I’ve always had a soft spot for the “Utes.” And not just because I think “My Cousin Vinny” is a great movie.

Utilities give you income. They give you safety. They give you stability. But now? Maybe they offer a little bit of EVERYTHING – all that PLUS a growth “kicker” via leverage to tech/Artificial Intelligence (AI) growth.

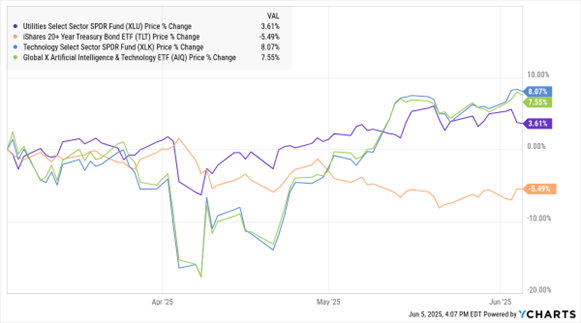

Consider this MoneyShow Chart of the Day – which shows the three-month performance of the Utilities Select Sectors SPDR Fund (XLU), iShares 20+ Year Treasury Bond ETF (TLT), Technology Select Sector SPDR Fund (XLK), and Global X Artificial Intelligence & Technology ETF (AIQ).

XLU, TLT, XLK, AIQ (3-Mo. % Change)

Data by YCharts

You can see that long-term Treasuries haven’t done well lately. Worries about government debt, ballooning deficits, stubborn inflation, and the falling dollar have driven TLT down more than 5% since March. Thirty-year Treasury Bond yields have climbed about 30 basis points in the same timeframe.

Rising rates USED to be bad for Utes. But for the last few months, XLU has been rallying right alongside XLK and AIQ...rather than getting dragged down by TLT.

Some of our MoneyShow experts have talked about the reasons for this link over the past year. See this piece from Roger Conrad of Conrad’s Utility Investor, or this MoneyShow MoneyMasters Podcast featuring him and Elliott Gue of Energy and Income Advisor.

But regardless of the reasons, my chart take is clear: Utilities seem to offer a little bit of EVERYTHING for traders these days.