For today’s trade of the day we will be looking at an On Balance Volume chart for the SDPR S&P Insurance ETF (KIE), states Chuck Hughes of Hughes Optioneering.

Before breaking down KIE’s OBV chart let’s first review the investment objective of the ETF. The KIE ETF seeks to track the performance of the S&P Insurance Select Industry Index (the “index”), the fund employs a sampling strategy. It generally invests substantially all, but at least 80%, of its total assets in the securities comprising the index. The index represents the insurance segment of the S&P Total Market Index.

Confirming a Price Uptrend with OBV

The KIE daily price chart below shows that KIE is in a price uptrend as the current price is above the price KIE traded at five months ago (circled). The On Balance Volume chart is below the daily chart. On Balance Volume measures volume flow with a single Easy-to-Read Line. Volume flow precedes price movement and helps sustain the price uptrend.

When an ETF closes up, volume is added to the line. When an ETF closes down, volume is subtracted from the line. A cumulative total of these additions and subtractions form the OBV line.

On Balance Volume Indicator

- When Close is Up, Volume is Added

- When Close is Down, Volume is Subtracted

- A Cumulative Total of Additions and Subtractions from the OBV Line

Volume flow precedes price and is the key to measuring the validity and sustainability of a price trend. We can see from the OBV chart below that the On Balance Volume line for KIE is sloping up. An up-sloping line indicates that the volume is heavier on up days and buying pressure is exceeding selling pressure. Buying pressure must continue to exceed selling pressure to sustain a price uptrend. So, On Balance Volume is a simple indicator to use that confirms the price uptrend and its sustainability.

The numerical value of the On Balance Volume line is not important. We simply want to see an up-sloping line to confirm a price uptrend.

Confirmed ‘Buy’ Signal for KIE

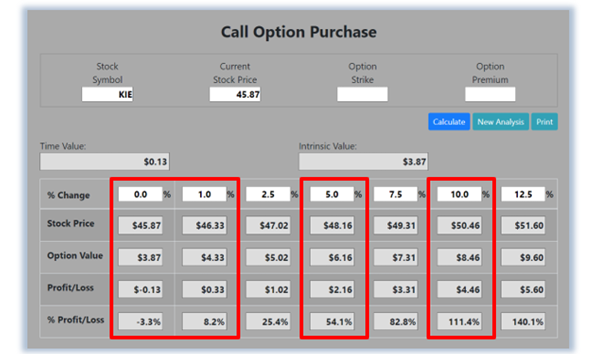

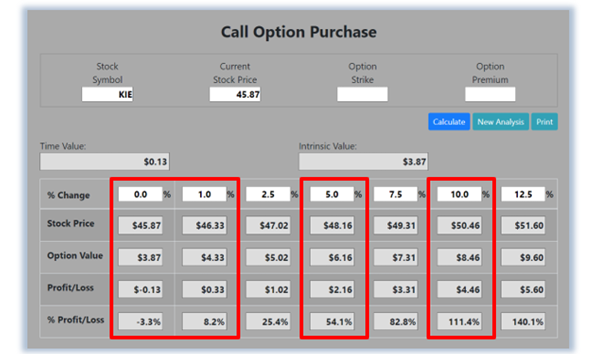

Since KIE’s OBV line is sloping up, the most likely future price movement for KIE is up, making KIE a good candidate for a stock purchase or a call option purchase. Let’s use the Hughes Optioneering calculator to look at the potential returns for a KIE call option purchase. The Call Option Calculator will calculate the profit/loss potential for a call option trade based on the price change of the underlying stock/ETF at option expiration in this example from a flat KIE price to a 12.5% increase. The Optioneering Team uses the 1% Rule to select an option strike price with a higher percentage of winning trades. In the following KIE option example, we used the 1% Rule to select the KIE option strike price but out of fairness to our paid option service subscribers we don’t list the strike price used in the profit/loss calculation.

Trade with Higher Accuracy

When you use the 1% Rule to select a KIE in-the-money option strike price, KIE only has to increase 1% for the option to break even and start profiting! Remember, if you purchase an at-the-money or out-of-the-money call option and the underlying ETF closes flat at option expiration it will result in a 100% loss for your option trade! In this example, if KIE is flat at 45.87 at option expiration, it will only result in a 3.3% loss for the KIE option compared to a 100% loss for an at-the-money or out-of-the-money call option.

Using the 1% Rule to select an option strike price can result in a higher percentage of winning trades compared to at-the-money or out-of-the-money call options. This higher accuracy can give you the discipline needed to become a successful options trader and can help avoid 100% losses when trading options. The goal of this example is to demonstrate the powerful profit potential available from trading options compared to ETFs.

The prices and returns represented below were calculated based on the current ETF and option pricing for KIE on 1/16/2024 before commissions. When you purchase a call option, there is no limit on the profit potential of the call if the underlying ETF continues to move up in price. For this specific call option, the calculator analysis below reveals if the KIE ETF increases 5.0% at option expiration to 48.16 (circled), the call option would make 54.1% before the commission.

If the KIE ETF increases 10.0% at option expiration to 50.46 (circled), the call option would make 111.4% before the commission and outperform the ETF return by more than 11 to 1. The leverage provided by call options allows you to maximize potential returns on bullish ETFs. The Hughes Optioneering Team is here to help you identify profit opportunities just like this one.