index is up 6% since mid-July. A stronger dollar broadly tightens financial conditions. With 40% of S&P 500 sales coming from overseas, a firm greenback also depresses foreign revenues while making those sales worth less when translated back into US dollars. All in all, stocks favor a weak dollar a lot more than a strong one.

This is a lot to unpack. Now, let’s see if the bear case holds water.

Rising Interest Rates Won’t Kill Stocks

Stocks are being marked down as investors worry that falling inflation will stall out, forcing the Fed to keep rates higher for longer. This would make weaker economic and earnings growth all but inevitable. Sounds pretty convincing right? Let’s dig deeper. Sticky inflation is at the heart of the bear case. It’s why the Fed may have to keep tightening. It’s also the primary reason interest rates are rising again. And it’s why the dollar is up.

Here’s what the bears miss about inflation.

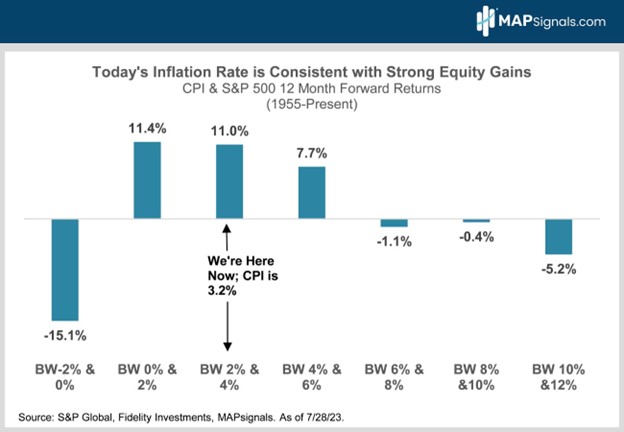

Even if inflation stops falling and stalls out at 3%, or even ticks back up to 4%, history says It’s unlikely to derail this bull market. Since 1955, the S&P has gained an average of 11% in the 12 months following inflation readings between 2% and 4%. Inflation has to be north of 6% before equity returns go negative.2022 was a case in point. The S&P 500 fell 20% as the CPI shot up to 9.1%.

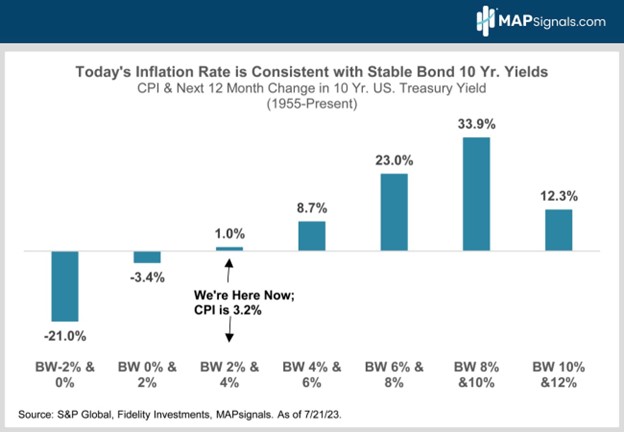

This is why sticky inflation won’t break the stock market. But let’s keep going. The other big boogeyman the bears are uber-worried about is rising interest rates. What the rate bears miss is that long-term interest rates have historically been very stable when inflation is running between 2% and 4% (chart). Inflation needs to exceed 6% before we see big jumps in 10-year bond yields. That’s the tipping point when high inflation starts hurting asset prices. 2022 was a case in point. Rates soared with inflation at 9%. 2022 proves this point. Rates soared with inflation at 9%, sending stocks cascading lower.

This is why interest rates probably won’t go up too much more and why they won’t kill stocks. OK, so the macro is expected to remain supportive for stocks. Let’s check in on institutional positioning via the Big Money Index (BMI). The BMI peaked at 84 on August first, two trading days post the S&P 500 peak on July 27. When the BMI rises above 80, it’s telling you stocks are overbought and ripe to fall. The BMI was dead, right? It’s an excellent tactical timing tool.

