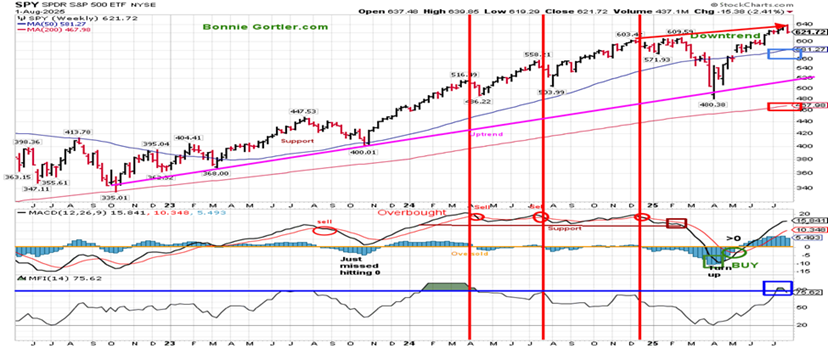

After hitting the short-term projection of 635, the SPDR S&P 500 ETF (SPY) pullback started last week. The intermediate upside projection at 700 remains. However, a weekly close below 575 would negate that, advises Bonnie Gortler, CEO of Bonniegortler.com.

Overall, SPY remains in an intermediate uptrend from October 2022. After hitting a low in April 2025, SPY consolidated its gains and then broke out of its channel, followed by making a new all-time high.

The MACD (middle chart) remains on a buy, above 0 but no longer rising. It bears watching to see if MACD does not make a new momentum high with price and turns down. MACD can generate a sell signal if weakness continues. The MFI Index turned down, closing at 75.62 after closing at 84.90, overbought, the previous week.

Meanwhile, new lows on the NYSE peaked at 1,167 on April 7, then contracted sharply as the market bottomed in April. Last week, new lows rose sharply from 15 (lowest risk) to close at 96 on Friday, indicating a warning of possible market weakness or a change in the tone of the market.

An increase above 150 would be negative. On the other hand, if the new lows contract and fall between 25 and 50, it would be positive in the short term.

Finally, the CBOE Volatility Index (VIX), a measure of fear, broke its downward trend since its high made at the April bottom on last week's sell-off. Historically, VIX tends to rise during the next several months. The VIX rose 36.5% last week, closing at 20.38. A reading above 22.50 would be the first sign that intraday volatility is likely to increase.