The non-financial media is awash with stories of Japan’s stock market reaching a new all-time high joining its US and European peers who are already in the clouds, states Ian Murphy of MurphyTrading.com.

Nvidia’s (NVDA) stellar rise on foot of this week’s earnings is also making front-page news. Meanwhile, The Economist is asking, ‘Should you go all-in on stocks?’ with an article that refers to academic research that examined historical comparisons between an all-stock portfolio and a diversified one.

When these types of stories start to appear in the mainstream media, the cycle is reaching the top, but ‘the top’ can be a long process, and let’s not forget one of my favorite market clichés, ‘The market can stay irrational longer than you can stay solvent’ - so let’s go with it for now!

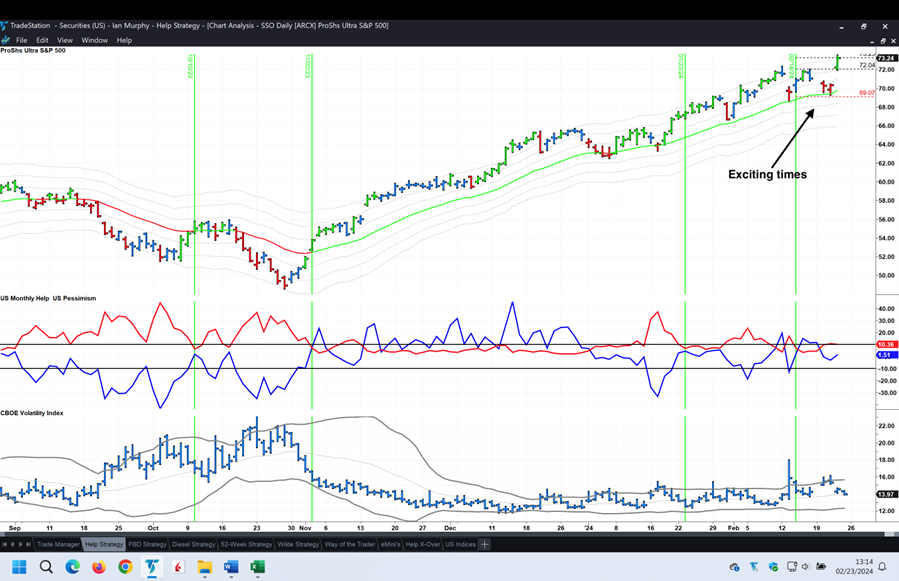

A few eagle-eyed Clients reminded me that I never called the latest Help Strategy trigger which occurred on Valentine's Day (that’s 14 Feb for non-romantics). It was a valid trigger. Not a great expansion and contraction of Help indicators to be sure, but it’s valid. At our end, we were so absorbed in getting screens to work that we failed to notice what was happening to them.

It has been an exciting journey since the 14th. Two days after the trigger, the first target was almost hit, but ProShares Ultra S&P500 2x Shares (SSO) fell short by just 5c (some traders pulled down the order for a fill). Two days after that, the initial stop was nearly touched but remained steadfast by 25c! Then yesterday, the price gapped up at the open (gracias a Nvidia) and started trading above the first target before going on to reach T2 also. Some traders canceled the sell orders pre-open and got better fills during the session. Either way, if you took this trigger, you must be well in profit by now!

As for trade ideas, the trigger above was on Week Seven, but we are still missing one for this week. Hopefully, something tradable (and rational) will come up on the screeners today. In the housekeeping department, we’ve been asked to show the entire desktop in screenshots so it’s clear which platform we’re using, and to mark workspace tabs on TradeStation so it’s easier to see which strategy the chart is taken from - done! This shot of the entire screen reduces the chart size a little in emails, but as always, the image can be magnified by clicking on it. Let me know what you think about the change.

Learn more about Ian Murphy at MurphyTrading.com.