So, what can the BMI tell us regarding when to buy stocks? Readings between 20 and 30 signal extreme selling conditions. Those rarely last long. That’s when you want to back up the truck! Check out how stocks rallied hard last October after the BMI dipped below 25 (the green line). The same thing happened in March when the BMI dipped under 30. Today the BMI is down to 45 and selling is picking up steam. A nice buying opportunity is near. This pullback should end over the next couple of weeks.

How to Play It

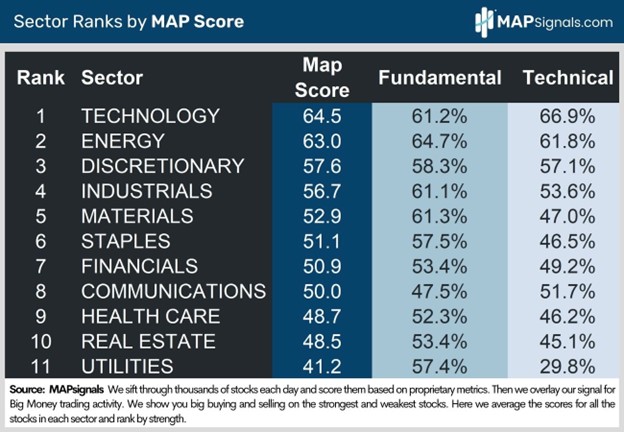

MAPsignals’ top two ranked sectors, energy, and technology are both outperforming big time. Here’s why:

Energy is seeing increasing institutional accumulation because the pros know that owning energy is a great portfolio hedge whenever inflation jitters run high. Positive EPS revisions are the most important fundamental driver of sector performance. Energy earnings are being revised up as oil rallies. Plus, energy is the cheapest sector in the market trading at only 12X 12MF EPS. It’s the only sector trading at a discount relative to its 20-year average P/E. Lastly, it still offers a juicy 3.5% dividend yield vs. the S&P’s paltry 1.5% payout.

The tech rally is taking a healthy breather after a monster YTD run. But it’s holding up relatively well. That’s why the S&P 500 is only down a few percent from the late-July peak. Tech is 28% of the S&P. Its resilience is supporting the market. Big Tech is benefiting from its fortress balance sheet. The magnificent seven that dominates the sector’s market cap is self-financing. They all generate tons of free cash flow. Put simply, that’s what’s left over after expenses are covered. They don’t need to borrow money. They can handle 5% interest rates just fine.

As for their customers, it’s going to take a lot more than mid-single digit interest rates to keep Americans, Europeans, Canadians, Australians, the Japanese, and just about anybody else from using Apple, Google, Amazon, Meta, Netflix, and Microsoft’s products. They’re just way too enmeshed in everyone’s everyday lives. These products and services are indispensable, rates or no rates! PS—Nvidia’s chips power it all!

Note how Technology and Energy stocks tower in terms of sector rankings:

On the flip side, MAPsignals’ three lowest-ranked sectors, real estate, utilities, and health care, are all lagging badly. Bond proxies with high dividend yields like utilities and real estate have been hit hardest as rising bond yields make their 4% payouts less attractive. Defensive, counter-cyclical sectors like staples and health care have also underperformed as the economy continues to hold up well and dodge recession. Their relatively high dividend yields are also undermined by rising rates. Oversold buying opportunities are approaching in all these rate-sensitive sectors but we’re not there yet.

Bringing It All Together

Stocks are being marked down as investors worry that falling inflation will stall out. This could force the Fed to keep rates higher for longer, making weaker economic and earnings growth all but inevitable. But here’s what the bears miss about inflation and rising rates. Since 1955, when inflation runs anywhere from 0% to 4%, the S&P 500 has chalked up 11% gains in the following 12 months while long-term rates remained stable.

Inflation has to be north of 6% before equity returns go negative and interest rates shoot up a lot. Today CPI is only 3.2%. Again, historical evidence makes a clear case of why rising interest rates won’t kill stocks. That’s why this correction probably won’t last much longer. MAPsignals’ BMI will soon be signaling a tactical buy signal if it reaches oversold. So, there you have it. The macro isn’t all doom and gloom and the BMI approaching the green zone agrees! That’s a powerful one, two-punch!

Don’t fear rising interest rates. Buy into it!

To learn more about Alec Young, visit Mapsignals.com.