In recent months, I’ve noticed a theme among long-term clients exploring numerous areas of trading and investing before eventually gravitating towards some form of active investing for passive income, states Ian Murphy of MurphyTrading.com.

Some people use technical or fundamental analysis techniques to find up-and-coming stocks, while others just use common sense. That’s what I want to discuss today. If we stay informed about what’s happening in the world, we can very often identify new trends from which individual firms will benefit. Let’s look at two recent examples:

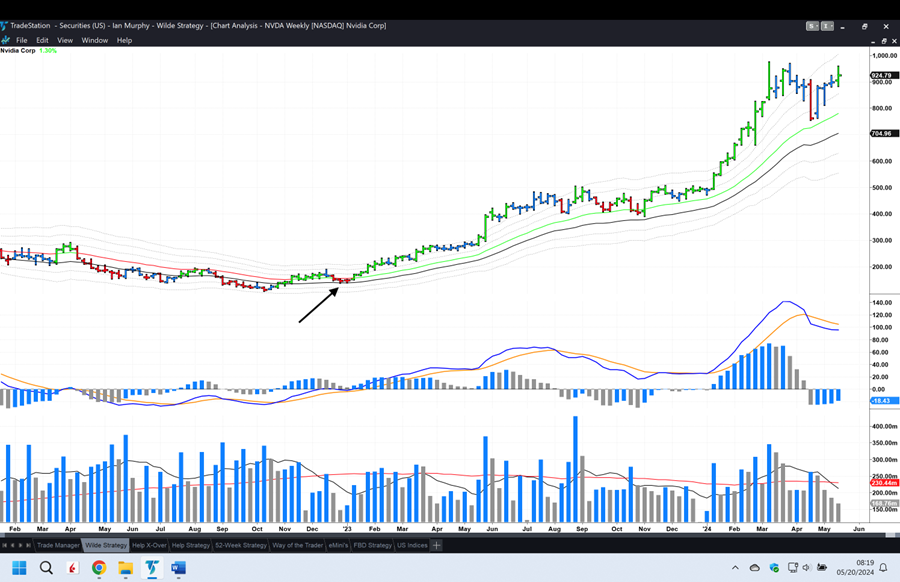

Nvidia (NVDA): When ChatGPT burst onto the scene in November 2022, most of us had never heard of Artificial Intelligence (AI) outside the world of science fiction. A few simple online searches at the time revealed which firms were likely to benefit from the new boom and chip makers were one of them. Looking at the chart above, NVDA is up 560% since the first higher low pattern on the -1ATR (black line) in December 2022 (arrow). An investment in NVDA in any one of the pullbacks since then would be in profit now.

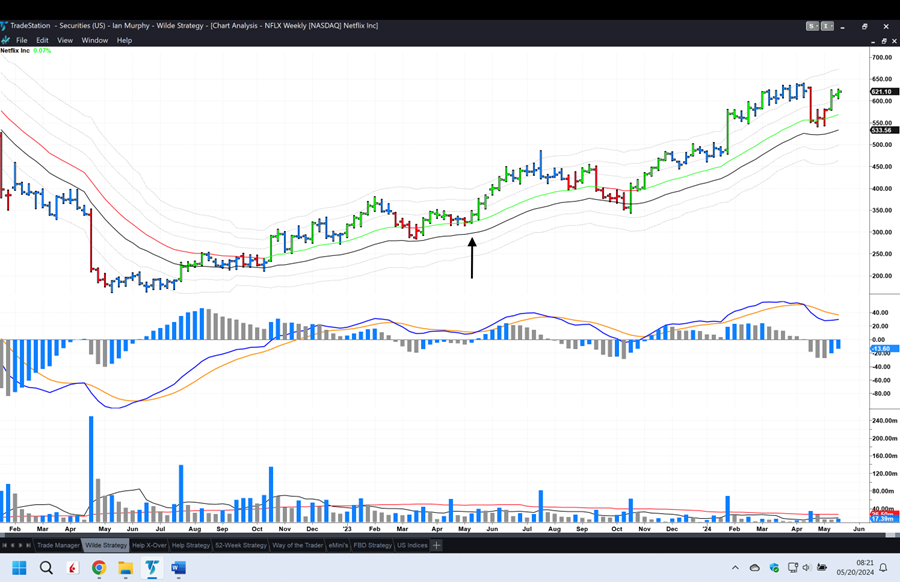

Netflix (NFLX): More recently, the streaming giant made waves by announcing they would clamp down on password sharing from May 2023 (arrow). I did an informal survey of family and friends at the time and concluded existing subscribers would stay with the firm and at least half of the password ‘moochers’ would sign up. It was always going to be a win-win for NFLX.

Remember, successful and expert investors spend most of their time finding stocks and then never fret about managing their positions because they will exit on a technical signal (close below -1ATR on a weekly chart, in our case). On the other hand, unsuccessful investors jump into positions too easily and then fret about managing and exiting them.

Learn more about Ian Murphy at MurphyTrading.com.