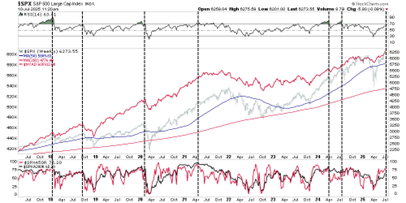

Last Thursday, we discussed the rise in market complacency. Several technical indicators also now point toward short-term overbought conditions. The market could enter a period of sideways consolidation or a mild pullback in the next two-four weeks, advises Lance Roberts, editor of the Bull Bear Report.

The catalyst for such a correction is unknown. But when markets are very complacent, a reason usually appears in short order. Given elevated RSI and Williams %R, upside is likely capped in the near term unless macro or earnings catalysts re-accelerate buying interest. If economic or earnings data disappoints, the S&P 500 Index (^SPX) could retrace toward the 50-day moving average (around the 6,050 – 6,100 range) before stabilizing.

However, the longer-term uptrend remains intact for now, with breadth indicators still supportive and the MACD in bullish mode. Any weakness should be treated as tactical and rotational, rather than the start of a broader downtrend — unless A/D and moving average participation begin to deteriorate.

What investors should do now:

1. Trim exposure in overbought/high-beta names, particularly those with large recent gains or extended valuations (e.g., speculative tech, meme stocks, or leveraged ETFs).

2. Raise modest cash buffers (5%–10%) to take advantage of pullbacks or rotation opportunities into lagging sectors like financials, healthcare, or industrials.

3. Tighten stop-losses on momentum positions and consider partial profit-taking in sectors trading well above trend lines.

4. Rebalance toward quality: favor companies with earnings visibility heading into Q2 earnings season. Focus on strong free cash flow, pricing power, and margin resilience.

5. Watch breadth: if the percentage of stocks above their 50-DMAs begins to decline while the index holds or rises, that would be a red flag for market fragility