Institutional investors are the “Smart Money.” Retail traders are the “Dumb Money.” That’s what people have whispered on Wall Street for a long time.

But maybe it’s time to rethink that “Dumb Money” moniker! Because retail investors have stuck with this market – and they’re getting PAID for doing so.

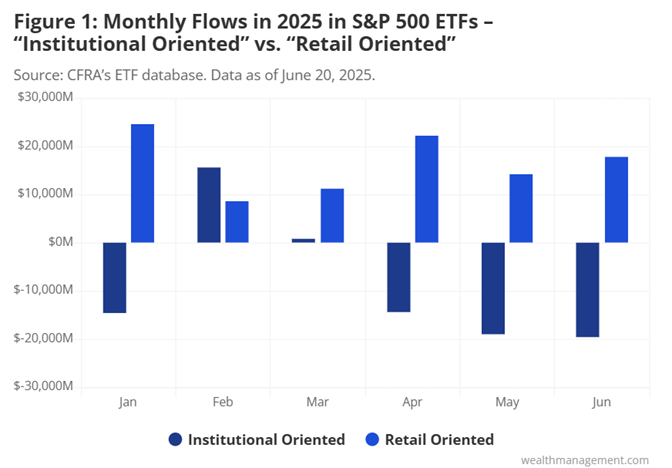

Take a look at the MoneyShow Chart of the Day, which comes from a piece CFRA Research’s Aniket Ullal wrote in late June for WealthManagement.com.

He broke down monthly flows in 2025 by “retail oriented” and “institutional oriented” ETFs. The SPDR S&P 500 ETF Trust (SPY) and iShares Core S&P 500 ETF (IVV) were his proxies for institutional buying and selling, while the Vanguard S&P 500 ETF (VOO) and the SPDR Portfolio S&P 500 ETF (SPLG) were his gauges of retail activity. He admits the methodology isn’t “absolute,” but “directionally useful.”

What’s the verdict? Even as the “Smart Money” was selling stocks in April, May, and June during the tariff-related volatility and economic uncertainty...the “Dumb Money” was buying them. And the “dumb” traders are the ones making money!

As long as buying the dip keeps working like this, you can expect it to continue. That, in turn, is the kind of fuel that can keep the markets marching higher. Not to mention make the “Dumb Money” moniker look more and more outdated. Or just plain wrong.