You’re heard the story. That tariff and trade policy is causing huge issues worldwide – and leaving corporations and investors in the dark about the future.

But is it possible that “uncertainty risk” is...overblown? The MoneyShow Chart of the Day should provide some food for thought on that score!

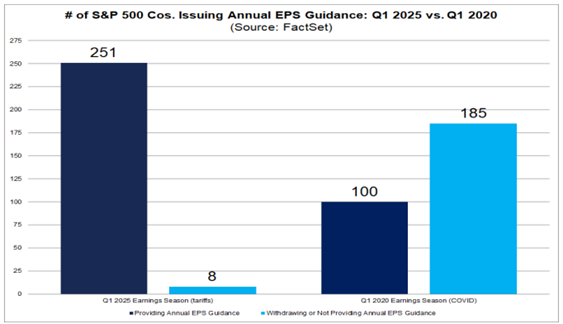

Source: FactSet

It comes courtesy of FactSet, a firm that provides great insights about earnings trends. The firm reviewed the commentary from the 478 S&P 500 companies who had already reported Q1 2025 earnings through May 22. Some 54% of them (259) offered earnings-per-share guidance for the full year.

But only 8% used the opportunity to withdraw previous projections – or not update prior guidance – due to tariff-driven uncertainty. If you look at the chart, you can see the numbers were MUCH higher during the last major disruption to world trade – the Covid-19 pandemic. Back in 2020, a whopping 185 S&P 500 companies yanked their prior guidance.

How is that possible? FactSet said some companies cited the weaker dollar as a force helping to offset tariff costs. Other companies said supply chain shifts, localization of production, and price hikes would reduce the earnings-suppressing influence of tariffs. Still others just chose not to RAISE guidance due to tariff uncertainty…but didn’t find the threat strong enough to force them to CUT it.

Bottom line? Uncertainty may not be the bugaboo Wall Street once feared. And if that’s the case, the rally off the lows may have more room to run!