Everybody assumes that interest rates are going up. And I don't disagree with that in the bigger picture, like 10-15 years. But I'm not worried about 15 years from now. I'm worried about today. So, let's take a closer look at the charts, writes JC Parets, founder of TrendLabs.

I'm worried about this month. I'm worried about this quarter. Sorry...not sorry.

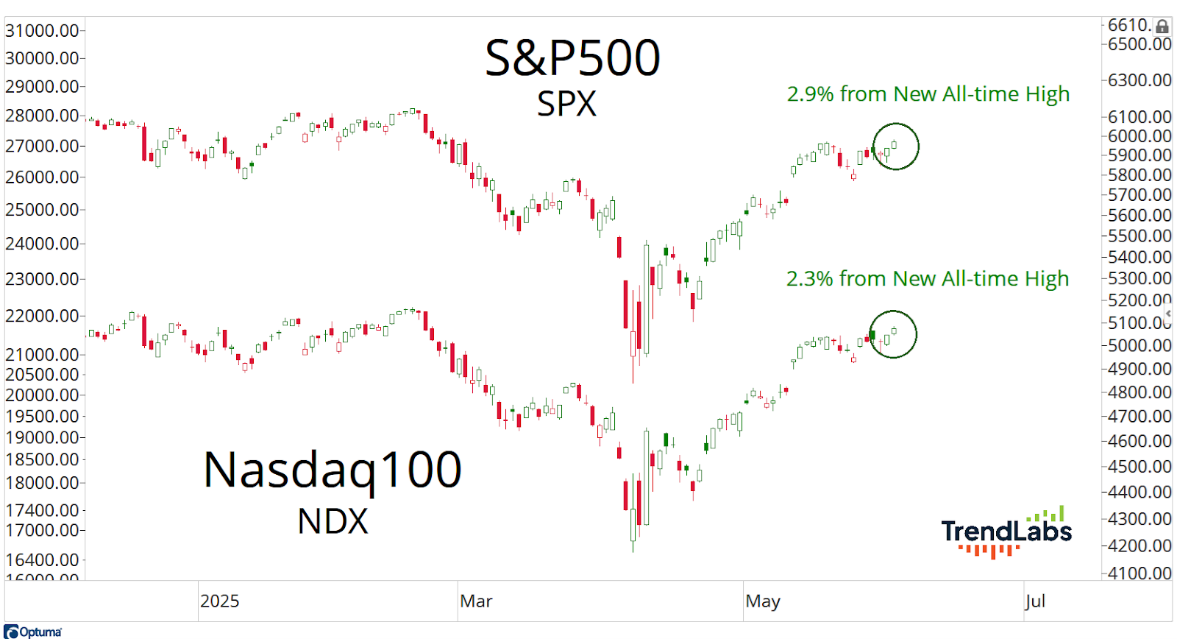

History has a way of repeating itself, even if this time feels different. The S&P 500 Index (^SPX) is less than 3% away from new all-time highs. The Nasdaq-100 (NDX) is a little more than 2% away from new all-time highs.

Two percent? That’s a pretty good afternoon or a decent week. That’s how close we are to new all-time highs, just for perspective.

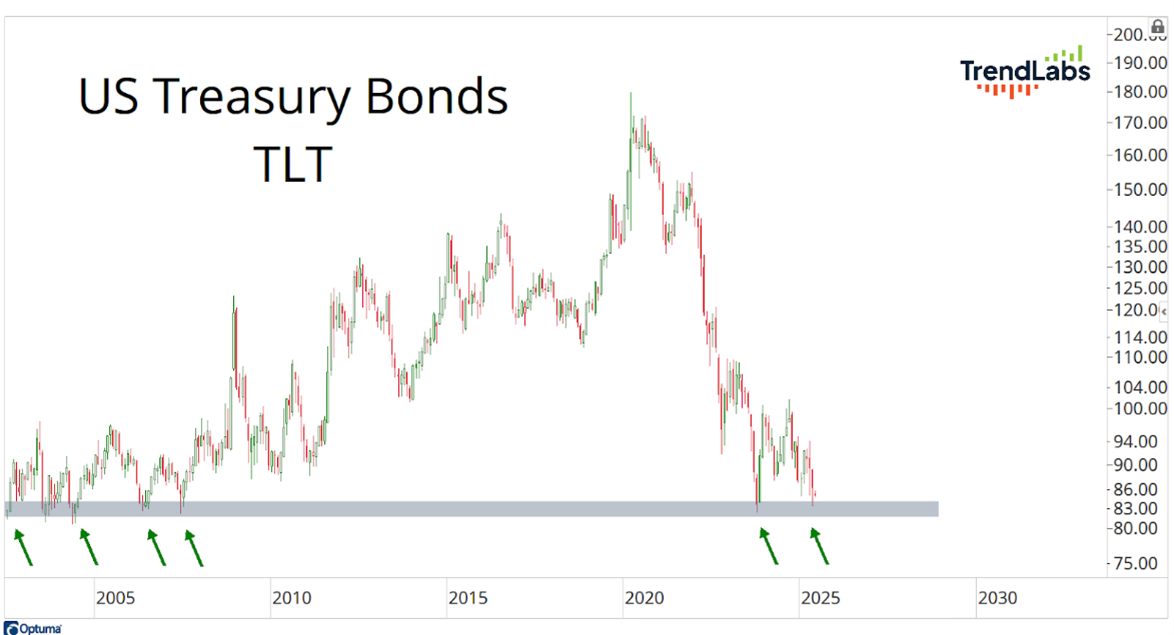

Now look at bonds. Every time the iShares 20+ Year Treasury Bond ETF (TLT) has been down near these prices, they’ve come in and bought them.

Every time.

But keep in mind that this time is the only time that matters. This time is the only time that can pay us. And, this time, commercial hedgers are buying bonds at extreme rates. That means the dumb money is selling bonds.

So, I like bonds for a bounce. And that's a good scenario for stocks.

We've got to put things in perspective. And we must act responsibly. We do both around here. And I hope you're getting used to how this works.