The US dollar Index is again on the decline. It will remain very weak below 99, and if it drops below 96.50, a sustained dollar decline will be underway. Meanwhile, the metals markets have been surging, write Mary Anne and Pamela Aden, editors of The Aden Forecast.

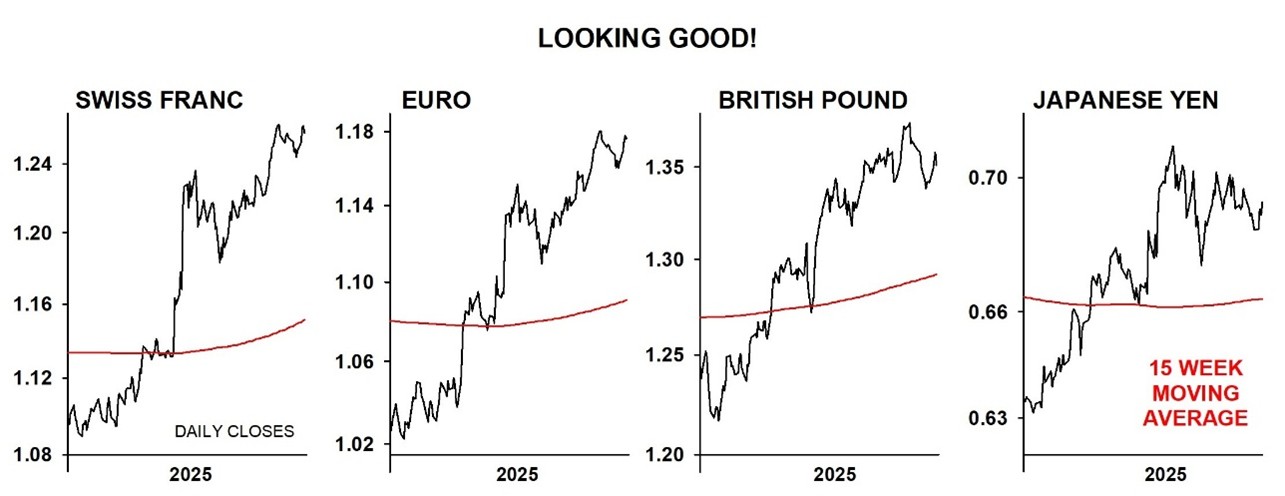

The major currencies are heading higher, and the euro and Swiss franc are near new highs. Keep your positions in euro, franc, pound, and yen ETFs – and the Invesco DB US Dollar Index Bearish Fund (UDN).

It also looks like gold’s "D" decline is likely over. As you can see on the chart below, gold is bouncing up from its 15-week moving average at $3,310 an ounce, which has been a great trend identifier. Plus, the leading indicator is also rising.

These are both signaling a renewed rise is probably now in force, along with stronger demand. If so, it will mean the D decline was moderate, which is a bullish sign for gold and all the metals. A rise above $3,450 would be a new record high, signaling extreme strength.