I have to admit I’ve been thinking a lot about bonds lately. It’s because I think this is a critical time and place for Treasuries. And whether or not we keep leaning on the speculative tech theme in the future is going to have a lot to do with the action in the bond market, notes Steve Strazza, chief market strategist at AllStarCharts.

The 30-year US Treasury Yield (^TYX) is backing off after testing its cycle highs. Meanwhile, the popular iShares 20+ Year Treasury Bond ETF (TLT) is rebounding off a big shelf of support.

If these key levels break —TYX to the upside and TLT to the downside — we’re talking about major pattern resolutions. Major pattern resolutions tend to be followed by significant reaction legs.

What I’m saying is bonds are at risk of tanking lower if this scenario were to play out. And have you noticed how stocks have felt about bond market volatility lately?

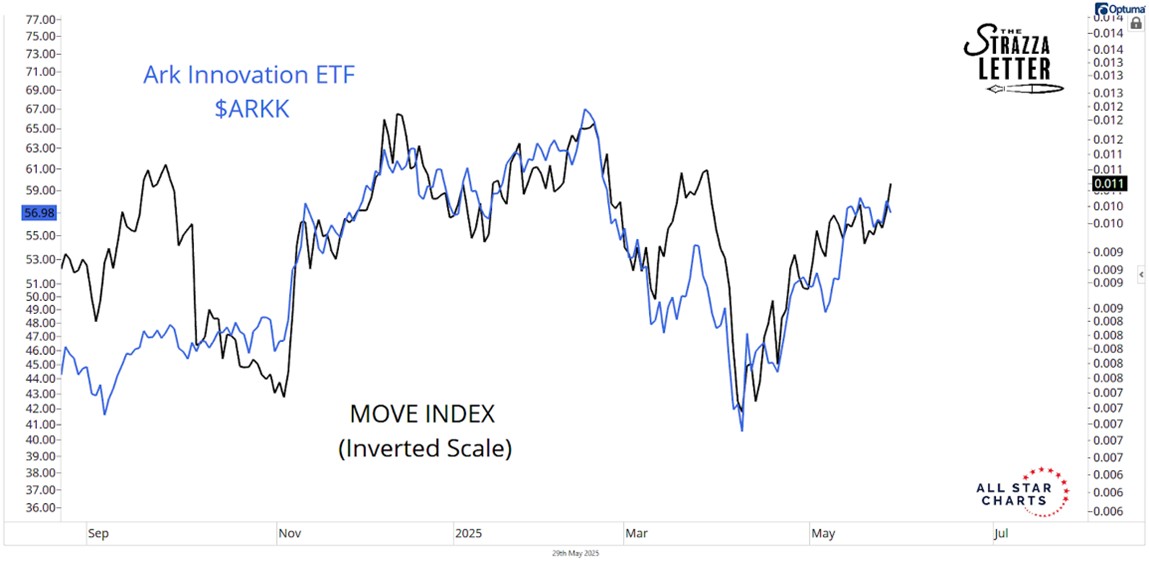

I’ve overlaid the ARK Innovation ETF (ARKK) with the inverted MOVE index to answer that question for you. Think of MOVE like the CBOE Volatility Index (^VIX) for bonds. This relationship shows that when the bond market is calm and orderly, it’s good for speculative growth. On the other hand, when bonds are volatile, these stocks come under pressure.

So, the bottom line is bonds can’t break down here if these risky stocks are going to keep trending well. If you own a lot of these kinds of stocks, like I do, I think it’s important to pay attention to bonds.