Do you know what my favorite part is about a good rug pull? When they happen quickly, states JC Parets of AllStarCharts.com.

And I think this one happens quickly too. I love it when there are major shifts in the market dynamic taking place underneath the surface, but the journalists are busy putting on pretend S&P 5000 hats. Good. Distract investors from what's important.

My daughter is 3 years old. In her pre-K class, they have silly hat day too. Meanwhile, we're shorting the S&P 500 (SPX) here as Copper Futures break down to new lows:

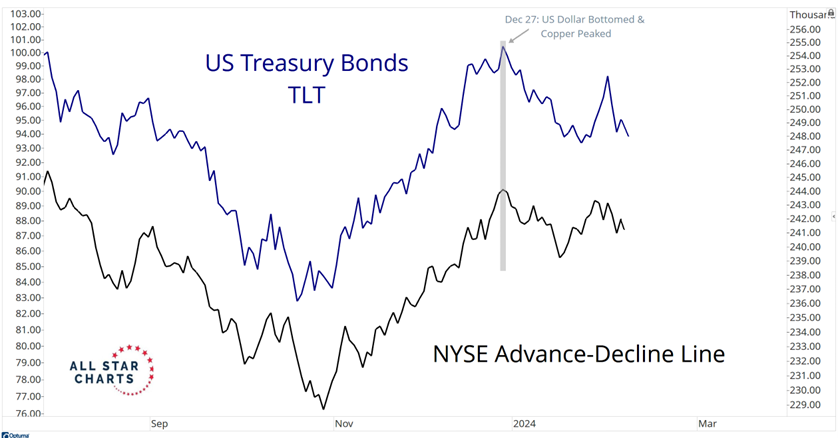

Notice the day that Copper futures peaked in late December. That was also the day the US Dollar bottomed. It was also the same day that Treasury Bonds peaked, and so did the NYSE Advance-Decline line:

On Wednesday the Dow, S&P 500, and Nasdaq100 all closed at new all-time highs. But the number of stocks on the NYSE that made new highs was a fraction of what it was last week. What's hilarious is that on Thursday we saw the same thing happen. The indexes make new highs. The headlines focus only on that. But then the actual new highs list is non-existent. The rug pull is already here. You're just not seeing it at the index level yet. I think it's coming any minute.

You'll notice that we most definitely have a deterioration in upside participation over the past eight weeks. What you don't have is an expansion in any of the new lows lists—even the short-term ones. I think mathematically, that happens next. When you see the new lows lists expanding, you'll know that things are going from getting less good to worse. We shorted Homebuilders today.

Cheers! Here's to a great rug pull! Look out below.

To learn more about JC Parets, please visit AllStarCharts.com.