It has taken me a few cycles to finally come to the realization that Bitcoin, Ethereum, and other cryptocurrencies are NOT a separate asset class at all. They are not currencies. They are not commodities. They are not some new thing. They are just stocks, explains JC Parets, founder of TrendLabs.

When we talk about cryptocurrencies or “tokens” or “coins,” we're talking about the same things. These are different words to describe code that can be traded onchain. And these cryptocurrencies are just stocks. They are technology stocks.

Within technology, you have different industry groups such as hardware, semiconductors, software, cloud computing, electronics, and more. Crypto is just one of those. With a total aggregate value of about $3.5 trillion, it's not the largest subsector, nor is it the smallest. It's just another tech subsector, no big deal.

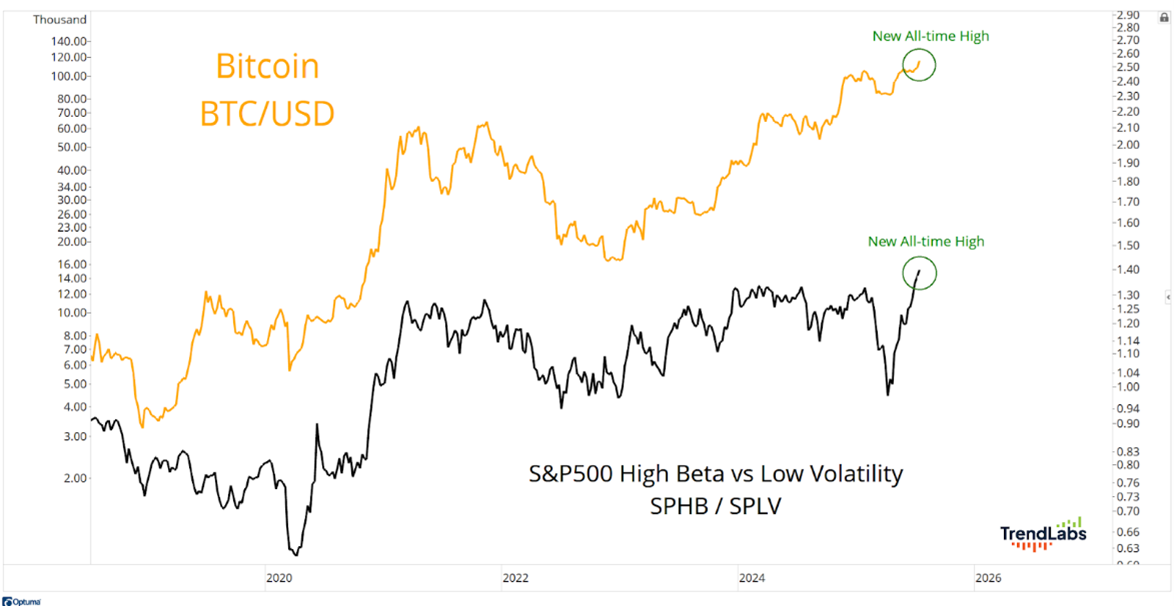

More specifically, cryptos are high-beta stocks. They tend to move more than lower-volatility stocks. Here's a chart of Bitcoin hitting new all-time highs after a multi-year consolidation starting in late 2021 following the post-COVID rally.

Notice how the ratio of the Invesco S&P 500 High Beta ETF (SPHB) versus the Invesco S&P 500 Low Volatility ETF (SPLV) – the black line — did the exact same thing through this entire period. The black line rallied after COVID, stopped rising in 2021, then consolidated for a few years. Now it's hitting new all-time highs...just like Bitcoin!

I encourage you to look at the stocks within the SPHB. You'll find a lot of technology and plenty of consumer discretionary stocks. You won't find much real estate or consumer staples. Those are the types of things you'll find in the SPLV.

When you overlay a chart of Bitcoin, they look a lot like it. That's because cryptos are tech stocks. I was wrong about that 12 years ago. I was still wrong about that 10 years ago. But I smartened up.

Most people haven't gotten there yet. They're still wrong. Cryptos are just more stocks. Let's treat them that way until they prove otherwise. And they're going up...just like stocks.