Until recently, major indices were breaking higher day after day. But plenty of outflows have been noted recently. I suggested two weeks ago you should be on the lookout for a potential healthy Summertime pullback. Our data signals less market participation and if this trend continues, get ready to buy the dip, advises Lucas Downey, co-founder of MoneyFlows.

The year 2025 has taught us that anything is possible with markets. We’ve gone from a market crash to market exuberance in record fashion. Incredibly the S&P 500 Technology sector jumped 50% from the April 8 lows. The last few months have created one of the best stock-picking environments in years…but eventually it’ll cool down.

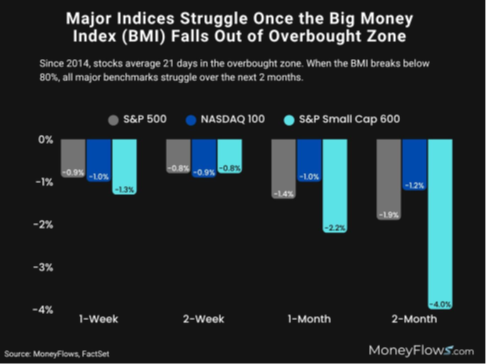

Two weeks ago, we discussed how stocks are no match for a Big Money Index (BMI) falling out of overbought. A falling BMI indicates that inflows are slowing, and outflows are growing. That’s what it takes for a healthy cool-off period.

When we plot major index returns post the last day of any overbought BMI, you’ll notice that large and small caps tend to fall. Two months after the BMI exits the red zone, the S&P 500 Index (^SPX) falls an average of 1.9% and the S&P Small Cap 600 falls 4%.

Now, this isn’t the end of the world. It offers a great opportunity to buy on any potential pullbacks…and we know that August and September tend to show seasonally weak trends. So, how should you play it?

First, follow the BMI…if it starts to head lower, you’ll know that more stocks are under distribution.

Second, focus on where the outflows are hitting: It could be small caps, it could be healthcare, it could be energy stocks, etc.

Third, start getting a buy list ready now. Once the tide goes out, you’ll want to be armed with an all-star stock list.