It’s been a while since we had an S&P 500 Index WINNING streak to talk about! Much of the chatter in March and April was focused on LOSING.

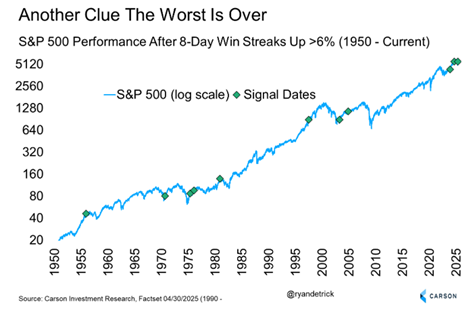

But now that we’ve seen eight “up” days in a row for SPX, what could come NEXT? Let’s go to the MoneyShow Chart of the Day. It’s courtesy of one of my favorite technicians, Ryan Carson, chief market strategist at Carson Group.

Source: Ryan Detrick, Carson Group, on X

You can see what happened historically after rallies of this length and magnitude for the S&P. As Ryan observed, three of four times that happened, stocks were up more than 20% a year later. Not bad.

That also squares with comments Paul Hickey, co-founder of Bespoke Investment Group, made in my MoneyShow MoneyMasters Podcast episode this week. He noted that we just “saw a record spike in the VIX and then almost a record decline in the VIX over a short period.” And he added: “Historically, that’s meant the worst was over and future returns were positive.”

Throw in exceedingly bearish sentiment – ANOTHER contrarian indicator – and you have to be happier with what’s happening out there. Now, let’s see if that nine-day run pans out!