The crowd is excited again. Growth stocks are at all-time highs. The latest development: the Nasdaq-100 Index golden cross. Here’s what it means for tech stock traders, writes Lucas Downey, co-founder at MoneyFlows.

Wall Street has a lot to cheer about. Microsoft Corp. (MSFT), Nvidia Corp. (NVDA), and Broadcom Corp. (AVGO) — leaders in the AI race — have soared to new heights. Analysts keep applauding their future earnings potential. I believe those estimates are still too low and massively underappreciate the acceleration in technological advancement.

Robotics, agentic AI, physical AI, and more are propelling stocks to levels few thought possible just two short months ago. Prophets warned of a death cross in April. We found the opposite to be true and signaled an incredible upside opportunity. A crowd-stunning rally came to Wall Street like a thief in the night.

Today, the Nasdaq-100 is forming a golden cross — when the 50-DMA crosses above the 200-DMA.

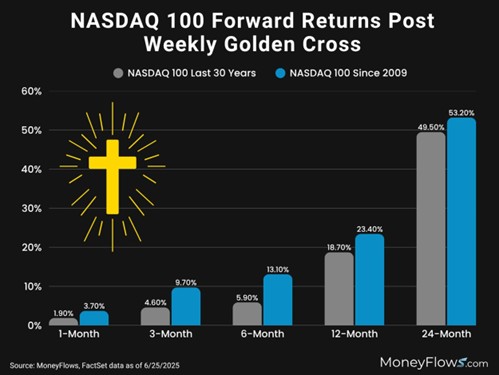

What happens next? Zooming out, there have been 17 golden crosses for the Nasdaq-100 in the last 30 years. Post-2009, forward returns look like this:

• 3-months: +9.8%

• 6-months: +13.1%

• 12-months: +23.4%

• 24-months: +53.2%

Why focus on 2009 and later? Because the latest tariff crash and rip follows the Covid-19 analog to a tee. Forced selling leads to a blowoff top, then further upside.

More importantly, institutions are gobbling up tomorrow’s leaders — small- and mid-cap compounders with accelerating earnings and AI tailwinds. They are outliers.