The rally that began in early April continues to drive stocks into new, all-time high territory. There hasn't been much of a correction, and so far, the internals have held up very well. However, we know volatility is low, and we also know that it generally begins to rise in August, observes Lawrence McMillan, editor at Option Strategist.

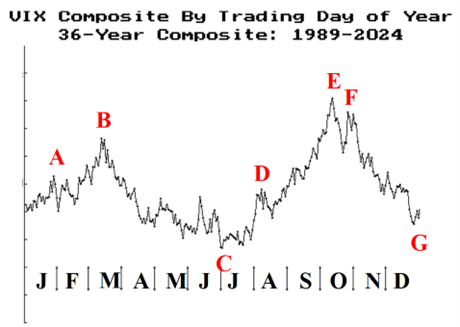

There are overbought conditions but no confirmed sell signals (yet). To bolster that last statement, the chart of the Composite CBOE Volatility Index (VIX) is reprinted below. We had written an article about this a few issues ago. The most notable thing is point “C” on the chart. That is, VIX typically makes its yearly lows in July and then begins to rise after that.

Currently, VIX is approaching the 2025 lows, which were set in January at 14.59. So, for all practical purposes, VIX made lows in July, as it normally does.

Even without confirmed broad market sell signals, I believe we can at least analyze this information to see if it makes any sense to “buy volatility” now, based strictly on its seasonal pattern.

To summarize, we remain bullish but vigilant. In particular, it is important to keep rolling deeply in-the-money calls to higher strikes -- or at least to tighten trailing stops.

Eventually, sell signals will be confirmed, and we will act on them. But overbought conditions can persist for far longer than one envisions, and thus we prefer to wait for the confirmed sell signals before taking bearish action.